Summary:

- $15.6 million added to the Housing Production Trust Fund, bringing it to $115.6 million

- Slight increase to the Affordable Housing Preservation Fund, bringing it to $11.8 million

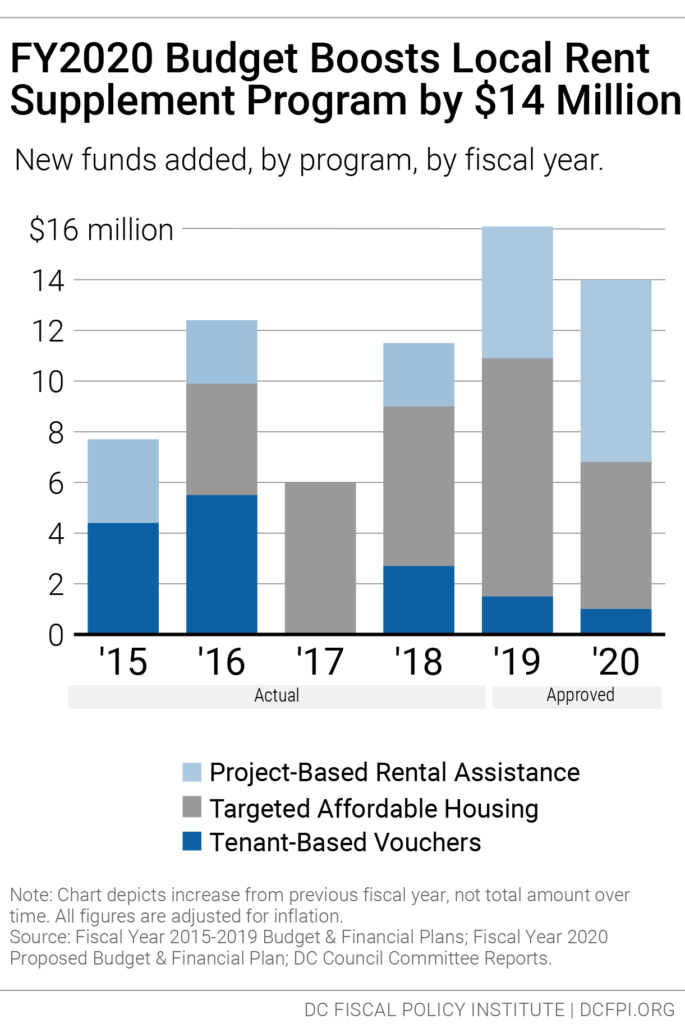

- $7.2 million added for project-based rental assistance, $5.8 million added for targeted affordable housing, and $1 million added for tenant rental assistance

- $3 million for a new “Workforce Housing” tax abatement

- $24.5 million one-time funds for public housing repairs

- $3.8 million expansion of the “Keep Housing Affordable” (Schedule H) tax credit

Local funding for affordable housing programs changed dramatically throughout the FY 2020 budget season (Table 1). The approved budget for fiscal year (FY) 2020 includes new, one-time resources to repair the most urgent public housing issues after a lengthy battle over Events DC’s unspent dollars. The budget also increases funding for the Housing Production Trust Fund (HPTF) for the first time since FY 2015. There was also a slight increase to the affordable housing preservation fund, and the Council fortunately reversed a ‘Workforce Housing’ program that would have supported families making over the median household income.

However, crucial issues remain: the District’s public housing stock is under threat, funding for HPTF remains inadequate, and the amount of tenant rental assistance does not meet the demand.

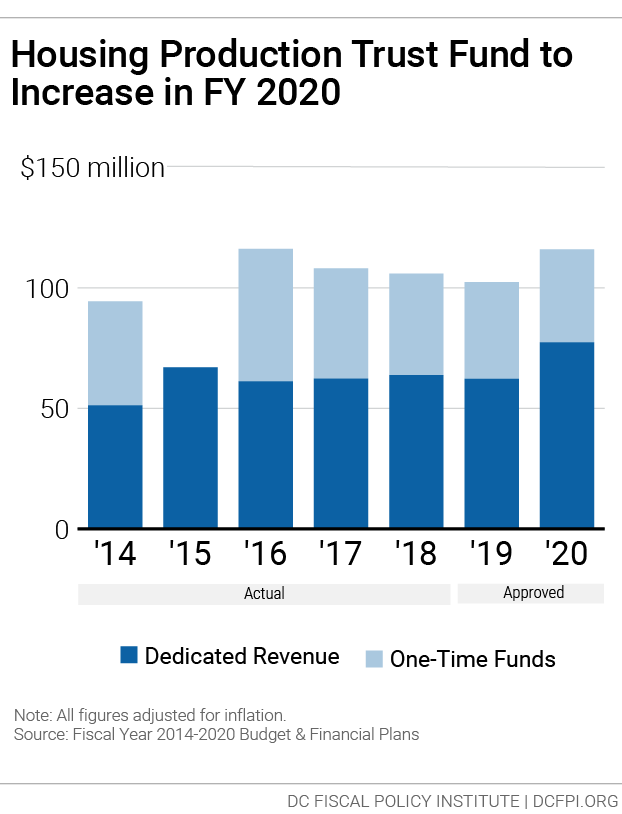

Modest Increase for the Housing Production Trust Fund

The approved budget increases the District’s investment in the Housing Production Trust Fund (HPTF) to $115.6 million, up from $102 million last year (when adjusted for inflation, Figure 1).[i] This investment will support the District’s primary tool to finance the production and preservation of affordable housing for low- and moderate-income residents. The budget supports the HPTF with $77 million in dedicated taxes and a $38.6 million supplement. Each year, 15 percent of deed recordation and transfer tax collections are dedicated to the HPTF. The one-time supplemental funding is not built into future budgets, meaning that additional funding will need to be identified again a year from now to maintain or grow the $115.6 million funding level.

While the budget reflects an important recognition that more resources are needed, it should be seen as a first step towards fully addressing rising costs of developing affordable housing and meeting the needs of families with extremely-low incomes.[2] Funding the HPTF at $200 million would help put DC on a path to meeting the most serious affordable housing challenges over the next decade.

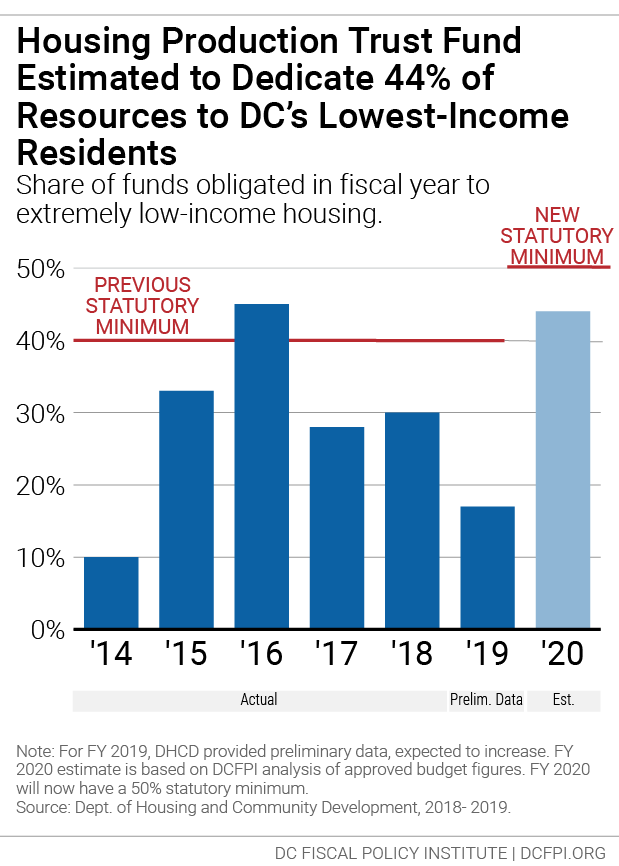

New Housing Production Trust Fund Target Modifications

New language incorporated into the Budget Support Act will now require 50 percent of HPTF resources be used to serve DC’s poorest families (those with incomes up to $36,400 for a family of four), a change that typically requires HPTF resources to be paired with rental assistance from DC’s Local Rent Supplement Program (LRSP). The District had met the prior targeting requirement of 40 percent only once in the past 5 years (Figure 2). The approved budget includes $7.2 million for LRSP tied to projects, which should assist the District in at least meeting the old targeting requirement.

Figure 2.

Increase to Preserve Affordable Housing

The approved budget includes $11.8 million for the Affordable Housing Preservation Fund (AHPF), which provides financing to preserve, acquire, and rehabilitate DC’s affordable housing stock. The Council initially eliminated funding for the AHPF to fund other housing programs, but ultimately reversed its decision and restored some of those cuts by shifting $4 million from the HPTF to the AHPF. Approximately 13,700 units with subsidies will expire by next year and are at risk of loss; steady funding for the AHPF can help protect these units.

Limited Support for Rental Assistance

The final budget provides $14 million in new funds for rental assistance through DC’s locally funded rental voucher program, the LRSP (Figure 3). This investment is a $1.4 million reduction from FY 2019 when adjusting for inflation and falls short of expanding access to housing that is affordable to the lowest-income families with the greatest needs.

Targeted Affordable Housing

The budget adds $5.1 million to support Targeted Affordable Housing (TAH) for 203 families and $737,000 to support TAH for 30 individuals plus staffing. TAH supports formerly homeless residents who lived in Permanent Supportive Housing and no longer need intensive services but still need affordable housing. It also assists residents whose temporary Rapid Rehousing assistance ends but still need rental assistance.

This is a reduction from the $9.2 million in new funding for TAH approved in the FY 2019 budget. The approved budget falls short of funding the 154 TAH units for individuals needed to end chronic homelessness in four years, a goal set by The Way Home advocacy campaign.[3]

Tenant-Based Vouchers

The budget provides $1 million in new assistance for tenant-based vouchers to assist individuals and families who currently are on the DC Housing Authority waiting list, which would pay for housing on the private market. The limited support for tenant-based vouchers means that the bulk of the 27,000 extremely low-income households spending at least half their income on housing will continue to face severe affordable housing challenges.

Project-Based Rental Assistance

The budget adds $7.2 million to the project-based component of LRSP, which provides operating assistance to for-profit and non-profit developers for specific units that serve low-income families. These vouchers are often awarded to affordable housing developments receiving gap financing from the HPTF. This should assist the District in reversing its poor track record of meeting the prior statutory requirement that 40 percent of HPTF resources serve extremely low-income residents. Given the new changes to the statutory requirements, future allocations should be targeted to meet those thresholds.

Figure 3.

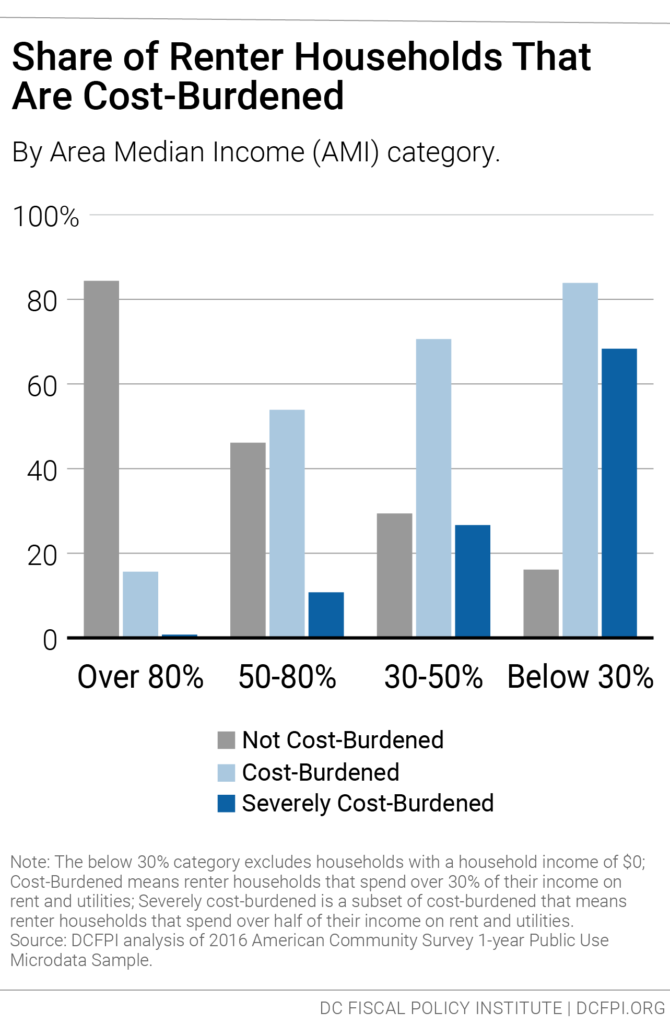

“Workforce Housing” Tax Abatement

The proposed budget included a new $20 million “Workforce Housing” program that would support the development of units for families making up to 120 percent area median income (AMI), which is $140,650 for a family of four. The approved budget reduced the program’s funding to $15.1 million and converted it into a 4-year tax abatement, which will cost the District $3 million in FY 2020. Reducing funding for the “Workforce Housing” program is reasonable, given that the majority of households making under 30 percent AMI are severely cost-burdened compared to households at higher income levels (Figure 4).

New Funding for Public Housing Repairs

After a lengthy debate with DC’s Chief Financial Officer, the Council identified a legislative mechanism to use $24.5 million of surplus funds from Events DC, formally the Washington Sports and Convention Authority, for public housing repairs. The DC Housing Authority is in the middle of implementing a “repositioning” plan that could risk housing stability and protections for current public housing tenants after redevelopment.

Figure 4.

Zero Funds for Lead Remediation

The Lead Safe Washington program, financed by federal HUD grants, was created to help eliminate lead dangers for low-income renters in apartment buildings. However, due to mismanagement of the funds, the District fell far below its targets and only rehabilitated 41 units compared to the 225 units the District initially proposed.[4] As a result, DC was deemed ineligible to apply for additional funding, which could have resulted in $4.1 million over 3 years. The approved budget did not include any local funds to compensate for the lost federal funding, despite the severe risks of lead poisoning.

Increase for Safe-At-Home Program for Seniors

The approved budget for the Department of Aging and Community Living’s Home and Community Based Support program increased by $1.4 million primarily to support the Safe at Home program, which funds preventative alternations to one’s home to reduce the risk of falls (e.g., handrails, shower seats, grab bars). The Council amended the program to lower the maximum grant amount for each residence from $10,000 to $6,000 and clarified that people with disabilities are only eligible for the program if they are at least 18 years old.

Shallow Subsidy Program for Seniors Increases

The approved budget includes $1.3 million in shallow subsidies for seniors, up from $736,000 in FY 2019 when the program was first piloted. The program targets seniors with incomes up to 60 percent of AMI (equivalent to $50,950 for a one-person household), who pay more than 30 percent of their income on rent. The program will provide rental assistance – up to $600 per month – to seniors who exceed the income requirements for the Local Rent Supplement Program but still require assistance. This increase will support an additional 81 households in FY 2020.

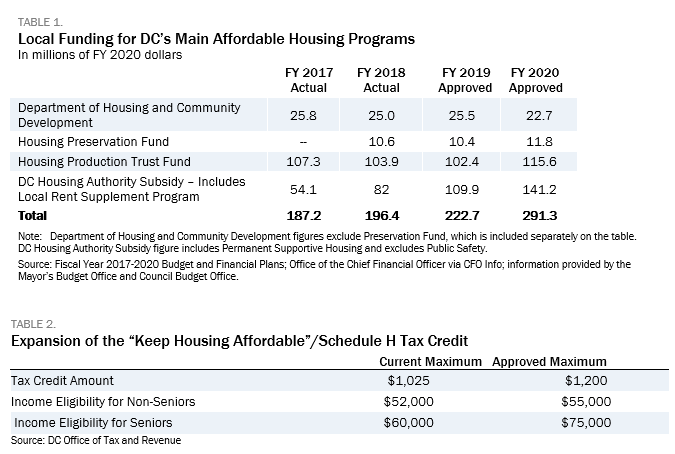

Expansion of the Schedule H Tax Credit

The approved budget also expands Schedule H (which is referred to in the budget as the “Keep Housing Affordable” tax credit), a property tax credit for low-income renters and homeowners who spend an excessive portion of their incomes on property taxes. While the tax credit is not solely for seniors, seniors living on fixed incomes or living in gentrifying areas are especially likely to benefit from this increase. Under the budget, the maximum tax credit would rise from $1,025 to $1,200, and the maximum income eligibility would rise from $52,000 to $55,000 for non-seniors and from $60,000 to $75,000 for seniors. The budget also includes positive administrative changes, such as eliminating the inclusion of dependent income in the credit calculation and making it easier to file electronically. Altogether, the changes to Schedule H will reduce income tax revenue by $3.8 million per year. (Table 2).

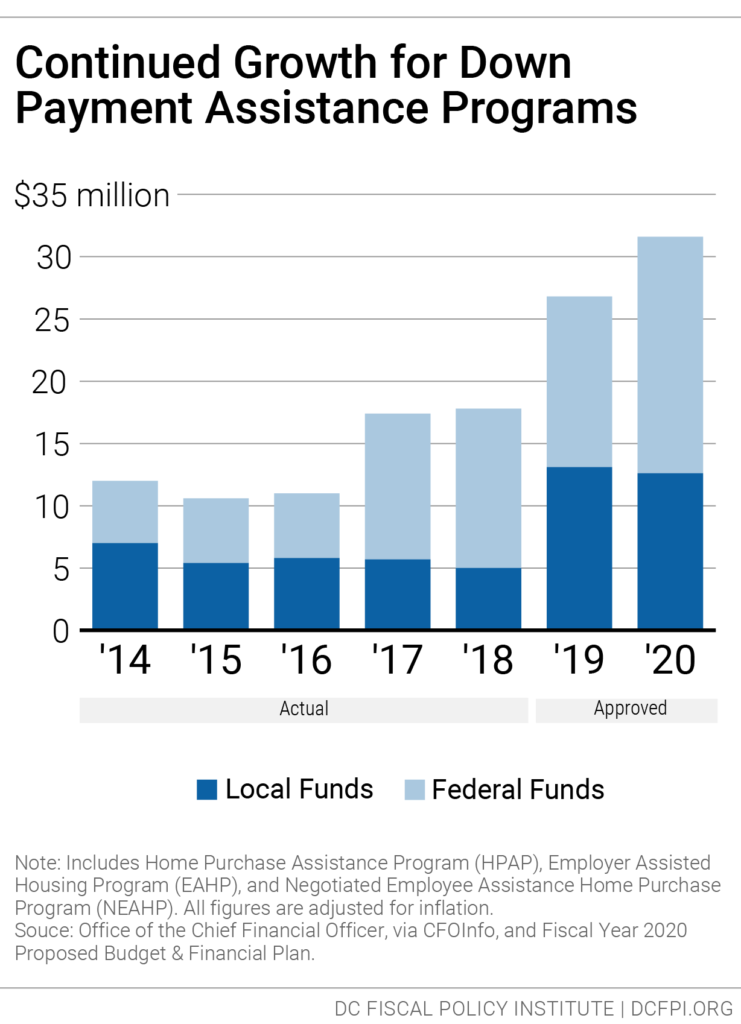

Growth of Down Payment Assistance Programs

The approved budget provides $27.3 million in local and federal funds for the Home Purchase Assistance Program (HPAP) and $4.4 million for the Employer Assisted Housing Program (EAHP). This is a $5.5 million total increase from FY 2019 when adjusting for inflation (Figure 5). HPAP provides interest-free loans to low- and moderate-income first-time homebuyers for down payment and closing cost assistance, while EAHP provides down payment assistance to qualified DC government employees.

Figure 5

Funding for down payment assistance increased over the past three years, and the District increased the maximum amount of assistance available per household to keep up with demand and the District’s high and rising home prices. In FY 2018, the District made over 360 down payment assistance loans through HPAP and over 140 down payment assistance loans through EAHP.

[i] In the Approved FY 2020 Budget Toolkit, DCFPI uses the most up-to-date inflation data, which is more current than the data that we used for the Proposed FY 2020 Budget Toolkit. As such, some figures may have slightly changed.

[2] Doni Crawford, To Ensure all Residents Have a Safe and Affordable Place to Call Home, DC Needs to Double Down on the Housing Production Trust Fund. DC Fiscal Policy Institute, March 10, 2019.

[3] Jesse Rabinowitz, “FY20 budget increases funds to end chronic homelessness, but falls far short of need.” The Way Home Campaign, April 12, 2019.

[4] Fenit Nirappil, D.C. Lost Eligibility for Federal Lead Grant After Failing to Spend $3 million. The Washington Post, March 1, 2019.