DC Health Link had a successful year, connecting more than 48,000 people to affordable health insurance plans. But now that enrollment for 2014 is over, insurance companies are beginning the process of making adjustments and submitting rates for their 2015 health plans.

While the new rates and offerings show that DC Health Link is adding competition to the market, there are still some significant price increases that consumers and District regulators should keep their eyes on over the next couple of months.

During the summer, health insurers submit health plans and prices for the coming plan year. For 2015, DC Health Link’s four major insurers adjusted the number of plans they will offer based on consumer demand, with both UnitedHealthcare and Aetna dropping plans with little or no enrollment. This resulted in an offering of 227 health plans for DC Health Link, 74 plans fewer than last year. Fewer plans will likely result in less confusion for consumers and more meaningful choices between products.

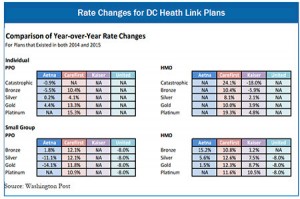

For the most part, price adjustments were mixed — with UnitedHealthcare dropping rates significantly when compared to 2014, and both Kaiser and Aetna having a mixture of both rate increases and decreases (See Figure). Only CareFirst submitted significant rate increases across all of their plan offerings — with increases ranging from 4 percent to 24 percent over 2014.

Double digit increases to health plan rates may seem alarming, but these are only the initial rate filings and are subject to change. The Department of Insurance, Securities, and Banking will review the rates to see if they are justifiable. Meanwhile, the openness and transparency of the submission process allows insurers to see what their competitors are charging and adjust prices downward. Last year, three of the four DC insurers lowered rates after their initial filing — suggesting that the act of making the rate filings public added to price competition. Over the next months, consumers should keep an eye on rate filings so they are better prepared to shop when open enrollment begins in November.

Both the rate review and transparency of the rate filings protect consumers from unjustifiable rate increases. Still more resources and a more stringent evaluation process by regulators is needed to ensure that District residents get what they pay for. Last year, the DC Council failed to pass a measure that would increase the public participation in the rate review process and set rate change thresholds for which more extensive evaluation is required. Provisions like these would better protect consumers in the future and help make the process more transparent.

To get more information on 2015 health plan rates, visit here.

To print a copy of today’s blog, click here.