The DC Council held a vote on the final FY 2011 budget on May 26. The Council voted to restore many cuts to low-income programs, while leaving some program cuts on the table and rejecting a progressive income tax increase.

Budget Cuts: What Was Restored?

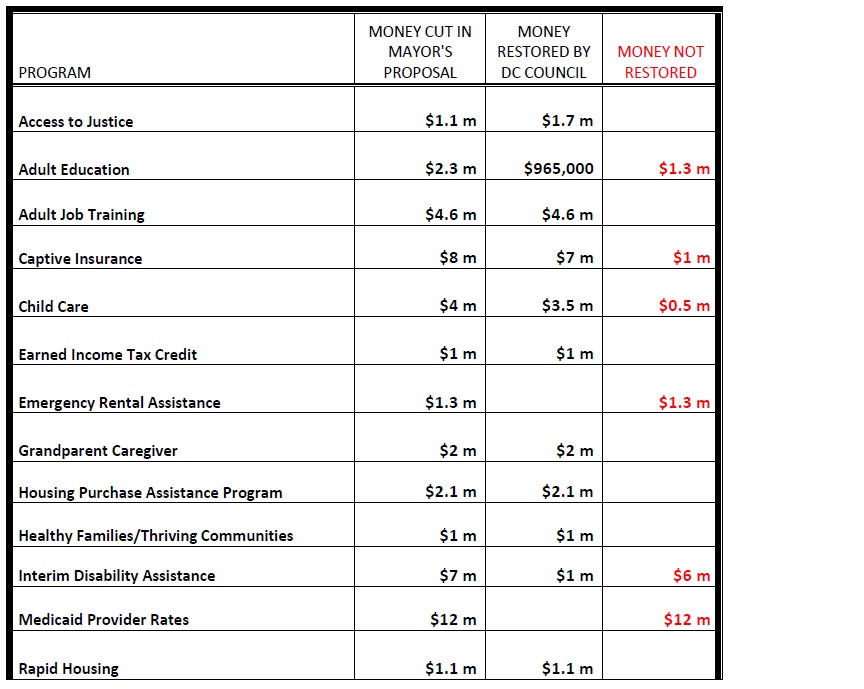

The Council restored funding ‘ mostly at the last minute ‘ to a number of programs critical to vulnerable DC residents that were facing large cuts. These programs include: Grandparent Caregiver, Rapid Housing, DC’s Earned Income Tax Credit (EITC), and adult job training. With the Council’s actions, these services will not be cut in 2011. (See the table below.)

Beyond these, the Council added $1 million to the Local Rent Supplement Program, which will help 75 very low-income households access safe and affordable housing

However, the Council left in place other cuts proposed by Mayor Fenty. They added $1 million to offset a small part of a $7 million cut to Interim Disability Assistance (IDA). IDA is a cash assistance program for residents with disabilities who are waiting for federal disability benefits to be approved and often have no other source of income. The Council did not find any funds for emergency rental assistance, which will be funded below the amount DC provided in 2008. And efforts to add $4 million to homeless services funding in the face of rising homelessness was not successful.

Revenue: Which Taxes Were Increased?

The DC Council debated raising income taxes on DC’s highest-income households, after Councilmember Jim Graham introduced an amendment to create a new tax bracket for households earning more than $350,000 in taxable income. (Currently, DC’s top tax rate is applied to households earning as little as $40,000.) However, the Council rejected the income tax proposal on an 8-5 vote. Councilmembers Michael Brown, Harry Thomas, Tommy Wells, and Marion Barry joined Councilmember Graham in voting for the amendment.

While the vote on the income tax increase failed, the Council voted in supported of several other tax increases. These included an expansion of the 6 percent sales tax to soda and medical marijuana and the addition of a 5 percent property tax rate for vacant properties. The Council also rejected some of the Mayor’s revenue proposals, eliminating a proposed parking meter rate increase and a 1 percent tax on hospital patient revenue. The proposed hospital tax was replaced with a $1,500 assessment per licensed hospital bed, which will generate far less revenue.

The following table shows how key low-income programs fared. DCFPI will follow up with a longer budget wrap-up when all FY 2011 budget documents are available.