Fact Sheets Publications and Resources

Fact Sheets

Immigrants are a Vital Part of DC’s Future

By DC Fiscal Policy Institute • April 2, 2025 • Inclusive Economy

Fact Sheets

The Lasting Harm of DC’s Criminal Legal Fines & Fees Demand More Reporting and Transparency

By Michael Johnson Jr. • October 10, 2024 • Inclusive Economy

Fact Sheets

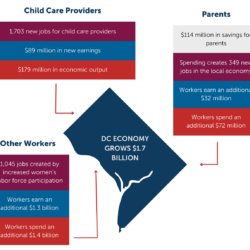

By Investing $139 Million in DC’s Child Care Subsidy Program, the Local Economy Could Grow $1.7 Billion

By DC Fiscal Policy Institute • August 6, 2024 • Early Child & Pre-K to 12 Education

Fact Sheets

DC Can Boost Income to Tackle Child Poverty

By DC Fiscal Policy Institute • May 23, 2024 • Income & Poverty / TANF & Income Support

Fact Sheets

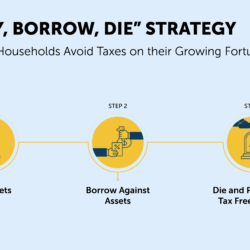

How Wealthy Households Use a “Buy, Borrow, Die” Strategy to Avoid Taxes on Their Growing Fortunes

By Tazra Mitchell • April 29, 2024 • Revenue & Budget

Fact Sheets

Without Replacement Funds for Expiring Pandemic Dollars, Schools Face Instability

By Erika Roberson • March 27, 2024 • Early Child & Pre-K to 12 Education / Revenue & Budget

Fact Sheets

The District Can Raise Critically Needed Revenue by Taxing Wealth

By DC Fiscal Policy Institute • February 21, 2024 • Revenue & Budget / Taxes

Fact Sheets

Executive Summary: Achieving Vision of Fairly Compensated Early Education Workforce Makes Anticipation of Cost Growth Imperative

By Anne Gunderson • February 6, 2024 • Early Child & Pre-K to 12 Education

Fact Sheets

Summary: Bringing It All Home: How DC Can Become the First Major City to End Chronic Homelessness and Provide Higher-Quality Services

By Kate Coventry • April 5, 2023 • Affordable Housing & Ending Homelessness / Homelessness

Fact Sheets

DC’s Earned Income Tax Credit: A Powerful Tool for Racial, Gender, and Economic Equity

By DC Fiscal Policy Institute • February 18, 2022 • Income & Poverty / Taxes