- $23.1 million for the Office of Paid Leave including $1.9 million to enforce the Universal Paid Leave Act

- $2.19 million to fully fund the I-77 repeal legislation (including budget out-years)

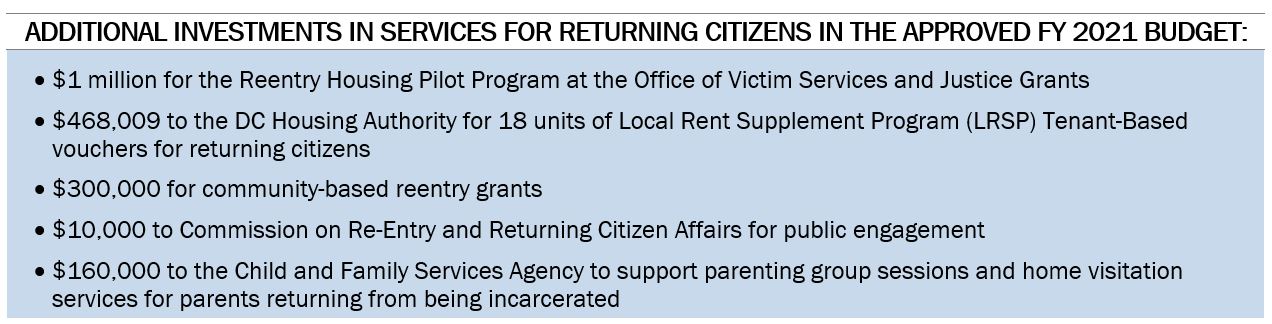

- To support returning citizens: $568,000 for the Paralegal Fellowship pilot program, and $254,000 to ORCA to fund the Access to Jobs Amendment Act of 2020

- Prioritization of Black-owned and women-owned businesses including $750,000 for a disparity study; a new CBE designation and $1.3 million Equity Impact Fund; $67,086 in recurring dollars to fund the 10-year property tax exemption for Sankofa Video, Books, and Café

- $1.3 million to fully fund the Racial Equity Achieves Results Amendment Act of 2020

- To support LGBTQ residents and District employees: $500,000 added to the Office of Victim Services and Justice Grants for workforce development program for transgender, non-binary, and gender non-conforming residents; and $150,000 to conduct a survey about the experiences of transgender and non-binary District employees

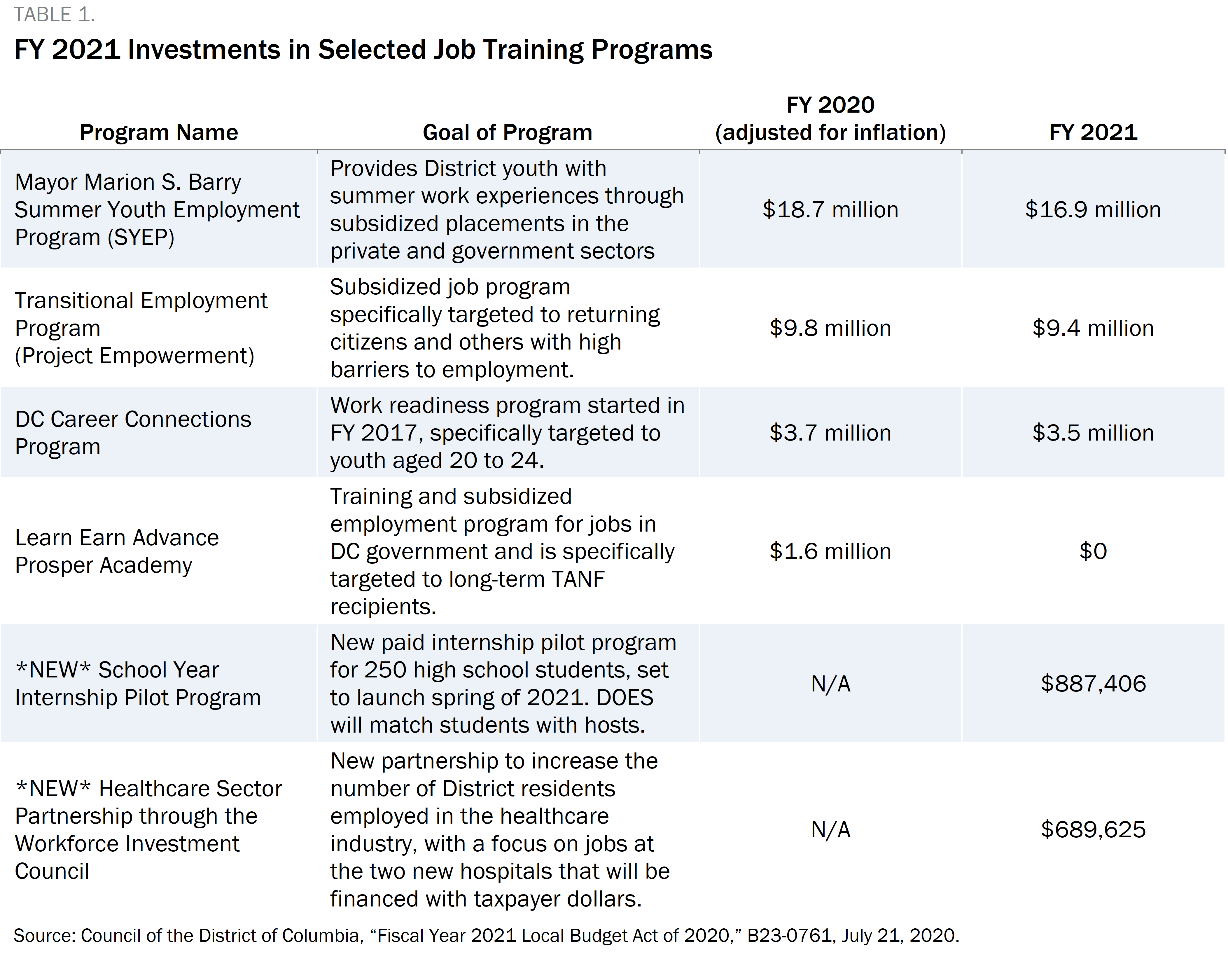

- $29.8 million for DC’s three main subsidized job training programs, but no new money for the Learn Earn Advance Prosper (LEAP) Academy.

- Two new programs: $887,406 for a School Year Internship Pilot Program and $689,625 for a Healthcare Sector Partnership through the Workforce Investment Council

The pandemic-induced economic downturn has caused unprecedented job losses in the District and across the nation. In the period from mid-March to mid-May 2020, the District lost 74,700 jobs, and resident employment fell by 39,800.[1] Economists are warning that the recession is worsening the already deep economic disparities between white people and many people of color nationwide. Black workers, for example, hold the highest rates of unemployment yet are less likely to get unemployment benefits.[2] This is made worse given that governments and private actors shut Black families out of wealth-building opportunities that white families received, making it harder for Black families to withstand a pandemic. Without government intervention aimed at achieving equity, highly racialized wealth and income disparities will continue to widen.

The approved budget for fiscal year (FY) 2021 invests in programs and policies that improve workers’ rights to fair wages and paid leave, promote the economic stability of returning citizens, target supports to Black-owned and women-owned businesses, and support the advancement of racial equity in the District. These, and other programs to support an inclusive economy, are essential to begin chipping away at the District’s wide economic disparities. Even more investment is needed if the District is to cultivate a truly inclusive economy.

Support for Workers’ Rights and Protections

Paid Family Leave Program

The Universal Paid Leave Act (UPLA), passed by the DC Council in 2016, grants eight weeks of parental leave for parents to be with their children, six weeks of family leave for workers to care for an ill relative, and two weeks of medical leave for workers to care for one’s own health needs. In June 2020, the Chief Financial Officer certified that the Universal Paid Leave Administration Fund balance is sufficient to proceed with benefit payments, despite the coronavirus-induced economic downturn. The District began administering paid leave benefits on July 1, 2020.

The approved budget for FY 2021 includes over $292 million within the Universal Paid Leave Fund and provides $23.1 million for implementation of the paid leave program through the Office of Paid Family Leave. This includes $1.9 million to support 10 full time employees in the Office of Human Rights (OHR) to enforce the UPLA, protecting employees against retaliation and ensuring that employers comply with the program. The new UPLA enforcement positions at OHR include equal opportunity specialists, attorney advisors, and training specialists.

The approved Budget Support Act (BSA) stipulates that up to 6 percent of the Universal Paid Leave Administration Fund will be used annually for public education about the program. Of that 6 percent, at least $500,000 must be used to fund the new Workplace Leave Navigators Program. The budget allocated $750,000 for this program, which will provide financial support to experienced organizations to help employers and workers navigate the various paid leave laws.

Tipped Workers

Initiative 77, which voters approved in 2018, would have eliminated the tipped minimum wage, but the Council repealed that policy. They subsequently passed weaker legislation in its place, the Tipped Wage Worker Fairness Amendment Act of 2018. This Act requires several provisions, including that the Department of Employment Services (DOES) create and maintain a website explaining workers’ wage and hour rights and anti-discrimination laws. The approved budget includes $1 million to DOES and $385,375 to OHR in FY 2021 to implement the act and fully funds ongoing maintenance in the out-years. Until now, this act had remained unfunded since its creation.[3]

On July 1, 2020, the minimum wage in the District increased from $14.00 per hour to $15.00 per hour, regardless of the size of the employer. For tipped workers, the base minimum wage increased from $4.45 to $5.00 per hour. These increases, while needed, are not enough for workers to get by in an expensive city without assistance, and the increase will not close the deeply entrenched racial wealth and income disparities in DC. A larger redistribution of resources, land, and other wealth building opportunities are needed for that.

Returning Citizens

The District of Columbia has the highest rate of incarceration in the United States.[4] When incarcerated residents are released, they face many challenges, including financial strain and discrimination in employment and housing. The District invests in various programs in an effort to mitigate these challenges and remove barriers to employment and financial stability for returning citizens. The investment in these programs will largely benefit Black DC residents as they make up over 95 percent of returning citizens from Bureau of Prison facilities to the District.[5]

Through the FY 2021 budgeting process, the District moved the Office of Returning Citizens Affairs (ORCA) into the purview of the Office of the Deputy Mayor for Public Safety and Justice (DMPSJ). It had previously been located within the Executive Office of the Mayor. The motivation for this move is to provide ORCA with more opportunities for collaboration with other agencies within the DMPSJ cluster.

The approved budget also includes two allocations to support employment programs for returning citizens. The budget provides $568,000 for the Paralegal Fellowship pilot program, which connects returning citizens with university-based paralegal certification programs, and $254,000 to ORCA to fund the Access to Jobs Amendment Act of 2020, which provides a financial incentive for employers to hire returning citizens for long-term careers.

Support for Black-owned and Women-owned Businesses

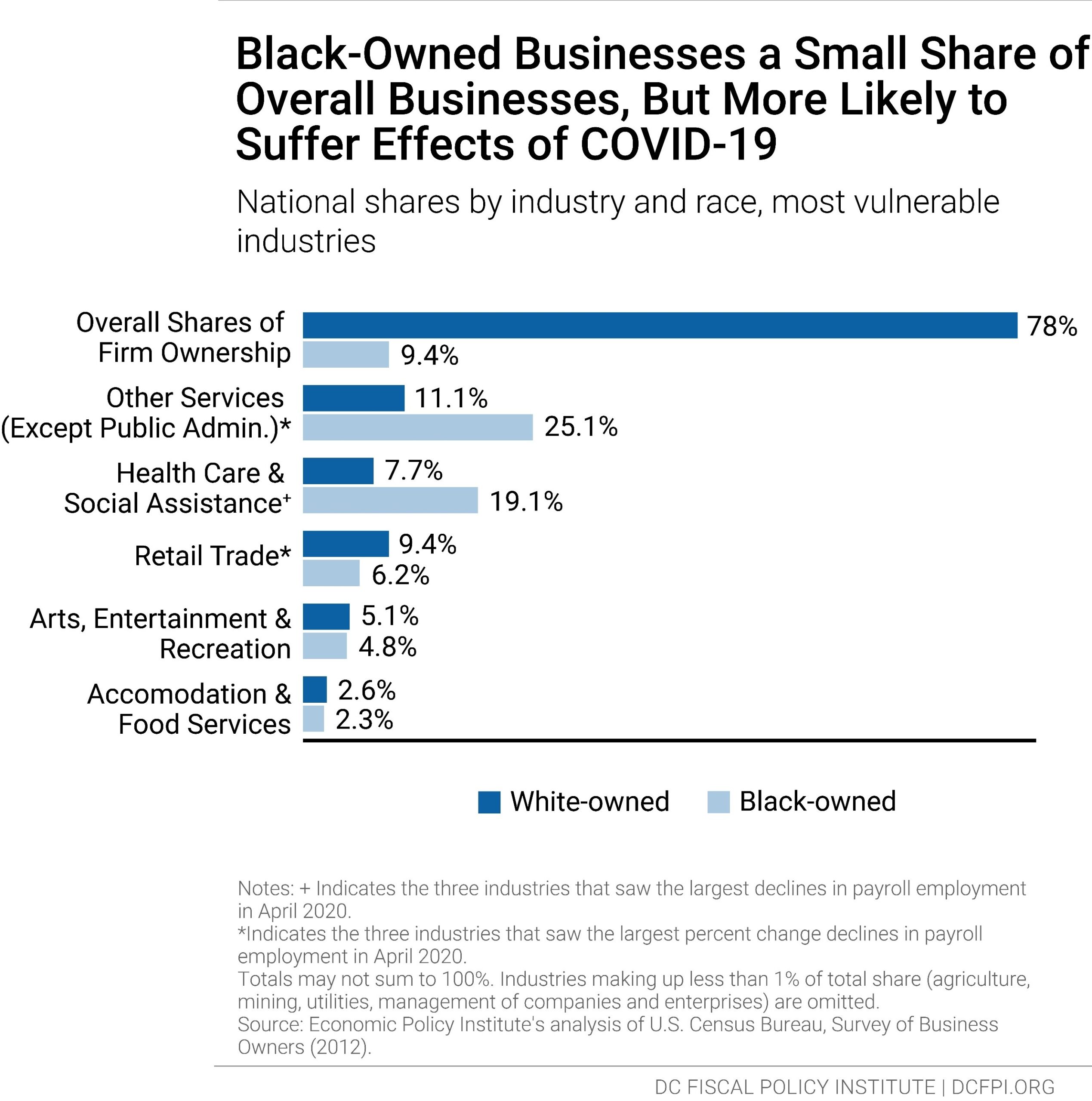

The global health pandemic has further exacerbated the unique challenges that Black business owners face, putting them at the greatest risk of economic devastation and displacement from the city (Figure 1). Few Black-owned small businesses tend to have enough cash on hand to cover expenses, with a majority having only two to three weeks’ worth of cash available. [6] Black business owners often lack assets—such as home equity—that they can use as collateral to invest in their businesses, let alone use to keep their businesses afloat amid an economic disaster. This is due to the persistent racial wealth gap—a result of this nation’s racist history of denying them access to government-sponsored, wealth-generating programs.[7]

Black businesses have faced much difficulty obtaining relief from the federal government’s Paycheck Protection Program.[8] This is no surprise as discriminatory financial lending practices means that Black and brown business owners nationwide are twice as likely to be denied loans than their white peers, are more likely to receive lower loan amounts when they do receive loans, and pay higher interest rates. This is why local economic relief programs that target Black-owned business owners are important and necessary. This year, the District developed a DC East of the River Small Business Economic Relief Microgrant Program for Wards 7 and 8. The approved budget continues to make investments in Black-owned and women-owned businesses, in response to historical underinvestment.

Disparity Study

The approved budget allocates $750,000 to the Department of Planning and Economic Development (DMPED) to contract the development of a disparity study to provide data on contract procurement by race and pursue more equitable procurement opportunities for Black and brown people. The Council required that the District commission a study to determine whether discrimination against people of color-owned and women-owned businesses exists in competing for government contracts. The DC Department of Small and Local Business Development (DSLBD) determined earlier this year that they did not have the data available to complete a robust analysis. Of the data that did exist, DSLBD found that just 26 percent of firms that identified as minority and 11 percent of firms that identified as woman owned were awarded contracts under the District’s procurement process between 2016 and 2018. The BSA requires that the District contract with a person or entity to collect the necessary data to complete the disparity study by January 23, 2022.

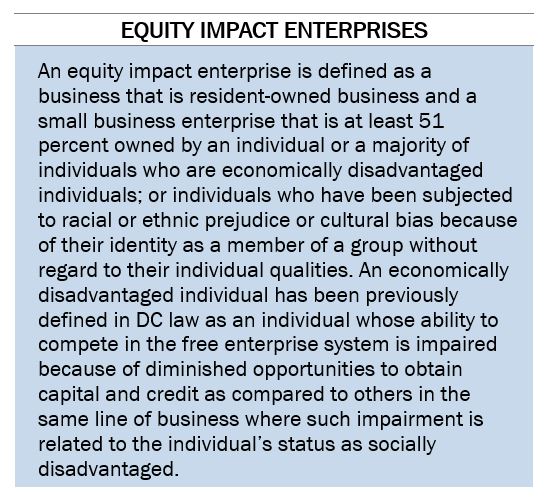

New CBE designation and Equity Impact Fund

The approved BSA establishes a new Certified Business Enterprise (CBE) designation, Equity Impact Enterprises, to better provide opportunities and address unique barriers faced by Black-owned and women-owned businesses. The budget authorized DMPED to make up to $599,000 in grants to equity impact enterprises operating in Wards 5, 7, or 8 to increase economic or community development.

The BSA also includes the creation of an Equity Impact Fund to be managed by a fund manager, whom the Mayor will select with the use of a scoring rubric that gives preference to equity impact enterprises. Once selected, DMPED will deposit an initial District investment of $1.25 million into the fund and use it to primarily facilitate technical assistance and investment in businesses that lack access to capital.

Sankofa Video and Books

The approved budget includes $67,086 in recurring dollars to fund the 10-year property tax exemption that the Council approved for Sankofa Video, Books, and Café last year. Sankofa Video and Books is a Black-owned bookstore that faced rising property taxes due to a development boom that is gentrifying and transforming neighborhoods. Legacy small businesses, like Sankofa, have served their neighborhoods for decades and are the heart of our communities—particularly in the Black community. Many legacy small businesses are at risk of closing because of doubling and tripling rents, and the resulting increases in property taxes. While this investment represents a one-off approach, we testified early this year on the importance of protecting the existence of legacy small businesses through a long-term, systemic approach.[9]

DC Anchor Partnership

The approved budget allocates $200,000 in recurring funds to the DC Anchor Partnership. This partnership provides opportunities for local people of color-owned and women-owned businesses to compete for and be awarded contracts by hospitals and universities.

Dream Grants and Aspire to Entrepreneurship

Within DSLBD, the approved budget includes $200,000 for Dream Grants—a micro loan program providing grants of up to $10,000 for small business entrepreneurs. This program aims to specifically support small business entrepreneurs in Wards 7 and 8, where Black residents overwhelmingly reside and where the greatest concentrations of poverty are in the city. The DSLBD Director previously testified that the agency developed weekly programming in Ward 7 to support ongoing development through a training series.

The approved budget also includes a $75,000 recurring investment for the Aspire to Entrepreneurship Program, a reduction of $175,000 from FY 2020. This program provides returning citizens with training to assist in business creation. Businesses developed by past participants include childcare centers, restaurants, trash hauling, landscaping services, event planning and mental health and wellness centers.

Fully Funds the REACH Act

The approved budget includes $1.3 million to fund the Racial Equity Achieves Results Amendment (REACH) Act of 2020. This funding will help establish the Office of Racial Equity within the Office of the City Administrator, which will be tasked with coordinating District efforts to achieve racial equity. The capital budget also includes $500,000 in one-time expenses to fund the development of and infrastructure for a racial equity dashboard that will assist District agencies in embedding racial equity into their performance-based budgets and track the racial impact of District programs and policies.

While the REACH Act was moved out of committee and received funding for implementation in the approved FY 2021 budget, the DC Council still has to approve the bill in the fall. We testified during budget season on our support for the REACH Act, its provisions, and how it can be bolstered by using tax policy as a tool for racial justice.[10] The Committee on Government Operation’s budget report added the following new provisions:

- Requires racial equity impact assessments for certain legislative measures, but these assessments would be non-binding and not required before the Council votes on those pieces of legislation

- Establishes the Council Equity Coordinator Program within the Council to produce racial equity materials and provide training for Council staff

- Establishes the Commission on Racial Equity, Social Justice, and Economic Inclusion as an independent agency to ensure transparency and accountability and make recommendations to the Council and Mayor on economic redress and other policies to reduce racial, social, and economic inequity.

- Requires racial equity training for all commissions and boards

- Defines racial equity as the moment when race can no longer be used to predict 41 life outcomes and outcomes for all groups are improved, in particular for persons of color.

Before its final passage, there will likely be some additional changes to the language of the REACH Act in its current form. One change that DCFPI supports is requiring the racial equity impact assessment be completed before the Council votes on legislation.

LGBTQ Investments

Members of the LGBTQ community, particularly trans* folks, regularly face workplace harassment and discrimination. The Council’s report on the Local Budget Act cited a 2011 national study that showed in the US, 15 to 43 percent of lesbian, gay or bisexual individuals, and 90 percent of transgender individuals, faced workplace harassment and discrimination.[11] Also citing the Supreme Court’s June 2020 ruling, which protects the rights of gay and transgender workers, the District added an enhancement of $500,000 to the Office of Victim Services and Justice Grants (OVSJG) for a wrap-around workforce development program for transgender, non-binary, and gender-nonconforming District residents.[12] The approved budget also includes an additional $150,000 for the DC Department of Human Resources to conduct a survey of transgender and non-binary District employees. The survey will ask about employees’ experiences in the workplace, and with hiring and recruitment.

The approved budget also includes $449,000 in funding for the Office of LGBT Affairs within the Mayor’s Office of Community Affairs.

These investments, in combination with funding for housing for LGBTQ individuals, constitute a significant increase over the FY 2020 budget of $252,500 (adjusted for inflation) for LGBTQ-specific programs. Such an increase comes after outcry from advocates and organizations in the LGBTQ community about lack of investment in the FY 2020 budget, particularly to support LGBTQ legal rights and health concerns.[13]

Jobs Training and Employment

The Department of Employment Services is a major source of job search, training, and placement programs for unemployed or underemployed adult District residents, as well as for DC youth. The FY 2021 approved budget includes a number of investments for job training programs and public-private sector employment partnerships (see Table 1 for more details).

[1] Fitzroy Lee and Stephen Swaim, District of Columbia Economic and Revenue Trends: June 2020, Office of the Chief Financial Officer, June 2020.

[2] Ava Kofman and Hannah Fresques, Black Workers Are More Likely to Be Unemployed but Less Likely to Get Unemployment Benefits, ProPublica, August 24, 2020.

[3] Fenit Nirappil, D.C. officials passed a law to help tipped workers after repealing a wage increase. It was never funded., The Washington Post, January 5, 2020.

[4] The LBA cites US Dept. of Justice 2018 Press Release; and Wagner, P., & Sawyer, W. (2018). States of Incarceration: The Global Context 2018.

[5] Ellen McCann, Ph.D., Ten-Year Estimate of Justice-Involved Individuals in the District of Columbia, Criminal Justice Coordinating Council, revised September 2018, pg. 12.

[6] Doni Crawford and Qubilah Huddleston, What Does COVID-19 Mean for the Survival of Black-Owned Businesses?, DC Fiscal Policy Institute, May 1, 2020.

[7] Terry Gross, A ‘Forgotten History’ Of How The U.S. Government Segregated America, NPR, May 3, 2017.

[8] Crawford and Huddleston.

[9] Tazra Mitchell, Testimony of Tazra Mitchell at the Committee on Business & Economic Development Performance Oversight Hearing, DC Fiscal Policy Institute, January 15, 2020.

[10] Doni Crawford, Testimony of Doni Crawford At the Budget Oversight Hearing for the Committee on Government Operations, DC Fiscal Policy Institute, June 18, 2020.

[11] The LBA cites Burns, C., & Krehely, J. (2011). Gay and Transgender People Face High Rates of Workplace Discrimination and Harassment.

[12] U.S. Supreme Court, 2020

[13] Mitch Ryals, After Feeling Snubbed Last Year, the LGBTQ Community Is Making Louder Demands This Budget Season, Washington City Paper, February 5, 2020.