The District ended 2016 with a lot more money in the bank, money that could be used to create more affordable housing, renovate more schools, or pay the start-up costs for the new paid family and medical leave program. But to make those important investments, we first need to change the policy that requires all surplus funds go into savings, which ties policymakers’ hands and takes away any choice over how to use the city’s growing resources.

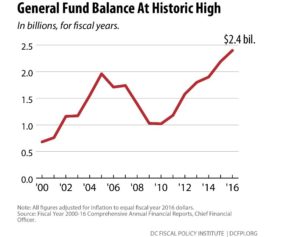

The just-released audit of the District’s finances—the Comprehensive Annual Financial Report (CAFR)—showed a dramatic $222 million increase in our General Fund balance in 2016. The fund balance represents DC’s accumulated assets, including various reserve funds. The fund balance has grown substantially in recent years, to $2.4 billion in 2016 from just over $1 billion in 2009, and is now at a record high.

The just-released audit of the District’s finances—the Comprehensive Annual Financial Report (CAFR)—showed a dramatic $222 million increase in our General Fund balance in 2016. The fund balance represents DC’s accumulated assets, including various reserve funds. The fund balance has grown substantially in recent years, to $2.4 billion in 2016 from just over $1 billion in 2009, and is now at a record high.

DC can end the year with more money in the bank—a surplus in budget terms—for a lot of reasons, just as you might end the year with a little extra in your budget. In 2016, the District collected more in taxes than expected, and spent less than had been budgeted. A year-end surplus is unique to each year’s circumstances, and it is unpredictable from year to year. For that reason, year-end surpluses can be used for only one-time expenses like building affordable housing or schools.

About $160 million of the fund balance increase is potentially available to spend on important one-time expenses to help DC residents. However, due to a policy the District adopted in 2010, all year-end surpluses must go into savings until the city has enough cash in reserve to fund DC government for 60 days. Having this much cash on hand is helpful mostly for the purpose of managing the city’s cash flow, including paying bills in between periods when major tax payments are made. Having cash on hand limits the need for short-term borrowing during the year. Yet short term borrowing currently is a small cost to the city—just $1.25 million in interest payments in 2017. Given this, it is not clear that saving surplus funds should be DC’s only priority this year.

Instead, the District should modify its saving-as-the-only-choice approach and use some or all of the surplus to build new affordable housing, preserve affordable housing that needs repairs, build or renovate schools to accommodate DC’s rapidly growing population, or set up a computer system for paid family and medical leave.[1]

Last week, at the Progress Amidst Uncertainty: Making the Most of DC’s 2018 Budget event, DCFPI outlined three policy proposals in response to the growing city surplus: delay the tax-cut triggers, spend the surplus, and set up a reserve fund. These are just a few of the ways that the District’s fiscal policy can be revisited to build stronger communities across the city.

We hope that Mayor Bowser will consider revising DC’s surplus policy in her proposed FY 2018 budget, so that some of the surplus can be spent on much-needed programs and services.

[1] Because a year-end surplus is not guaranteed every year, the District cannot use the surplus to fund programs or services that have ongoing costs, like hiring more teachers or providing permanent supportive housing to residents experiencing chronic homelessness.To print a copy of today’s blog, click here.