It’s one of the best kept secrets that DC’s property taxes are the lowest in the Washington region. Over the past decade, the District has set the residential rate to 85 cents per $100 of assessed value, increased the homestead deduction, and set a ten percent cap on how much a home’s assessment can grow each year for tax purposes.

Sounds like things are working pretty well. And they are for most homeowners. Which is why it’s puzzling that a bill before the DC Council would cut property taxes broadly for homeowners even more. DCFPI favors another bill before the Council, which would offer targeted help to owners who face the greatest struggle paying their bills. We think that is the right approach at a time we should use our civic resources to meet the greatest needs.

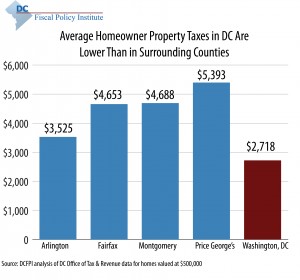

The blanket property tax cut would reduce the annual cap on assessments from ten percent to just five percent per year. It’s unclear why this relief is needed, since property tax bills for DC homeowners already are lower than in surrounding jurisdictions. The average property tax for a DC home worth $500,000 stood at $2,718 in 2012, compared with $3,525 in Arlington County, $4,653 in Fairfax County, $4,688 in Montgomery County, and $5,393 in Prince George’s County.

Moreover, the typical DC homeowner pays tax on just 73 percent of their home’s value, thanks to the 10 percent cap and the homestead deduction. This suggests that the current cap is working well to limit increases in homeowner property taxes. Once again, it is not clear why further reductions in homeowner property taxes should be a legislative priority.

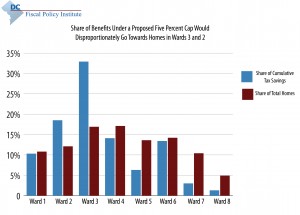

The biggest argument against a blanket tax cut is that it would disproportionately help those who need it the least. A DCFPI economic analysis of the city’s property tax database shows the benefits of slashing the cap to five percent would largely go to owners of high value homes and to residents in the city’s highest-income wards:

- Some 64 percent of the benefits of a five percent cap would go to homes worth more than $550,000, even though they represent just 31 percent of DC homes. By contrast, homes worth under $275,000 would get only eight percent of the benefits, even though they make up 29 percent of DC homes.

- Homes in Ward 3 would claim 33 percent of the benefits of a five percent cap, while homes in Wards 7 and 8 combined would receive just four percent of the benefit. This is because the homeownership rate is low in Wards 7 and 8, so that few households benefit at all, and because home values are far lower there.

DCFPI strongly supports an alternative property tax reduction bill that is before the DC Council, the Schedule H Property Tax Relief Act of 2012. Schedule H is a property tax credit targeted to households for whom property taxes are high relative to income. It is limited to lower-income households, but it applies to renters in addition to homeowners.

DCFPI strongly supports an alternative property tax reduction bill that is before the DC Council, the Schedule H Property Tax Relief Act of 2012. Schedule H is a property tax credit targeted to households for whom property taxes are high relative to income. It is limited to lower-income households, but it applies to renters in addition to homeowners.

Support for this targeted tax relief is strong, but the credit has been neglected since it was created 35 years ago. The income eligibility level is just $20,000, and the application rules are complex. This reform bill would update this important tax credit and give tax relief to thousands of households who face pressure paying their tax bill.

DC’s overall homeowner property tax system is not broken, but our tax credit to help low-income homeowners needs to be updated and strengthened. Let’s put our repair efforts where they are needed and give targeted tax help to our neighbors who really need it.