On July 17th, Mayor Fenty released an amended budget proposal to address a newly identified $340 million budget shortfall. This comes just two months after the Mayor and Council worked to pass a FY 2010 budget that included $800 million in budget-balancing measures. However, unlike the recently enacted budget which largely protected funding for programs and services – including low-income residents – the Mayor’s amended new proposal includes significant cuts in services that fall disproportionately on programs that affect DC’s low-income residents.

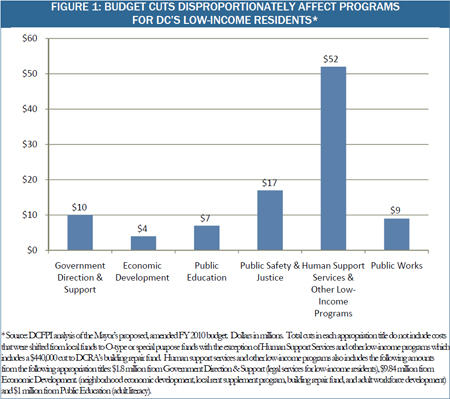

- Half of the budget cuts would fall on agencies serving low-income residents. The cuts to programs serving low-income residents and other vulnerable populations total $52 million, over half of the $99 million in total reductions. [1] This is despite the fact that these agencies represent just 30 percent of DC’s local funds budget. (See Figure 1.)

- Low-income cuts are three times greater than the cuts to any other program area. Proposed cuts to public safety (mostly in the Department of Corrections) total $17 million, while cuts in other areas were smaller.

Along with cuts, the Mayor’s proposal largely balanced the budget with the use of $125 million of DC’s rainy day fund and by relying on other fund balances from special purpose funds and dedicated tax funds. Unlike the original FY 2010 budget which included nearly $150 million of revenue raising proposals to help mitigate the need for deep cuts to services, the Mayor’s amended proposed budget includes just one revenue raising option. The proposed revenue increase will raise just $7 million by increasing a tax on phone bills that will pay for 911 and 311 services.

Cuts to Existing Programs Will Reduce Services to DC’s Most Vulnerable Families

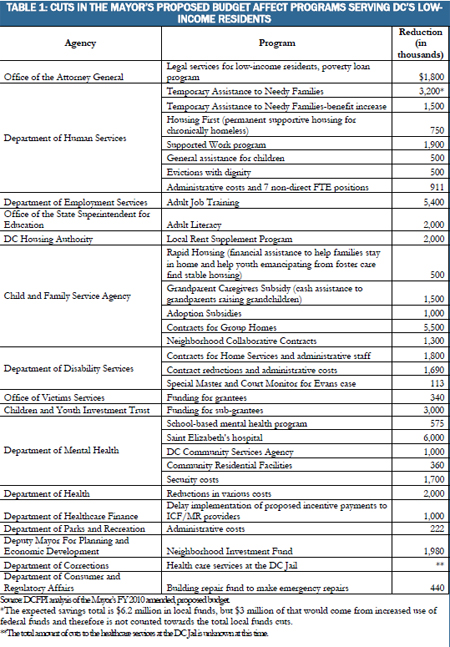

Cuts in the Mayor’s proposed budget include adult workforce development, adoption subsidies, neighborhood economic development, rental subsidies, and cash assistance for grandparents caring for their grandchildren, among others. (See the attached table for details on the low-income program cuts.)

Some of the cuts in the Mayor’s proposal will reduce basic income or other assistance to some of DC’s poorest families.

- Temporary Assistance for Needy Families and Related Programs: One of the largest program cuts in Mayor Fenty’s recent budget plan is a $6.2 million reduction in the Temporary Assistance for Needy Families (TANF) program – which provides cash assistance and job readiness services to low-income families with children.[2] The Mayor also proposed eliminating a $2 million employment training program for TANF recipients, as well as a $1.5 million increase in TANF cash benefits that was included in the FY 2010 budget. This increase was barely enough to cover inflation – and will now leave benefits at just 28 percent of the federal poverty line.

TANF is a critical program, providing support to one-third of the District’s children, including many families who lost jobs in the economic downturn. The Mayor’s budget proposal would cut monthly cash benefits for these families if they do not meet requirements to participate in work activities – and for the first time in DC’s history, could eliminate benefits entirely for some families. The proposal also would increase benefits for those who meet the requirements.

The goal of these provisions is to encourage more TANF parents to prepare for employment, but the approach is seriously flawed. Rather than incentivize families to move toward work, the new penalties are likely to push vulnerable families deeper into poverty.[3]

- Legal Services and Poverty Loan Repayment Program: This program provides funding to legal aid groups that provide civil legal assistance to low-income DC residents. The $1.8 million proposed cut represents a 50 percent decrease in funding for this program. The Legal Aid Society of the District of Columbia notes that proposed cuts could cost the legal services network 18-20 lawyers, even though demand for Legal Aid’s services has increased as a result of the economic downturn.[4] Studies in other states have shown that every dollar spent on legal assistance saves the government between $4 and $7 by addressing residents’ problems before they require more costly fixes. For example, providing residents legal services that can prevent evictions can save emergency shelter costs.[5]

Cuts to Planned Program Enhancements Also Will Have Serious Consequences

Many cuts in the Mayor’s budget proposal focus on new or expanded initiatives for 2010. Yet the lack of new funds will have a significant impact in many cases.

- Failure to Make Progress on Major Social Challenges: For example, the new budget plan would eliminate additional funding for adult literacy and adult job training, two areas of DC’s budget that have long been underfunded. The District spends very little on adult literacy, for example, even though one-third of adults are functionally illiterate, and spending on adult job training is low even though there are as many as 60,000 adults who could benefit from it. These cuts would limit the ability of the city to invest in low-income residents in ways that might help them take advantage of the eventual rebound in DC’s economy.

- Cuts that Could Lead to Unanticipated Increases in Demand for Social Services. For example, the “rapid housing” program supports families where there is a risk of a child entering the foster care system or if the barrier of inadequate housing is keeping a child from reunification with his or her parents. The program also helps prevent homelessness for youth aging out of foster care by providing them assistance to transition to their own apartment.Every dollar spent on this program saves an estimated $4 in reduced placements, according to the Children’s Law Center. Yet the Mayor’s budget plan would cut a modest expansion of this program. With more jobless families likely to be struggling to pay rent bills, the need for this program is likely to be growing.

The Mayor’s Gap-Closing Package Includes Just One Revenue-Raising Option

The Mayor’s proposed budget only included one new revenue-raising option, a $7 million increase for a tax on phone bills that will pay for 911 and 311 services. This is despite the fact that the budget shortfall is almost entirely a result of a fall in revenues, not a result of overspending on programs.

Raising additional revenues would have allowed the Mayor to limit service cuts. In fact, 25 states have raised revenues during this economic downturn in order to maintain funding for important programs and services. Moreover, raising taxes during an economic downturn – particularly on high-income residents – can be less harmful to the local economy during a recession, than cutting services. This is because high income earners spend a larger portion of their income outside of the local economy and because they are likely to continue to maintain spending.[6]

[1] Total cuts do not include local funds that were shifted to O-type or special purpose revenues, except for a $440,000 shift of FTE costs into the Department of Consumer and Regulatory Affairs building repair fund.

[2] The expected savings total is $6.2 million in local funds, but $3 million of that would come from increased use of federal funds.

[3] Katie Kerstetter, “Mayor Fenty’s TANF Proposal Will Increase Hardship among Poor Families with Children and Will Not Help Families Move from Welfare to Work” July 23, 2009. DC Fiscal Policy Institute. http://dcfpi.org/?p=722

[4] Jonathan Smith, “Mayor’s Proposed Budget Cuts Harmful to DC Residents Living in Poverty,” The Legal Aid Society of the District of Columbia. http://www.makingjusticereal.org/mayors-proposed-budget-cuts-harmful-to-dc-residents-living-in-poverty

[5] Ibid

[6] Elissa Silverman, “Raising Revenue by Creating a New Tax Bracket for Top Earners: A Progressive Approach to Solving DC’s Budget Shortfall,” DC Fiscal Policy Institute, April 27, 2009. http://dcfpi.org/?p=417