DC’s revenues are rising sharply due to a robust economy, but most of the money is not available to spend on needed services, due to an automatic “tax-cut trigger” policy. Mayor Bowser and the DC Council should revisit this policy in order to ensure that the District’s growing prosperity can be used to address our major challenges, like DC’s affordable housing crisis or persistently high unemployment among black residents.

The increasing tax collections, revealed this week in a new revenue projection, reflect expected growth in collections from real property taxes, sales taxes, business income taxes, and deed transfer and recordation taxes. Notably, business taxes income taxes will rise to a record level next year even though overall business tax rates have been cut recently.

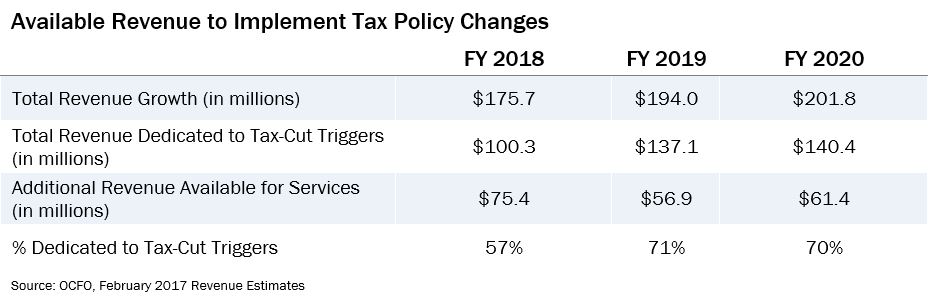

Current law devotes all recurring revenue above the prior year’s forecast to tax cuts recommended by the Tax Revision Commission a few years ago. The new revenue estimate is enough to implement all remaining tax-cuts on the list, totaling $100 million in FY 2018 and about $140 million in subsequent years.

The revenue forecast increase is big enough to also support increased investments in the upcoming Fiscal Year 2018 budget, but tax cuts will still consume over half of our growing revenue. Under the tax-cut trigger policy, $100 million in taxes will be cut next year, while new revenue available for schools, housing, Metro and other needs will be $75 million.

The tax cuts include changes that especially help low- and moderate-income residents, like increasing the standard deduction in DC’s income tax. The new tax cuts also include things that help the most wealthy DC residents, like eliminating taxes for estates worth up to $5.25 million (up from a $1 million exemption threshold last year).

The key problem with the tax cuts is their automatic nature, which ties policymakers’ hands and does not allow them to weigh other uses of growing revenue, such as schools, housing, or health care. With the highest level of homelessness among major cities, growing school enrollment, and a Metro system badly in need of repairs, a policy that prioritizes tax cuts over everything else doesn’t make sense. The automatic tax cuts make it hard to address the uneven benefits from DC’s growing economy, including poverty east of the Anacostia River that remains higher than a decade ago. The $100 million in tax cuts would be enough funding to provide housing vouchers for approximately 6,250 families or build over 1,000 new affordable homes a year.

We hope that Mayor Bowser and the DC Council will modify the tax-cut trigger policy in the FY 2018 budget to untie our policymakers’ hands and make it easier to meet the demands of a growing and divided city.