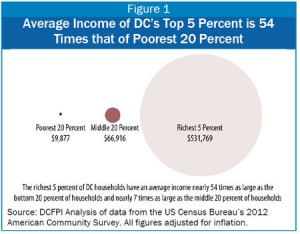

The District’s income inequality is fourth highest among large cities in the country, according to a new report from the DC Fiscal Policy Institute released today. The average income of the District’s richest households’the top 5 percent’is $530,000. That puts DC at the top of large US cities, exceeding even San Francisco, Boston, and New York. The average income of the top 5 percent of District households is 54 times the average income of the bottom 20 percent’$9,900.

The report, “High and Wide: Income Inequality Gap in the District One of the Biggest in the U.S.,” uses recent data from the U.S. Census Bureau American Community Survey to examine the income distributions of the 50 largest U.S. cities.

Some major findings of the report include:

The average income for the District’s top 5 percent of households is now over half a million dollars, the highest among large U.S. cities.“¯In 2011, the  average income of the top 5 percent of DC households exceeded $500,000 for the first time.”¯By 2012, the average income of this group reached $530,000.”¯DC is one of only three cities where the average income of the wealthiest 5 percent is above $500,000. Examining other east coast cities, the District’s highest-income households average almost $100,000 more than their New York counterparts, $125,000 more than their Boston counterparts, and $275,000 more than their Philadelphia counterparts.

average income of the top 5 percent of DC households exceeded $500,000 for the first time.”¯By 2012, the average income of this group reached $530,000.”¯DC is one of only three cities where the average income of the wealthiest 5 percent is above $500,000. Examining other east coast cities, the District’s highest-income households average almost $100,000 more than their New York counterparts, $125,000 more than their Boston counterparts, and $275,000 more than their Philadelphia counterparts.

The average income of the bottom fifth of DC households is just $9,900.“¯Although DC has one of the highest costs of living among large cities, the average income of our poorest households is roughly average compared with other large cities.”¯ This income covers just 12 percent of the basic family budget ($85,000) for a single parent with two children — the ninth worst when compared with other large cities.”¯If the gap in incomes between the top 5 percent and the bottom 20 percent were to equal that of the average large city, the District would need to raise the average income at the bottom from $9,900 to $15,000.”¯

Closing the gap requires the District to create new opportunities to help residents get the skills they need to compete for jobs. It also requires steps to make work pay, building off the recent increase in the minimum wage. This includes recommendations from the District’s Tax Commission, such as raising the personal exemption and standard deduction in the income tax and expanding the Earned Income Tax Credit, which would help low-wage workers take home more of what they earn.

Investments in education and job training could help our workforce be better prepared for the higher wage employment opportunities. Finally, the District can help alleviate the high costs of living for residents who are barely making it, including making budget choices to expand affordable housing opportunities.

To read a copy of the report, click here.

To print a copy of today’s blog, click here.