The tax reform package approved last month by the DC Council will reduce taxes for literally hundreds of thousands of DC residents. The  changes — based on recommendations from the D.C. Tax Revision Commission — will help make work pay for low-wage workers and help middle-income households better cope with the District’s high cost of living.

changes — based on recommendations from the D.C. Tax Revision Commission — will help make work pay for low-wage workers and help middle-income households better cope with the District’s high cost of living.

Today, the District’s Dime explores how key income tax changes will affect three DC households: a single worker earning $18,000, a single parent earning $30,000, and a married couple earning $100,000.

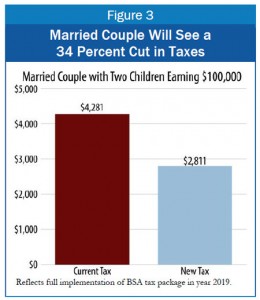

- Expanding the Earned Income Tax Credit (EITC) for low-income workers without children. The EITC, a tax credit for the working poor, lifts many families with children out of poverty, but it provides very small benefits to workers without children in their home. The maximum credit for childless workers is less than $200 and only goes to workers earning under $14,000. The new tax package expands eligibility to $23,000 and increases the maximum credit to almost $500. A single person earning $18,000 will go from owing $533 this year to getting a refund of $102, largely as a result of the new EITC. (See Figure 1.)

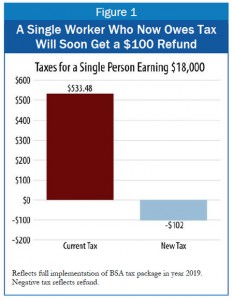

- Raising the personal exemption and standard deduction to federal levels. The District’s personal exemption and standard deduction, which exempt a certain portion of income from taxes, are small compared with

other states and the federal income tax. This is especially hard for low- and moderate-income families that rely heavily on these deductions. The tax package will raise these deductions to the federal levels — a best practice followed by six other states. Figure 2 shows that this will dramatically help moderate-income families. A single parent with two children and $30,000 income currently gets a $146 refund as a result of the EITC. With her taxes reduced as a result of a higher standard deduction and personal exemption, her refund will jump to $724.

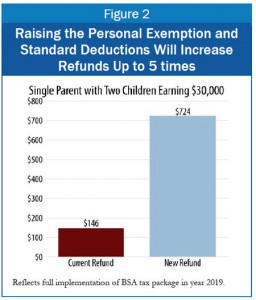

other states and the federal income tax. This is especially hard for low- and moderate-income families that rely heavily on these deductions. The tax package will raise these deductions to the federal levels — a best practice followed by six other states. Figure 2 shows that this will dramatically help moderate-income families. A single parent with two children and $30,000 income currently gets a $146 refund as a result of the EITC. With her taxes reduced as a result of a higher standard deduction and personal exemption, her refund will jump to $724. - Cutting the tax rate for middle incomes. The package cuts the tax rate for income between $40,000 and $60,000 from 8.5 percent to 6.5 percent. The rate cut plus the increase in personal exemptions means that middle income families will keep a lot more of what they earn — helping them pay for things like school uniforms, work supplies, and music lessons. A married couple earning $100,000 will see their taxes cut from $4,281 to $2,811. (See Figure 3.)

The Council’s tax package presents a unique opportunity to reduce taxes for virtually all District residents, while also targeting the highest reductions to those who need it most. The cuts will assist families in coping with the growing cost of living and allow for investments that can improve economic circumstances.

To print a copy of today’s blog, click here.