If it comes to choosing between a proposed sales tax increase that amounts to pennies per purchase or supporting important services, the DC Council’s priority should be to protect the services.

Money from the sales tax increase to 6 percent from today’s 5.75 percent, proposed in Mayor Bowser’s budget, can help support child nutrition, after-school programs, rental assistance, and other important purposes.

The proposal would put the District’s sales tax rate in line with Maryland and Virginia and add just 25 cents to a $100 purchase. The new revenues are needed in a year when the city faces a major gap between what it expects to take in and the cost to maintain services. And they will help support important new commitments to affordable housing and family economic security, among others.

The sales tax increase is modest in its impact on residents. And even with the tax increase, the proposed District budget is lean.

The sales tax increase is modest in its impact on residents. And even with the tax increase, the proposed District budget is lean.

- Even for DC’s poorest”¯families, the tax increase would be small — just $20 a year for a household making $20,000 according to the Institute of Tax and Economic Policy. And many of these households are getting tax cuts adopted by the DC Council last year, and these tax cuts more than offset the sales tax increase.

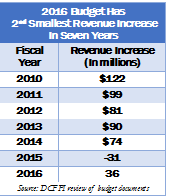

- The $36 million in revenue increases in the budget for the next fiscal year budget is lower than in five of the past six years. Even with the new revenue, total spending next year will be less than the amount needed to maintain this year’s services, according to DC’s Chief Financial Officer.

Nevertheless, some Councilmembers, including Chairman Mendelson, have expressed interest in undoing the sales tax increase. This would require identifying $22 million in cuts to services or finding other untapped funds.

At a time when so many are struggling to make ends meet, it makes more sense to strengthen services that help District residents improve their lives and build toward a more secure future.

The DC Fiscal Policy Institute testified in favor of the sales tax increase at a hearing last Friday.