Local revenues are expected to decline by more than $1 billion over the next three years compared to previous estimates, largely due to federal layoffs steep enough to throw DC into a mild recession, according to the Chief Financial Officer’s (CFO) new revenue forecast. The revenue drop will not create a budget shortfall in the current fiscal year (FY) that ends in September. However, the drop over the next three years will likely put the financial plan out of balance when accounting for rising costs, requirements to replenish reserves, and a spike in demand for safety net programs as more unemployed residents turn to the District for help. DC lawmakers must raise revenue to mitigate harm and help residents weather the coming storm.

The last time DC faced a revenue decline this substantial was in 2020, when the pandemic caused unemployment to spike. Similarly, as the president takes an axe to government jobs and contracts, unemployment will rise and cause workers to lose income and spend less, leading to reduced revenues and deep harm to DC’s economy. DC is likely to see racial inequities worsen too, given that a quarter of its workforce is federal workers, and nationally, Black workers make up a bigger share of federal employees than private sector workers. DC’s budget squeeze will be even worse if Congress approves deep federal budget cuts that could cause DC to lose another $1 billion from Medicaid cuts alone, in addition to the chance that the president will relocate some agencies out of DC.

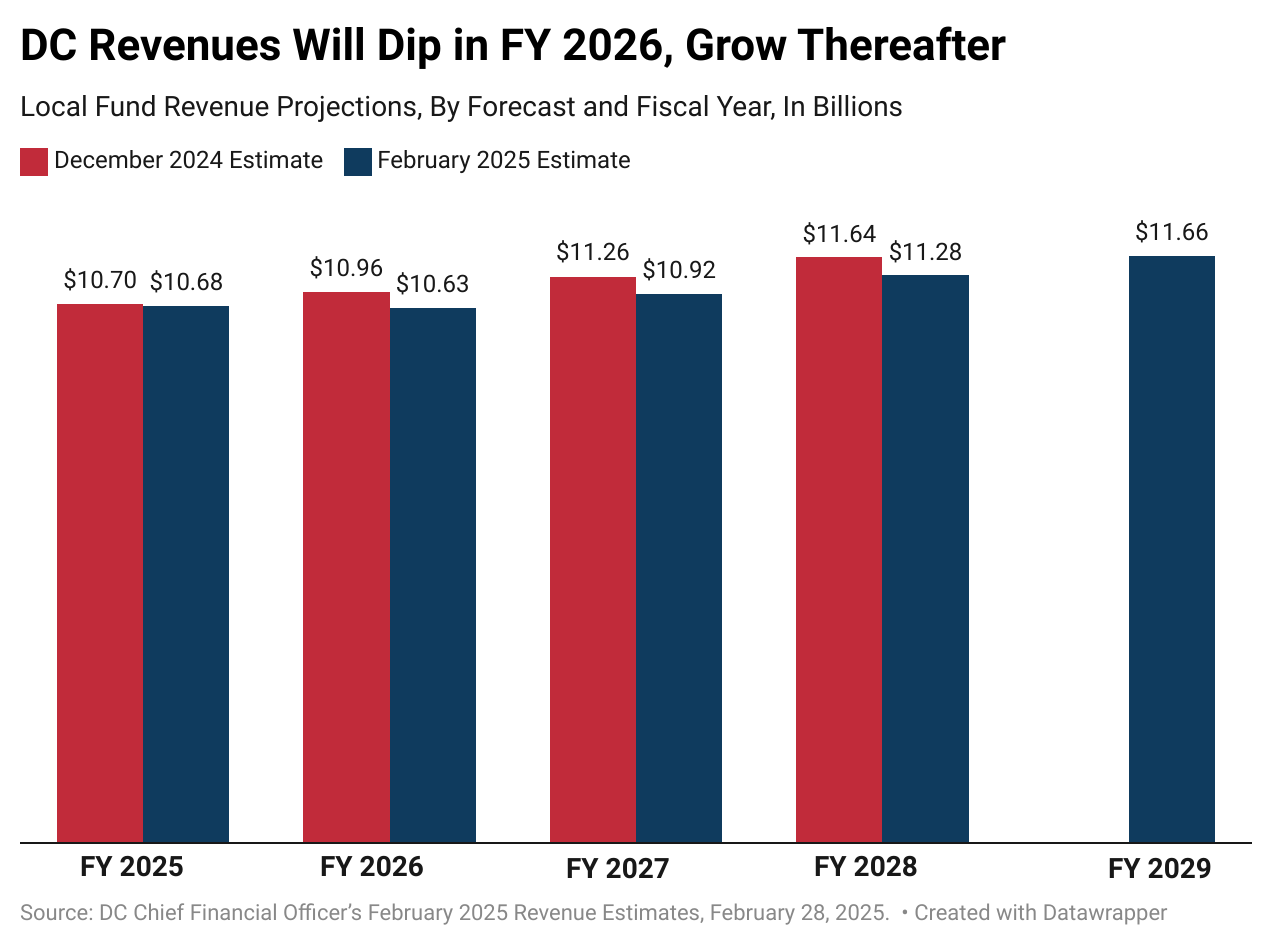

Even with Big Hit, DC Revenues Will Grow Year-to-Year Beginning in FY 2027

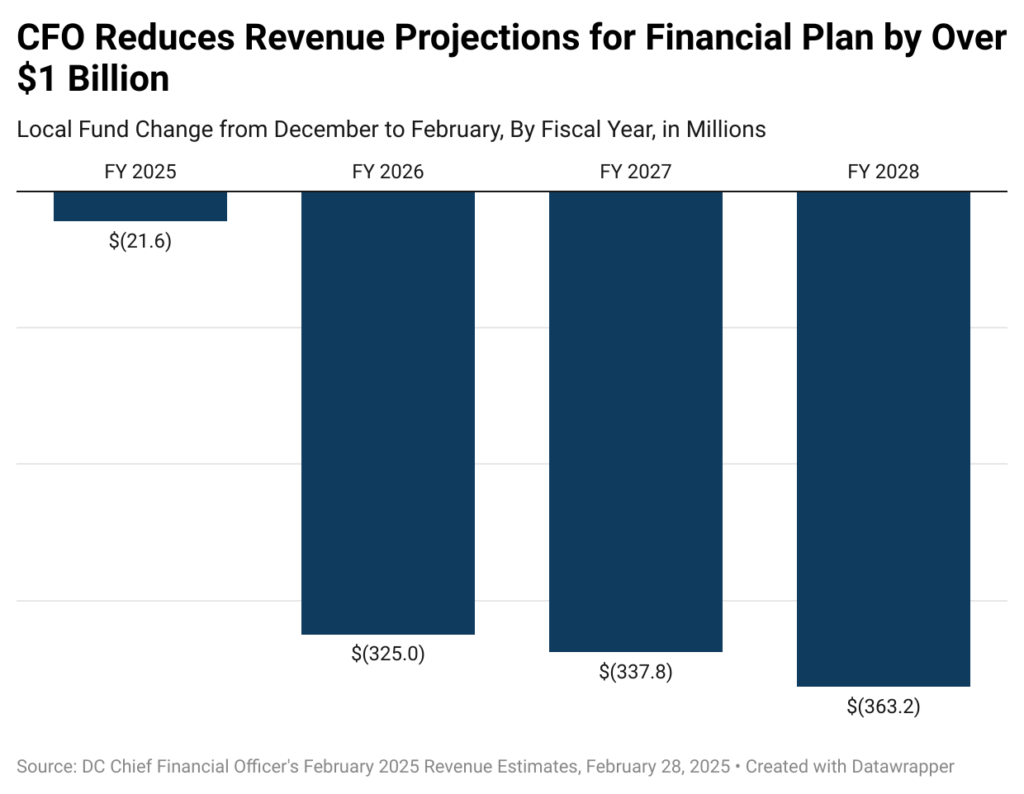

The February forecast reduced revenues for all four years of the current financial plan, compared to the December estimate (Figure 1). The reduction is $21.6 million in the current fiscal year and averages $342 million between FY 2026 and FY 2028. Worsening lawmakers’ ability to balance the financial plan is that for the first time in several years, DC will not have an excess surplus from FY 2024 to help offset these revenue losses and mitigate harm to residents.

Even with this sizeable reduction, revenues will still grow year-over-year for most of the forecast. The CFO, Glen Lee, expects revenue to dip in FY 2026 but begin to recover in FY 2027 and increase year-over-year thereafter, just at slower rates than what he projected in December (Figure 2). Lee also newly released revenue projections for FY 2029, anticipating the same annual growth rate as FY 2028 at 3.3 percent.

Federal Layoffs Drive DC’s Revenue Decline, Likely to Disproportionately Harm Black Workers

Federal workforce reductions will have an outsized effect on the District’s economy because the federal government employs 25 percent of DC’s workforce, compared to 1.4 percent nationally. Lee projects that DC will lose 21 percent of federal jobs, or 40,000, by the end of the financial plan. DC businesses also receive a significant share of federal funding and contracts, which are also slated for reduction. Combined, the CFO anticipates this will cause employment to decrease by 2.6 percent in FY 2026, throwing DC into a mild recession, and by another 0.4 percent in FY 2027.

Black workers always bear the economic brunt of recessions due to systemic racism stretching back centuries. Under the forecasted recession, Black workers will likely suffer the most given they are more likely to be in the federal workforce than the private sector or civilian workforce overall, and because the sheer volume of ripple effects federal job losses will have on industries where Black workers are also disproportionately represented, such as retail. Black residents are already likelier to be unemployed in DC: 10.7 percent of Black workers were unemployed as of the 4th quarter of 2024, compared to 2.4 percent of white workers and 5.7 percent of all workers, according to the Economic Policy Institute. For generations, public sector jobs have been a pathway to the middle class and wealth for Black workers and much of that progress is at risk under the new administration.

Unsurprisingly, DC is set to see a large drop in income tax and sales tax collections compared to the December forecast, as residents lose employment income and have less money to spend on basic needs and at local businesses. The CFO also revised downward property tax revenue due to lower assessed values across almost all classes of properties, reflecting the effect of remote work and a recent decline in residential home prices. Corporate and unincorporated business taxes are expected to increase in FY 2025, but in the out years of the financial plan, the CFO reduced corporate revenue projections due to federal cuts while softening the anticipated decline in unincorporated business tax collections driven by real estate challenges.

DC Should Raise Revenue to Limit Harm to its Residents and Economy

Lawmakers must take a balanced approach to DC’s fiscal challenges when approving the FY 2026 budget. Relying solely on cuts to public investments is short-signed and would increase hardship, deepen racial inequities, and worsen the economic downtown—as the Great Recession proved. Raising revenue, on the other hand, would allow DC to stave off cuts, protect the most vulnerable residents, and strengthen local programs that boost incomes and help stabilize the economy. Options available include targeted revenue increases, especially on high-wealth households and closing loopholes in DC’s business taxes. Lawmakers should also reverse course and reject poorly designed tax breaks downtown, and they must also be creative—for example, they could follow Maryland’s lead and consider launching an initiative to recruit federal workers into open District government jobs.