Every child in DC should have the chance to live to their fullest. But more than 1 in 5 children in DC live in poverty and, because of systemic racism, more than 1 in 3 Black children do.[1] Poverty, especially when it’s persistent, has long-lasting negative effects on children and their well-being into adulthood. Eliminating child poverty in the District is both possible and imperative. A DC Child Tax Credit (CTC) could help the District achieve this goal.

Black Children in the District Are Disproportionately Likely to Live in Poverty

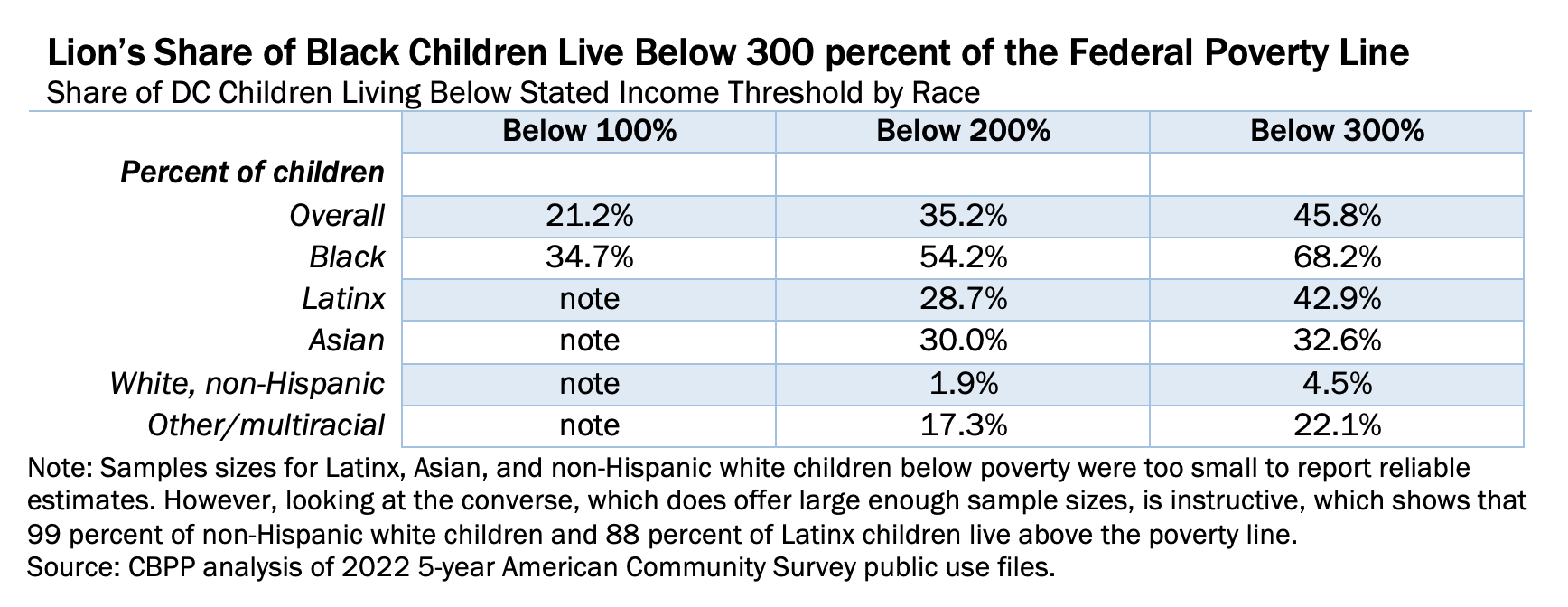

Parents with low incomes may struggle to provide their children nutritious meals, enriching learning environments in the home, or quality child care—all things needed for kids to flourish. Child poverty is higher in DC than nationally and disparities between the well-being of Black children and white children are extreme (Table 1). With the prevalence of poverty among Black children in DC and given the long reach of poverty and its effects on children when they grow into adults, it is not surprising to see persistently high poverty rates among Black residents.

The Child Tax Credit is a Proven Tool for Reducing Poverty

Boosts to cash income help children from families that are poor and low income do better and go further in school, and work and earn more as adults. When the federal government temporarily expanded the national CTC during the pandemic, the credit cut DC’s child poverty rate by more than half, according to Urban Institute analysis.[2]

Approximately 97 percent of the lowest income families in DC leveraged the recent federal CTC income boost to afford rent, food, and other basic needs. This is not surprising given the high cost of living in DC. A District-level child tax credit targeted to families up to 300 percent of federal poverty line—about $90,000 for a two-parent family of four—would reach nearly 80,000 children, including tens of thousands no longer eligible for (part or any of) the federal CTC. If large enough, a DC credit could substantially reduce child poverty. A $1,500 per child tax credit for DC would reduce child poverty by 18 percent, according to analysis for DCFPI by Columbia University’s Center on Poverty & Social Policy.

A Local CTC Can Strengthen DC’s Economy

Eliminating child poverty is achievable and would dramatically reshape DC’s economic strength over the long-term. Children in families with low incomes that get an income boost like the CTC provides do better and go further in school and work and earn more as adults, research shows. Other research shows that ending child poverty would boost gross domestic product. The District can adopt a CTC to take aim at child poverty and open up social and economic possibilities that today are out of reach of tens of thousands of DC’s children.

[1] Erica Williams, “A Child Tax Credit Would Reduce Child Poverty, Strengthen Basic Income, and Advance Racial Justice in DC,” the DC Fiscal Policy Institute, March 6, 2021.

[2] Gregory Acs and Kevin Werner, “How a Permanent Expansion of the Child Tax Credit Could Affect Poverty,” Urban Institute, July 2021. This analysis uses the Supplemental Poverty Measure (SPM), which is an alternative to the official poverty measure that allows researchers and advocates to 1) gauge the impact of various forms of assistance in calculating income and 2) set a threshold based on a fuller range of living expenses, including housing.