Expanded DC Earned Income Tax Credit Is Helping Thousands

DC Residents Received $190 Million Combined In Federal And DC EITC in 2016

CONTACTS:

Claire Zippel, DC Fiscal Policy Institute, 202-325-8351, czippel@dcfpi.org

Joseph Leitmann-Santa Cruz, Capital Area Asset Builders, 202-419-1440 x102, jleitmann-santacruz@caab.org

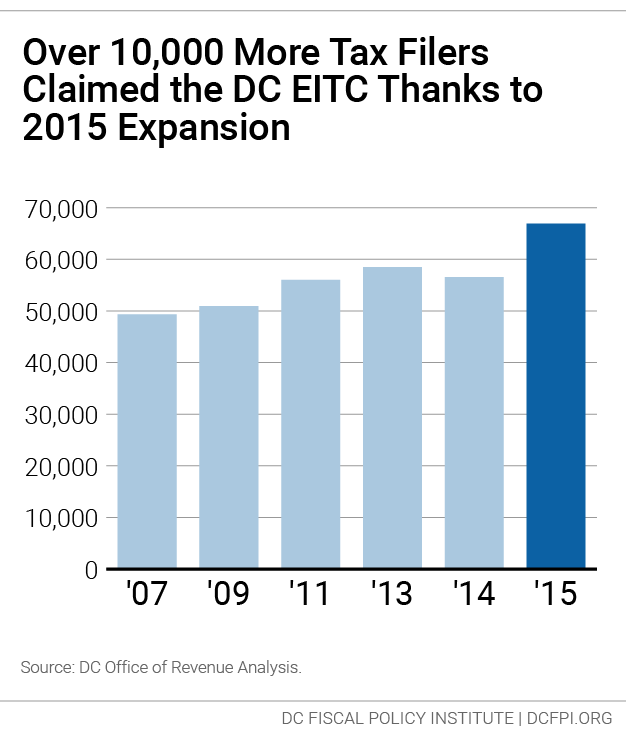

DC’s recent efforts to boost the incomes of low-wage workers through its Earned Income Tax Credit are working, according to a new analysis of DC tax returns. Over 10,000 more DC working families and individuals claimed DC’s EITC in tax year 2015, thanks to an expansion targeted to workers without children in their home, who previously qualified for only modest benefits. The expansion, recommended by the DC Tax Revision Commission and approved by the DC Council in 2014, put an additional $8.3 million in the pockets of the DC workers with low earnings. More work that ensures DC workers know about and claim the credits they’ve earned will increase the expansion’s positive impact on the ability of hardworking residents to make ends meet.

The DC EITC, a refundable tax credit for workers with low earnings based on the federal EITC, is a key tool for reducing poverty among working families and individuals. The recent DC expansion addressed the fact that the federal credit for workers without children is very low. The DC Council more than doubled the value of the DC EITC for these workers, and expanded income eligibility so that more workers can claim the credit. The DC credit is now in the top tier of state-level EITCs in terms of its size. It boosts incomes by as much as $2,500 for working families with children and $500 for workers without children in the home.

The DC EITC, a refundable tax credit for workers with low earnings based on the federal EITC, is a key tool for reducing poverty among working families and individuals. The recent DC expansion addressed the fact that the federal credit for workers without children is very low. The DC Council more than doubled the value of the DC EITC for these workers, and expanded income eligibility so that more workers can claim the credit. The DC credit is now in the top tier of state-level EITCs in terms of its size. It boosts incomes by as much as $2,500 for working families with children and $500 for workers without children in the home.

In 2016, the combined federal and DC EITC put about $190 million into the pockets of low-income working families and individuals in the District. Nineteen percent of DC tax filers claimed the DC EITC.

A new policy brief by the DC Fiscal Policy Institute shows that the expansion made a big difference for workers with low wages or limited work hours.

- 10,300 more filers claimed the DC EITC in tax year 2015, an 18 percent increase. Meanwhile, the number of filers claiming the federal credit did not grow, suggesting that DC’s policy change was responsible for the increase.

- Single filers—most of whom do not have children—drove the increase, signaling that more filers claimed the credit due to the expanded eligibility and benefit levels for workers without children in the home.

- In total, 66,900 DC tax filers claimed $63.6 million in DC EITC in tax year 2015—up from 56,600 filers and $55.3 million in credits claimed in tax year 2014.

“Expanding the District’s EITC has been a huge help to thousands of DC workers struggling on low wages. Hardworking DC residents now have more money to make ends meet. It’s an important step to make sure that DC’s growing prosperity is reaching everyone,” said Claire Zippel, policy analyst at the DC Fiscal Policy Institute.

Even with this good news, more work still needs to be done to ensure that all eligible District residents know about and claim the tax credits they’ve earned. According to Capital Area Asset Builders (CAAB), as many as 20,000 lower-wage DC residents are still not claiming the federal EITC, and thus not receiving over $40 million in federal tax credits. This suggests that with increased awareness and free tax preparation, even more workers would benefit from the DC EITC expansion.

“We need to inform, educate and empower our community on the EITC because the EITC can make a real difference for-the-benefit of low-income DC individuals and families. Every year, the EITC lifts thousands of Washingtonian families out of poverty and keeps them out of poverty,” said Joseph Leitmann-Santa Cruz, CAAB’s Associate Director and Manager of the DC EITC Campaign, a citywide, cross-sector initiative that provides access to information on the EITC and connects Washingtonians with free tax preparation services throughout the District. The DC EITC Campaign is made possible through the support from the District of Columbia Office of the Deputy Mayor for Planning and Economic Development, Citi Community Development and United Way of the National Capital Area.

###

About the DC Fiscal Policy Institute

The DC Fiscal Policy Institute promotes opportunity and widespread prosperity for all residents of the District of Columbia through thoughtful policy solutions. We accomplish this through research and analysis, direct engagement with policymakers, and strategic partnerships with other organizations and individuals.

About Capital Area Asset Builders

Capital Area Asset Builders (CAAB) is a not-for-profit organization working to empower low- and moderate-income residents of the Greater DC area to take control of their finances, increase their savings and build wealth for a better future.