Chairman Bowser and members of the Committee, thank you for the opportunity to testify today. My name is Jenny Reed, and I am the Policy Director of the DC Fiscal Policy Institute. DCFPI engages in research and public education on the fiscal and economic health of the District of Columbia, with a particular emphasis on policies that affect low- and moderate-income residents.

I am here today to testify in support of the proposed $87 million increase in funding for the Housing Production Trust Fund as well as the need for increased transparency of the HPTF.

The Housing Production Trust Fund (HPTF) ‘ which is managed by the DC Department of Housing and Community Development ‘ is DC’s main source for affordable housing construction and renovation. The HPTF also assists tenants who wish to purchase their building when it is put up for sale. Under legislation enacted in 2002, some 15 percent of deed recordation and transfer taxes are dedicated to the fund each fiscal year. This funding rose substantially after FY 2002, during the District’s real estate market boom. In addition, deed tax rates were raised in FY 2007 to expand funding for HPTF and other housing programs.

The Housing Production Trust Fund (HPTF) ‘ which is managed by the DC Department of Housing and Community Development ‘ is DC’s main source for affordable housing construction and renovation. The HPTF also assists tenants who wish to purchase their building when it is put up for sale. Under legislation enacted in 2002, some 15 percent of deed recordation and transfer taxes are dedicated to the fund each fiscal year. This funding rose substantially after FY 2002, during the District’s real estate market boom. In addition, deed tax rates were raised in FY 2007 to expand funding for HPTF and other housing programs.

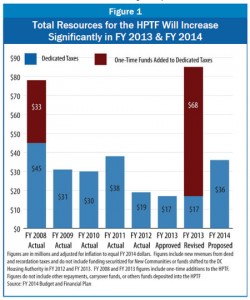

However, starting in 2008, DC’s real estate market cooled substantially and this resulted in a sharp decline in support for HPTF. As DC’s real estate market began to heat up again in FY 2011, resources for the HPTF began to rise. Yet, in both FY 2012 and FY 2013, the mayor’s budget cut approximately $20 million in new funding for the HPTF. Those cuts were set to stay in place through 2016.

The mayor’s proposed FY 2014 budget and revised FY 2013 budget would significantly increase resources for the HPTF (see Figure 1, previous page). Funding for the HPTF in the revised FY 2013 budget is $82 million, nearly three times the FY 2012 funding level. Total resources in FY 2014 are proposed to be $36 million and would more than double the resources available in the FY 2013 approved budget (not including the $67 million in one-time funds). It is notable that the proposed FY 2014 budget would devote the full 15 percent of deed taxes to the Trust Fund in FY 2014 and in future years, and would not re-direct any of those funds to other programs, as has been done in recent years.

To read the complete testimony, click here.