- $100 million investment maintained in the Housing Production Trust Fund

- $5 million of CDBG funding used to unlock $88 million in federal dollars for gap financing to create over 600 new units of affordable housing

- $2.07 added to the Affordable Housing Preservation Fund

- $50 million in the capital budget for public housing repairs and maintenance

- $5 million added for project-based rental assistance and $1.4 million added for tenant-based rental assistance for families on the DCHA waiting list

- Rent control reauthorization passed without reform

- New property tax abatement program to incentivize affordable housing in high-need areas, but it fails to incentivize development for DC families with the lowest incomes.

Affordable housing is key to providing long-term safety and stability, particularly for low-income communities and Black and brown communities facing the greatest housing challenges in the District. Deep structural inequities shape social determinants of health—the physical, social, and economic conditions in which we are born, live, and work. Structural racism has resulted in Black residents consistently making up about 75 percent of virus-related deaths and Black and brown residents making up 75 percent of positive cases for the virus in DC.[1] Nearly all residents living in the District’s public housing are Black and many of these units have caused their inhabitants to become sick.[2] This pandemic has made the connection between housing and life even more evident when one of the keys to staying healthy is staying at home.

Despite the huge revenue shortfall, the District was able to avoid major cuts to housing programs. However, the pandemic has created unprecedented economic conditions, leaving many renters unable to keep up with rent payments. A survey conducted by the Census Bureau showed that roughly 11 percent of DC renters were behind on rent in July.[3] Affordable housing programs still need to be supported with robust, recurring funding in the future to ensure that families will be able to withstand the looming eviction crisis after the public emergency is lifted and the local eviction prohibition ends.

Modest Investments in Affordable Housing Production and Preservation

Housing Production Trust Fund

The Housing Production Trust Fund (HPTF) is DC’s primary tool for building and preserving affordable housing. Last year, the FY 2020 approved budget included an $115.6 million investment in the HPTF—its first increase since FY 2015. But the supplemental budget cut the FY 2020 increase to $100 million and the FY 2021 approved budget allocated $100 million to HPTF. The FY 2021 allocation includes $73.5 million in dedicated taxes and $26.5 million in other local dollars, which includes a $9 million investment that the Council added to ensure that HPTF funding levels matched previous years’ investments.

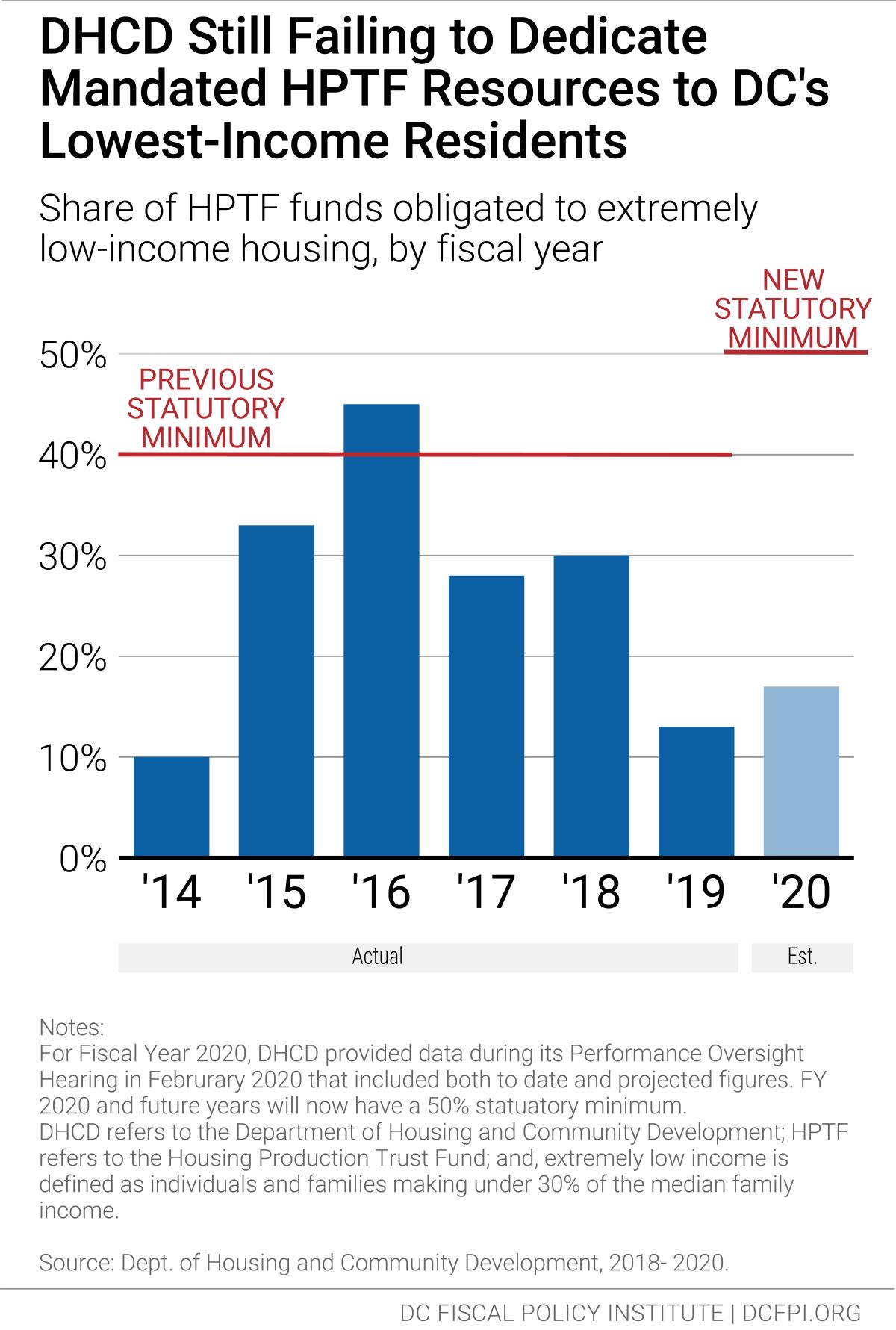

The law requires that 50 percent of HPTF resources be used to serve DC families with the lowest incomes (those with incomes up to $37,800 for a family of four). But the District has met its targeting requirements only once in the past 5 years (Figure 1). In order for the District to meet its mandated requirements, it typically requires pairing HPTF resources with rental assistance from DC’s Local Rent Supplement Program (LRSP), but policymakers often underfund this program. The District has developed a new plan to begin consistently meeting those goals—as money for new projects is added to the HPTF, DC will allocate a corresponding amount of project-based rental assistance to the financial plan.

Leveraging HUD’s Section 108 Program for Affordable Housing Production and Preservation

The approved budget includes language that allows the District to take advantage of the Community Development Block Grant Section 108 Loan Guaranty Program through the US Department of Housing and Urban Development (HUD). This program allows local governments to leverage their Community Development Block Grant (CDBG) to access low-cost financing for large-scale housing and economic development projects. The approved FY 2021 budget allocates $5 million of the District’s CDBG to allow the District to unlock $88 million in federal dollars for gap financing for the creation of over 600 new units of affordable housing. Neither the Council nor DHCD have yet indicated whether these dollars will be disbursed by the same mechanisms by which HPTF dollars are distributed.

Preservation Fund

The approved budget includes $2.07 million for the Affordable Housing Preservation Fund. The Preservation Fund uses public dollars to leverage private dollars in a 3-to-1 match to offer acquisition and predevelopment financing to preserve, acquire, and rehabilitate DC’s affordable housing stock. The public-private nature of this fund means that even a small increase in public investment results in a much larger investment.

New Capital Budget Allocation for Public Housing

The approved FY 2021 budget allocates $50 million in the capital budget for public housing repairs and maintenance. This is a considerable increase from the $24.5 million allocated to public housing repairs in FY 2020. The funding will go to address critical deferred maintenance issues in DC Housing Authority (DCHA) properties. There was considerable debate throughout the budget process as some councilmembers tried to locate additional sources of capital funding for FY 2022; however, funding for public housing repairs in FY 2022 remains at $15 million.

Notably, the approved budget splits the public housing rehabilitation funding from the New Communities program and creates a new DCHA project within the Capital Improvements Plan (CIP) for public housing repairs. The New Communities Initiative is a District government program that redevelops distressed public housing sites into mixed-income developments. The District allocated $20 million in FY 2021 and $10 million in FY 2022 for New Communities projects.

A controversial provision in an earlier form of the budget would have required DCHA to seek Mayoral approval for all expenditures on repairs and maintenance. However, the final budget stipulates that DCHA must submit a proposed spending plan to the Council and to the chairperson of the Council committee with oversight of the Housing Authority. There is no stipulation that the Council must approve that plan.

Limited Support for the Local Rent Supplement Program

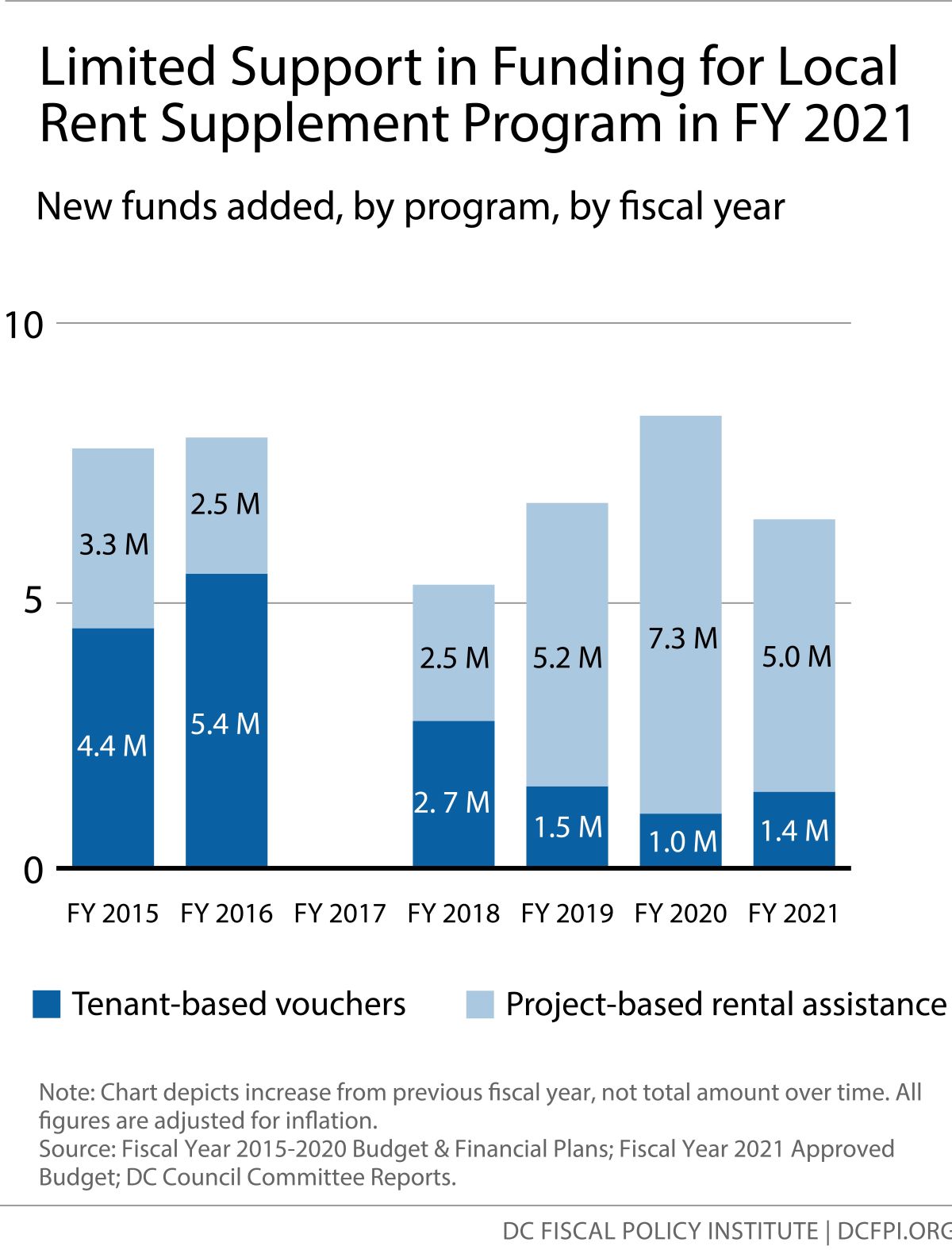

The approved budget includes a total of $6.4 million in new funds for rental assistance for families on the DCHA waiting list and for project-based rental assistance through DC’s Local Rent Supplement Program (LRSP), which is administered by DCHA (Figure 2).[4] This is a $1.8 million reduction from FY 2020 when adjusting for inflation and falls $28 million short of expanding access to housing that is affordable to the lowest-income families with the greatest needs.[5] The approved budget also includes $1.05 million in new funds for tenant vouchers for special populations.

Tenant-Based Vouchers

The budget provides $1.4 million in new assistance for tenant-based vouchers to assist 70 families, who are currently on the DCHA waiting list, with rental assistance on the private market. Nearly 40,000 households are currently on this waiting list, with more families added in at least each of the past three fiscal years.[6] This means that the bulk of families on this list will continue to face severe affordable housing challenges that have been exacerbated during this pandemic.

Project-Based Rental Assistance

The budget also adds $5 million to the project/sponsor-based component of LRSP, to provide operating assistance to for-profit and nonprofit developers for 258 new units that serve DC’s families with the lowest incomes (those with incomes up to $37,800 for a family of four). Because project-based LRSP cannot be used until development projects are completed, this funding often goes unspent for two to three years. As a result, the District will now move project-based LRSP to future years in the financial plan to account for when it will actually be spent. The financial plan is reported to include an increase of $5.4 million in project-based LRSP in FY 2022 and 2023 (we will confirm once more information is released by the CFO).

Project-based LRSP assistance is often awarded to affordable housing developments receiving gap financing from the HPTF. This new way of budgeting for project-based LRSP should assist the District in reversing its poor track record of meeting the statutory requirement that 50 percent of HPTF resources serve extremely low-income residents. All future allocations of project-based LRSP in the financial plan should be targeted to meet those HPTF thresholds.

Tenant Vouchers for Special Populations

The approved budget includes $1.05 million for 43 tenant vouchers for special populations. These vouchers will be available to 18 returning citizens, 15 seniors, and 10 seniors who identify as LGBTQ.[7]

The FY 2021 approved budget also includes $14 million for the Emergency Rental Assistance Program. Please see the Homeless Services Toolkit for more details.

COVID-19 Federal Rental Assistance

The District is leveraging federal assistance to provide additional rental relief to families facing financial hardship due to COVID-19. DHCD is using $1.5 million in existing federal HOME Investment Partnerships Program funds to establish a Tenant-Based Rental Assistance Program (TBRA). TBRA will assist up to 400 eligible households in small buildings with rental assistance, including retroactive rent for April and May, for at least six months. Program income eligibility is based on the Department of Housing and Urban Development’s COVID-19 income and rent schedule and will be available to those with incomes up to $72,780 for a family of four.[8]

DHCD is using $6.2 million from the CARES Act’s CDBG allocation to develop the COVID-19 Housing Assistance Program (CHAP). CHAP will provide up to three months of overdue rental assistance for low-income renters who have fallen behind due to COVID-19 from April 2020 onward. Program income eligibility is higher than TBRA and will be available to those with incomes up to $79,600 for a family of four.[9]

The District will also be able to use $2 million to cover the operating costs of nonprofit organizations that will administer both programs.

Minor Investment in Shallow Subsidy Program for Seniors

The approved budget includes $71,284 in new funds to DCHA for the shallow subsidy program for seniors, first piloted in FY 2019. The program targets seniors with incomes up to 60 percent of AMI (equivalent to $52,900 for a one-person household), who pay more than 30 percent of their income on rent. The program provides rental assistance—up to $600 per month—to seniors who exceed the income requirements for the Local Rent Supplement Program but still require assistance. This program received a $1.3 million investment in FY 2020, prior to the pandemic.

Rent Control Reauthorization Passed without Reform

The Budget Support Act for FY 2021 included a provision for a 10-year reauthorization of the existing rent stabilization legislation. The provision extends the Rental Housing Act of 1985 to December 2030. Many tenants and advocate groups have criticized this reauthorization, asserting that the law as it was written in 1985 is outdated and needs significant updating to meet the District’s current demand for stable affordable housing. While the DC Council approved the reauthorization with the BSA, in the upcoming legislative season, the Council will consider five rent control reform bills proposed by Councilmember Bonds. The Council will likely also consider the rent control omnibus bill introduced by Councilmembers Nadeau and T. White that would significantly reform and expand the District’s rent stabilization program.

New Property Tax Abatement Program

The approved budget creates a new property tax abatement program to incentivize the development of affordable housing in areas of the city with less affordability. Projects would be subject to first source hiring requirements and contracts with Certified Business Enterprises for a portion of project operations. After much deliberation throughout the budget process, the final iteration of the program will:

- Begin in FY 2024, with abatements capped at $200,000 and $4 million annually thereafter;

- Be eligible to properties developed or redeveloped in the high-need planning areas of Rock Creek West, Rock Creek East, Capitol Hill, and Upper Northeast; and,

- Offer developers a tax abatement for properties developed or redeveloped with at least one-third of units affordable and rented for up to 40 years to people with incomes on average at 80 percent of MFI (those with incomes up to $100,800 for a family of four).

While the geographic targeting is laudable, this income threshold is high, failing to incentivize the development of housing for the neediest renters. Additionally, the abatement as designed will pay for the cost of each affordable unit within 15 years, not 40 years, meaning a longer-term tax break isn’t needed. The Council should improve the program design in future legislation.

New Local LIHTC Program for Affordable Housing Development

The approved FY 2021 Budget Support Act creates a new local Low-Income Housing Tax Credit (LIHTC) program. The DC LIHTC program will, starting in October 2021, automatically give 10-year credits to projects that receive federal LIHTC awards. The local credits will be equal to 25 percent of the value of the federal award. Projects that receive these awards can take advantage of these tax credits once the projects are complete, meaning that the District will unlikely bear any major cost of this program until FY 2023 at the earliest.

Given the very modest investments in the Housing Production Trust Fund and the Preservation Fund in FY 2021, policymakers are hoping that this new program will provide additional incentive and support the development of new affordable housing.

Down Payment Assistance Programs Take a Hit

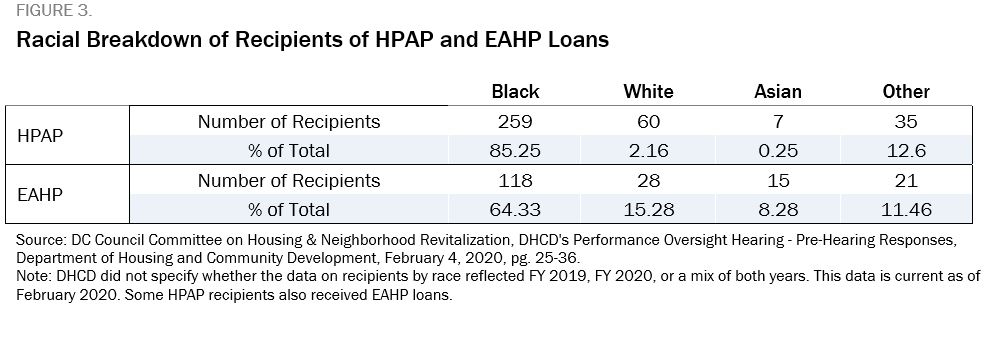

The approved budget includes $19.3 million in local and federal funds for the Home Purchase Assistance Program (HPAP) and $1 million for the Employer Assisted Housing Program (EAHP). This is an $11.5 million decrease from FY 2020 when adjusting for inflation. HPAP provides interest-free loans to low- and moderate-income first-time homebuyers for down payment and closing cost assistance, while EAHP provides down payment assistance to qualified DC government employees. DHCD provides statistics for the pool of HPAP and EAHP recipients for its performance oversight hearing each year, including by race (Figure 3).

Funding for down payment assistance had increased over the prior three fiscal years, and the District increased the maximum amount of assistance available per household to keep up with demand and the District’s high and rising home prices. Thus far, DHCD has been able to deploy funding to meet demand for HPAP and EAHP among various income categories of the approvable applicant pool.[10] The Director acknowledged that demand for EAHP has slightly declined so the full impact of the reduction in funding for FY 2021 remains to be seen.[11]

[1] Government of the District of Colombia, “Coronavirus Data by Race and Ethnicity,” August 11, 2020.

[2] Morgan Baskin, “As D.C. Weighs How to Fix Its Public Housing, Families Keep Getting Sicker,” Washington City Paper, March 20, 2019.

[3] Center on Budget and Policy Priorities, “Tracking the COVID-19 Recession’s Effects on Food, Housing, and Employment Hardships,” Updated August 21, 2020.

[4] Please see the homeless services toolkit for more information on the Targeted Affordable Housing component of LRSP.

[5] Doni Crawford, “Affordable Housing: All Residents, Especially Longtime Black and Brown Native DC Residents, Have a Safe and Affordable Place to Call Home,” DC Fiscal Policy Institute, February 5, 2020.

[6] DC Council Committee on Housing & Neighborhood Revitalization, “DCHA’s 2019 Performance Oversight Hearing,” DC Housing Authority, March 2020.

[7] Please see the inclusive economy toolkit for a comprehensive summary of District investments in returning citizens.

[8] US Department of Housing and Urban Development, “DC HOME Income Limits,” US Department of Housing and Urban Development, June 28, 2019.

[9] US Department of Housing and Urban Development, “CDBG Income Limits,” July 1, 2020.

[10] DC Council Committee on Housing & Neighborhood Revitalization, “DHCD’s Performance Oversight Hearing – Pre-Hearing Responses,” Department of Housing and Community Development, February 4, 2020, pg. 30.

[11] DC Council Committee on Housing & Neighborhood Revitalization, “DHCD’s Budget Oversight Hearing,” Department of Housing and Community Development, June 15, 2020.

[12] DC Housing Finance Agency, “COVID-19 Mortgage Relief,” August 11, 2020.