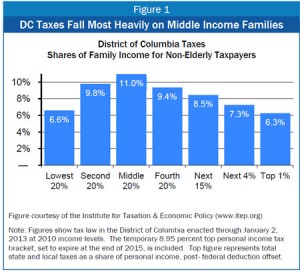

DC taxes fall most heavily on moderate-income families, according to a report released today from the Institute for Taxation and Economic Policy (ITEP), while DC’s highest-income families face the lowest combined DC taxes as a share of income. This report, an update to a 2009 report that was analyzed by DCFPI, finds that families with incomes between $22,000 and $62,000 pay between 10 percent and 11 percent of their overall income in combined sales, income, and property taxes after taking into account any federal offsets. The top 1 percent of DC families, making more than $1.4 million, pay a lower share of their income in taxes ‘ 6 percent ‘ than any other group of residents.

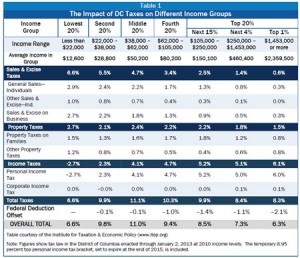

The main reason for DC’s tilted tax structure is the city’s reliance on higher sales and excise taxes which consume a  larger share of DC’s low- and moderate-income families’ budgets. For example, sales and excise taxes take up just under 5 percent of the income of DC’s middle income households, but just under 1 percent for DC’s top 1 percent (see Table1). DC’s property tax also falls most heavily on low- and moderate-income families. DC’s income tax is progressive, with higher rates and liabilities as incomes rise, but it does not fully offset the effect of sales and property taxes.

larger share of DC’s low- and moderate-income families’ budgets. For example, sales and excise taxes take up just under 5 percent of the income of DC’s middle income households, but just under 1 percent for DC’s top 1 percent (see Table1). DC’s property tax also falls most heavily on low- and moderate-income families. DC’s income tax is progressive, with higher rates and liabilities as incomes rise, but it does not fully offset the effect of sales and property taxes.

The good news is that taxes remain relatively low for DC’s lowest income households. Those earning less than $22,000 a year pay 6.6 percent of income in taxes, lower than for most other income groups, thanks in large part to a progressive income tax structure, a refundable earned income tax credit (EITC) and a refundable property tax credit for renters and homeowners named schedule H. Last month, the Council passed changes to schedule H that would in part extend the property tax relief up the economic ladder to a large share of middle- income DC households with the highest tax burdens. In fact, recent changes to schedule H would increase the income eligibility ceiling from $20,000 a year to $50,000.

You can read the full report, which includes more detailed charts and taxes paid by families in DC and the rest of the states, by visiting ITEP at: www.itep.org