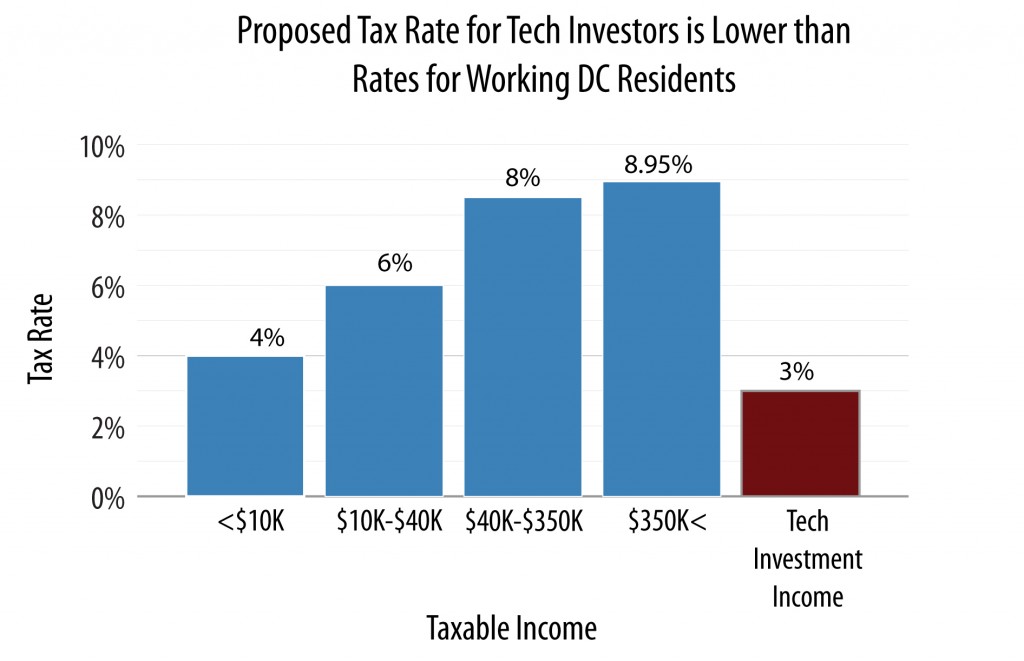

A bill being considered by the DC Council in September would tax income from investments in DC’s technology companies to just three percent. That’s lower than the rate paid by other working District residents.

- Tax cuts for tech millionaires would mean less revenue for services. Cutting taxes for tech millionaires could cost the city a substantial amount at a time when budget cuts have forced some DC schools to cut librarians and when homeless shelters do not have enough resources to stay open year-round.

- Tech millionaires would get a huge tax cut on their existing investments. The proposed legislation would even cut taxes for people who already own parts of tech companies. If the tax cut is supposed to create an incentive to invest, it doesn’t make sense to offer it current investors.

- Cutting investment tax rates has not proven to help the economy. Researchers find no connection between the national capital gains tax rate and economic performance. If it hasn’t worked in the entire U.S., why would it work in DC?

- The District already provides large tax incentives for the tech sector growth. Since 2000, DC has offered large tax incentives for high-tech companies, and LivingSocial just got a $32.5 million tax abatement. Why do we need to provide tax breaks to the companies and their investors?