On May 25, the Council voted to eliminate DC’s tax exemption for interest earned on out-of-state bonds’a tax incentive offered by no other state. This policy move is a progressive change slated to increase revenues by $13 million in FY 2012 and nearly $30 million per year in subsequent years. Nevertheless, this proposal has raised some questions about who would be affected. In particular, concerns have been raised about the effect of the new policy on lower-income retirees.

However, data provided by the Chief Financial Officer reveals that most of the taxpayers affected would be higher-income earners, and few would be retirees. Moreover, the impact of eliminating the tax break would be relatively modest — under 1 percent of income for most taxpayers.

The numbers helps illustrate why this policy move makes good sense:

- In 2008, about 20,000 DC households — just 6 percent of all taxpayers — held tax-exempt bonds.

- Only one-fourth of households with tax-exempt interest had retirement income.

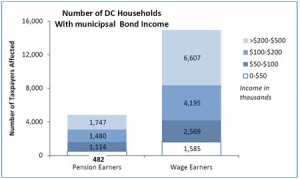

- Most residents with out-of-state bond income are higher-income. Among wage earners who hold out-of-state bonds, 72 percent have income above $100,000. Among retirees with out-of-state bonds, 67 percent have incomes over $100,000.

- In fact, there are only 482 DC lower-income retiree households (below $50,000 adjusted gross income) that earn any income from out-of-state bonds. This is just 2.4 percent of the DC households with income from out-of-state bonds.

Overall, the impact on tax bills for DC residents would be relatively small:

- For most taxpayers, taxes will increase by less than one percent of income.

- For retirees with incomes below $50,000, the increase would be $276 per year on average, or 0.9 percent of the average income. For retirees at higher-income levels, the increase averages 0.3 percent of income.

- Most of the increased tax would be paid by higher-income residents: among retirees with out-of-state bonds, two-thirds of the additional taxes will be paid by those over $200,000 in income, and 87 percent will be paid by those over $100,000.

There is broad agreement that eliminating a tax break to invest in out-of-state bonds makes policy sense. States provide such a break only for in-state bonds, to encourage residents to support the state’s infrastructure projects. With the Council’s recent vote, DC now joins every state in its treatment of income from out-of-state bonds.

The new data confirm that not only is this a sound policy move, but also that the impact for most residents will be non-existent or modest, and that most of those who are affected are higher-income residents.