The District’s Dime is back with more updates on the changes in next year’s budget! Today we’ll cover two big topics in DC: affordable housing and taxes.

Affordable Housing in DC’s FY 2015 Budget

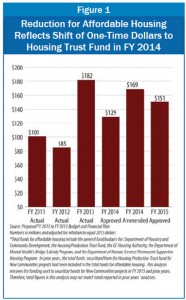

The District plans to spend $151 million in local revenues on affordable housing next year. That’s 16 percent more than the initially approved budget for FY 2014, after adjusting for inflation. But the Mayor and Council added $40 million in mid-2014 to the Housing Production Trust Fund. Taking that into account, the FY 2015 budget is a 10 percent drop from the FY 2014 budget. The FY2015 budget includes:

- Increases to rental assistance. About 500 more low-income households will get help from DC’s local rent supplement program, including some seniors who will be able to move out of nursing homes and homeless families.

- Funds to house chronically homeless veterans and families. The District will end chronic homelessness among veterans next year and provide permanent supportive housing to about 75 chronically homeless families.

- A new locally funded low-income housing tax credit (LIHTC). The new credit, modeled on the federal LIHTC, will draw more private investment into the production of affordable housing.

Tax Changes in DC’s FY 2015 Budget

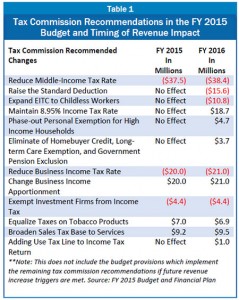

Next year’s budget includes many tax changes by starting to implement many of the recommendations of the D.C. Tax Revision Commission. These changes include:

- Income Tax Cuts for Virtually All Residents. Lower- income residents will benefit from an increase in the standard deduction and from an expansion of the Earned Income Tax Credit for childless workers. The budget also reduces the income tax rate on income between $40,000 and $60,000, which will help moderate and higher-income residents. The budget calls to further increase the standard deduction and further reduce the middle-income rate in future years if certain revenue triggers are met.

- Business Tax Changes. These include a cut in the business income tax rate, a change in the way multistate companies determine DC profits, and a business income exemption to encourage investment firms to locate in DC. The business tax rate will be reduced further if triggers are met.

- Property Tax Assistance for Seniors. The budget expands the Schedule H property tax credit for low- and moderate-income seniors and allows interest-free property tax deferrals for long-time senior homeowners.

- Sales tax changes. The budget raises taxes on non-cigarette tobacco products and expands the sales tax to a number of services. Both were recommended by the tax commission.

Keep checking back in with the District’s Dime for more toolkit updates this summer!

To print a copy of today’s blog, click here.