While many DC residents struggle to pay rent, Mayor Bowser and DC Council are advancing two pieces of legislation that strip away legal and financial protections from tenants while failing to address the dire issue of affordability. An estimated 44.7 percent of District renters are “rent burdened,” meaning they pay more than 30 percent of their gross income to rent according to one-year estimates from the US Census Bureau’s American Community Survey (ACS). Rent burden among renters of color in DC is even higher. This high level of rent burden—which has not statistically changed since 2021—should be an urgent call to lawmakers to address the affordability crisis.

Rather than helping tenants afford skyrocketing rents, bills introduced by lawmakers support landlords that have seen large increases in rental arrears. DC Council voted to advance the Emergency Rental Assistance Reform Amendment Act, without key amendments to expand the definition of a housing emergency and ease some of the burdensome documentation requirements for renters. This legislation came on the heels of Mayor Bowser’s Rebalancing Expectations for Neighbors, Tenants, and Landlords Act (RENTAL Act), which aims to speed up eviction timelines and dramatically narrows the scope of the Tenant Opportunity to Purchase Act (TOPA), a 45-year-old law that gives tenants the first right to purchase their building if it goes up for sale.

Rather than putting struggling renters in a more precarious position, DC lawmakers should focus on improving rental assistance, which would ensure Black and non-Black renters of color with low incomes have stable and affordable places to call home. It would also help landlords collect rent.

Residents of Color are the Most Likely to Struggle with Rent in DC

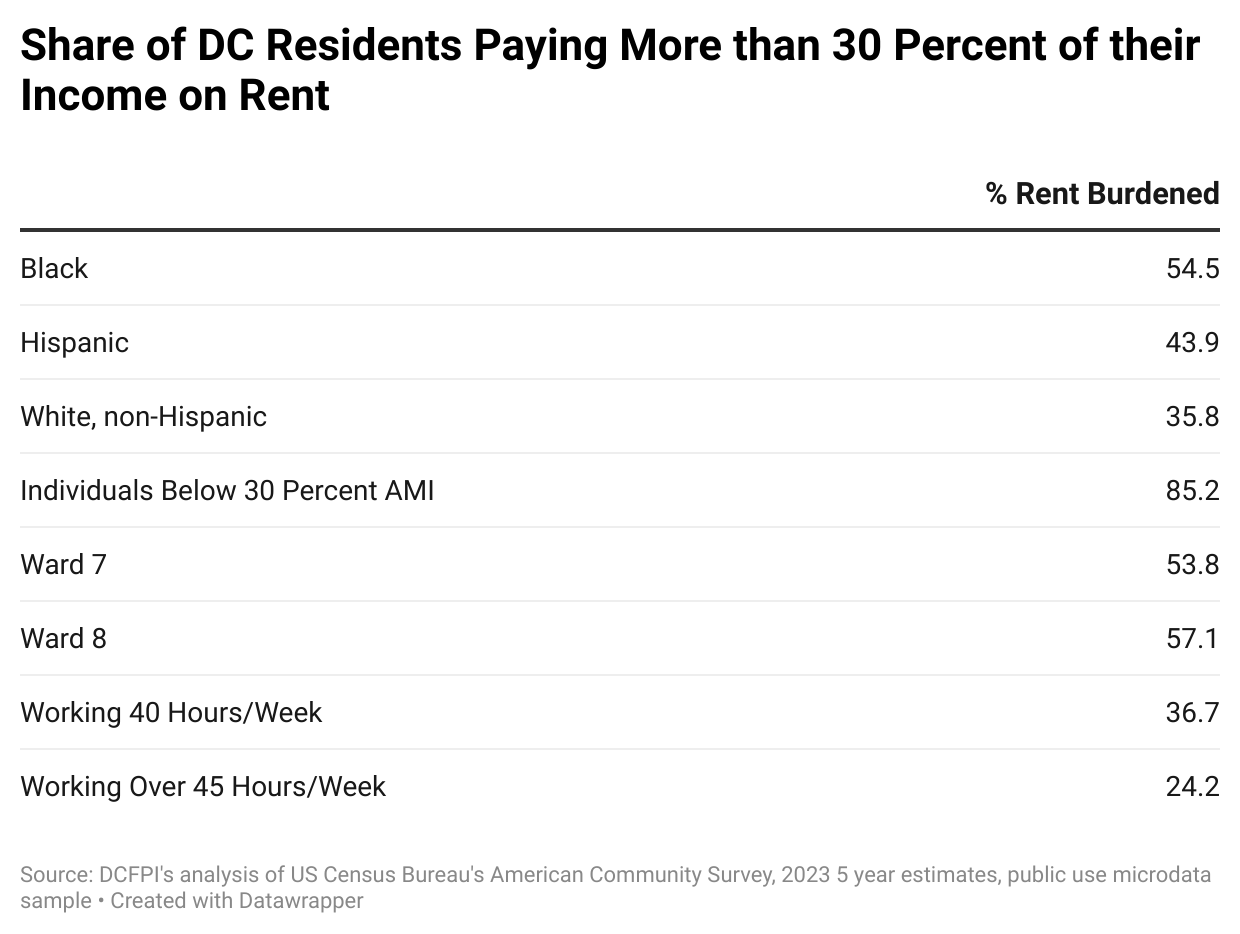

Generations of policy choices, both on the local and federal levels, have led to racial income and wealth disparities, segregation, and the steady disappearance of affordable housing in the District—denying Black and non-Black residents of color equitable access to housing. From 2019 to 2023, more than half of Black renters (54.5 percent) and nearly half (43.9 percent) of Hispanic renters, on average, paid more than 30 percent of their income in rent, compared with one-third (35.8 percent) of white, non-Hispanic renters, according to DCFPI’s analysis of the ACS’s five-year microdata files (Table 1).

When focusing on individual low-income renters who fall under 30 percent of the Area Median Income (AMI)—those with incomes at or below than $32,500 a year—85.2 percent are rent burdened. These renters are predominantly Black.

While high housing prices affect every part of DC, renters East of the River are the most likely to be rent burdened. In Wards 7 and 8, which are predominantly Black, 53.8 percent and 57.1 percent of tenants, respectively, pay more than 30 percent of their income in rent.

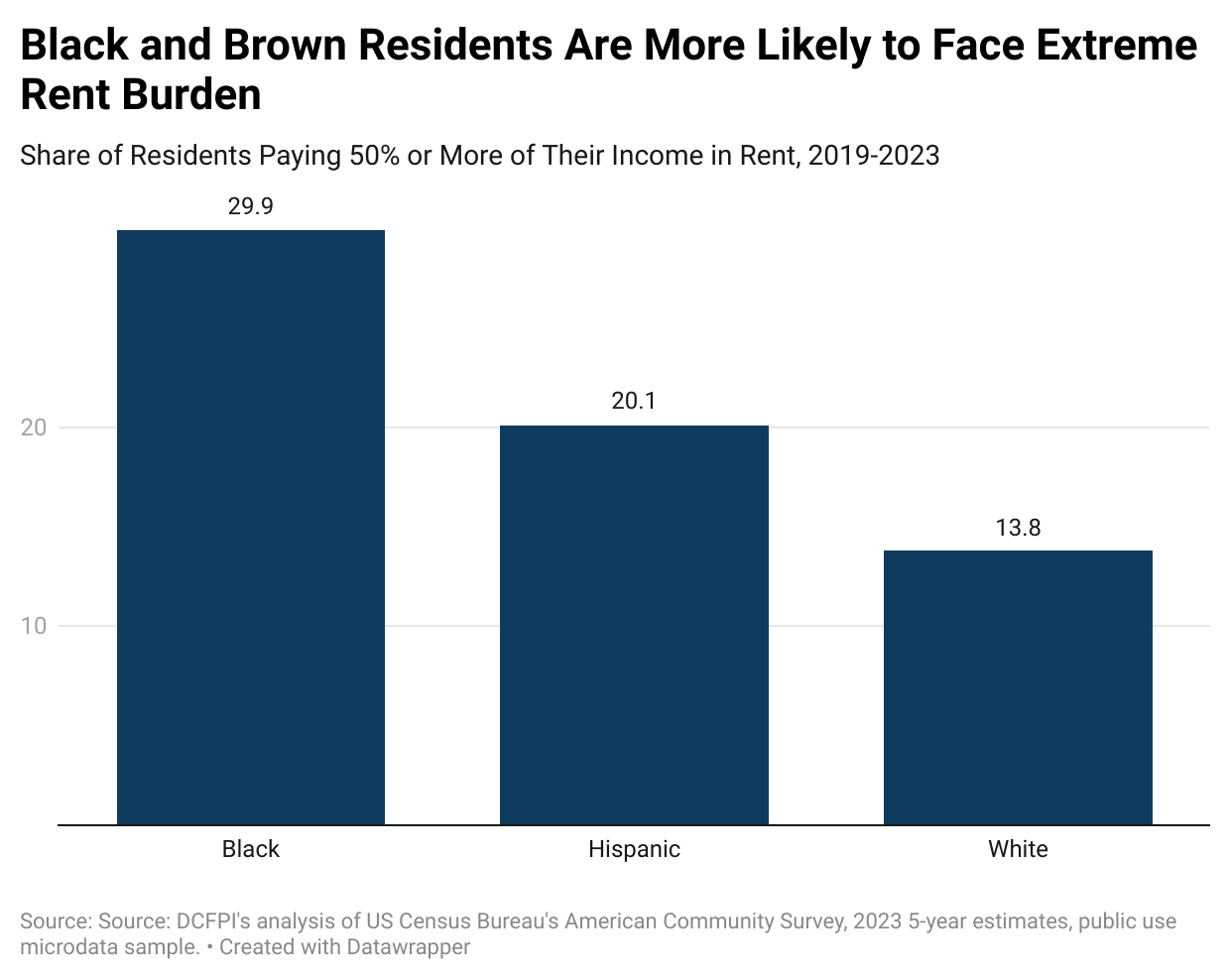

Racial disparities also appear in cases of “extreme rent burden,” where renters spend more than 50 percent of their income on rent. From 2019 to 2023, more than 1 in 4 Black renters (29.9 percent) and 1 in 5 Hispanic renters (20.1 percent) were extremely rent burdened compared to 13.8 percent of white renters (Figure 1).

Having a Job Doesn’t Mean a Person Can Afford Rent in DC

Working, even at a full-time job, doesn’t guarantee a District resident can afford rent. In an economy where income is hyper-concentrated among the top 20 percent, many renters work two or sometimes three jobs, and still may not earn enough to pay the bills—an estimated annual income of over $62,000 is required in the District to cover the essentials for a single-person household, per the Economic Policy Institute. As a result, more than one-third of renters working full-time, or 40 hours per week, are rent burdened (Table 1).

In 2023, DC median household income remained statistically unchanged from the prior year, despite an improving economy and steady increases in the minimum wage. White residents were the only racial and ethnic group to see income gains over the prior year. The data demonstrate that more must be done to grow incomes for Black workers and to reduce racial and ethnic disparities in economic opportunity and well-being. As incomes fail to keep up with the high cost of housing in DC, residents of color in particular are at risk of eviction, homelessness, and displacement.

Mayor Bowser and DC Council Need to Do More to Make Rent More Affordable

While the recent legislation has been framed as a fix to a failing housing ecosystem, the reality is that both bills target support to landlords while undermining core renter protections and failing to address affordability and the high need for rental assistance.

Solving the root problem of affordability will require a combination of strategies and public funding for housing programs that meets the scale of the problem. More new construction will help bring down market rate rents over the long-term, but is not enough to create affordability across the income spectrum. Programs like emergency rental assistance provide short-term relief to residents, preventing them from being evicted due to being unable to pay their rent. Investing more in the construction and preservation of affordable housing and enforcing requirements to build deeply affordable units will provide residents with low incomes with affordable homes. Lawmakers should take a holistic strategy for ending the affordability crisis and focus on policies that help residents with the lowest incomes afford a stable, safe home.