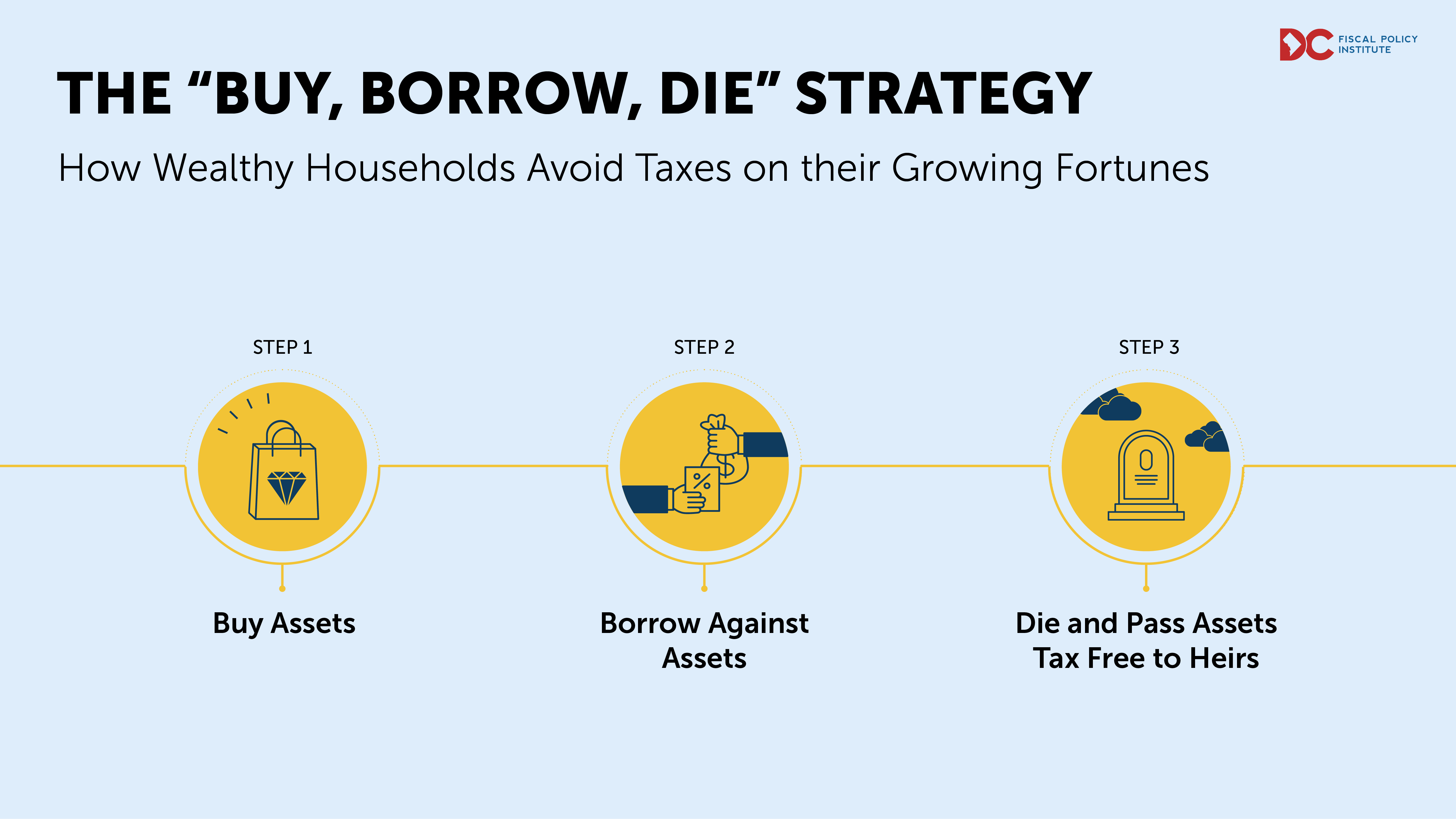

The US and DC tax systems include many advantages for wealth, allowing it to concentrate in the hands of a few households. Wealthy households, for example, can use the three-step “buy, borrow, die” strategy to get massive capital gains tax advantages. This strategy protects the inheritance of wealth, especially extreme wealth, allowing the very wealthiest families to hold, live off of, and transfer that wealth without ever paying taxes on it—and it’s all legal. Racial justice requires unrigging the system that allows for tax avoidance and taxing wealth more heavily to increase our shared resources, so that all have what they need to thrive.

Step 1: Buy Assets

Wealthy family buys stocks, bonds, real estate, art, or other high-value assets. It strategically holds on to these assets and allows them to grow in value. The family won’t owe income tax on the growth in the assets’ value unless it sells them and makes a profit.

Step 2: Borrow Against Assets

Wealthy family borrows against its assets’ growing value and uses the newly available cash to live off or invest in other assets, like rental properties. The family does NOT owe taxes on its asset-leveraged loans because the government doesn’t tax borrowed money.

Wealthy family uses its untaxed wealth to access significant amounts of untaxed cash to live luxuriously while continuing to grow its wealth, untaxed, indefinitely.

Step 3: Die and Pass Assets Tax Free to Heirs

Wealthy parents or benefactors of the family keep the original appreciated assets until their death, leaving those assets to an heir. Neither the current federal or local tax code require the original asset holders or the heir to pay taxes on the growth in value up to that point. Instead, the tax code wipes out any tax liability for the capital gains by “stepping up” the baseline value of the assets from the original price to their value at the time of the benefactors’ death. This enables the wealthy family’s heirs to altogether avoid taxes on the increased value of stocks, real estate, and valuable artwork.

To learn more, see “Taxing Capital Gains More Robustly Can Help Reduce DC’s Racial Wealth Gap.”