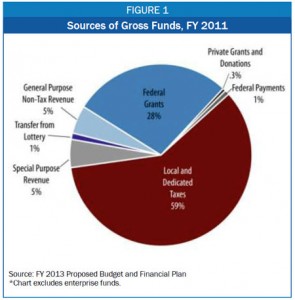

The DC government collects revenue in a variety of ways from its residents, businesses, and the federal government. These revenues are used to fund the wide array of services provided by the District, from schools to health care to libraries to road construction. The DC government collected about $8.8 billion in revenue in fiscal year (FY) 2011, with the largest sources being local taxes and federal funds. Other sources include various non-tax revenues such as licenses, fees, and private grants and donations. Much of the city’s non-tax revenue is described as “special purpose” revenue because it is devoted to specific purposes.

All of these funding sources together are called “gross funds.” Figure 1 shows a breakdown of gross funds revenue for FY 2011. The District’s major revenue sources are discussed below.

All of these funding sources together are called “gross funds.” Figure 1 shows a breakdown of gross funds revenue for FY 2011. The District’s major revenue sources are discussed below.

Taxes

Taxes account for nearly 60 percent of the revenue collected by the DC government. Most tax revenue becomes part of the city’s general fund and is used to fund the basic services included in the District’s budget. Some taxes, known as dedicated taxes, can only be spent on specific activities. For example, all parking sales taxes are dedicated to the District’s annual funding responsibility for Washington Metropolitan Area Transit Authority (WMATA).

To view the complete report, click here.