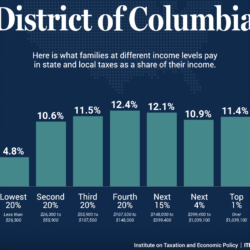

Taxes and other sources of revenue make up the collective resources we need to meet the city’s growing needs and invest in public services that allow all DC residents to thrive. Our revenues can pay for high quality education for DC’s children, keep housing instability and homelessness at bay, offer workers and businesses well-functioning public transportation, and so much more. By ensuring a racially and economically just tax system based on residents’ ability to pay—with the wealthiest paying the greatest share of their income in taxes relative to households with middle and low incomes– we can build an equitable economy of shared abundance. Lawmakers should dedicate revenues raised from equitable tax policy to public investments that support Black and brown communities who have long been denied their share of the District’s economic growth because of structural racism.

Report

By Erica Williams • May 1, 2024 • Revenue & Budget / Taxes

Report

By DC Fiscal Policy Institute • February 7, 2024 • Revenue & Budget

Blog

By Erica Williams and Nikki Metzgar • January 9, 2024 • Revenue & Budget

Blog

By Tazra Mitchell and Anne Gunderson • October 3, 2025 • Revenue & Budget

Budget Resource Page

By DC Fiscal Policy Institute • August 25, 2025 • Revenue & Budget

Blog

By DC Fiscal Policy Institute • July 16, 2025 • Revenue & Budget