DC’s local spending and revenue has not outgrown, but rather kept pace with, growth in the economy.

Taxes and other sources of revenue make up the collective resources the District needs to maintain roads and reliable public transportation, create affordable housing and wealth building opportunities for residents, fund quality public schools and parks, culture, and recreation. The budget is also a powerful tool for addressing DC’s longstanding racial inequities, and DC lawmakers have made meaningful investments in transformative solutions to big social problems—among them, leading programs in early childhood development and ensuring residents have access to health care. Public spending through the budget is the foundation of a strong economy.

The District is also a unique jurisdiction that holds responsibilities of both local and state governments. No other city, for example, is responsible for the state share of human services, like Medicaid or TANF, or the state’s share of education spending. Likewise, no state is responsible for the full range of local services DC provides like trash collection, police and fire protection, park maintenance, and local economic development.

While DC government should always pursue effective and efficient spending as a matter of course, common claims that the District needs to “right size” its spending, or that budget growth is out of control, aren’t rooted in reality. In fact, DC’s Local Fund budget—the portion primarily funded by residents’ income, property, and sales tax dollars–has held steady over the last 20 years, when taken as a share of the economy. And, because revenue and spending are projected to decline sharply over the next four years, DC lawmakers should raise additional resources to keep up with community needs, to recruit and maintain public employees, and to take aim at the District’s deep level of inequity.

DC Local Fund Budget has Held Largely Steady Over the Past 20 Years

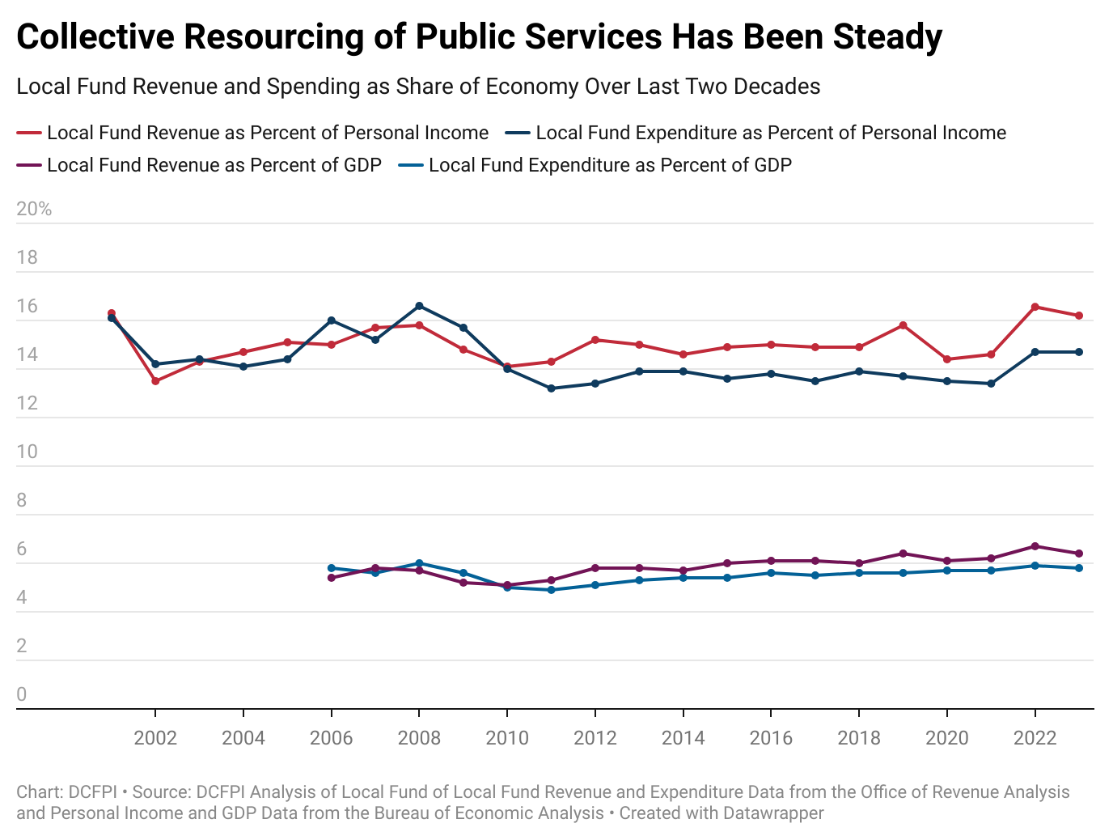

Measuring revenue and spending as a share of the economy reflects DC’s fiscal capacity—or its ability to sustain or grow its taxes and public investments based on the health of the economy. By two different measures of the economy—personal income and Gross Domestic Product (GDP), spending and revenue hasn’t varied much over time. As share of personal income (Figure 1):[1]

- Local Fund revenue typically ranged between 14 to 16 percent, averaging 15 percent, with a few instances of jumps and dips during and after recessions.

- Local Fund spending, similarly, most typically ranged between 13 and 15 percent, or 14 percent on average, with small jumps and dips during and following recessions.

- While not the peak, Local Fund spending was higher as a share of the economy in FY 2001, the final year of the federally mandated Control Board, than it was in FY 2023.

The trend line is even smoother when using GDP for the District from 2006 (as far back as the data were available) to 2023.

- Local Fund revenue as a share of GDP ranged from the 5-7 percent during that time range, hitting an average of 5.9 percent.

- Local Fund spending ranged between 5 to 6 percent, averaging 5.5 percent during that timeframe.

- While not the peak, Local Fund spending was higher as a share of the economy in FY 2001, the final year of the federally mandated Control Board, than it was in FY 2023.

These trendlines underscore that DC’s local spending and revenue has held steady relative to growth in the economy.

When examining Local Fund revenue and personal income projections from the Office of the Chief Financial Officer’s February 2024 revenue estimate, DCFPI analysis shows revenue growing more slowly than the economy. According to the projections, Local Fund revenue could drop to as low as 13.1 percent of personal income by FY 2028. That is lower than any other year over the 22-year period DCFPI analyzed.

Other Measures of DC Budget Tend to Exaggerate the Reality

The DC budget is often compared with prior years without adjusting for inflation to demonstrate how the budget has grown. Looking at revenue and spending over time in these terms will produce an exaggerated picture of budget growth. That’s because it fails to account for changes in key factors like the rising costs of providing services and the additional needs that come with a growing population. With more economic activity and more people, or with growing incomes, for example, a jurisdiction should expect needing to make additional investments in infrastructure, programs, and services.

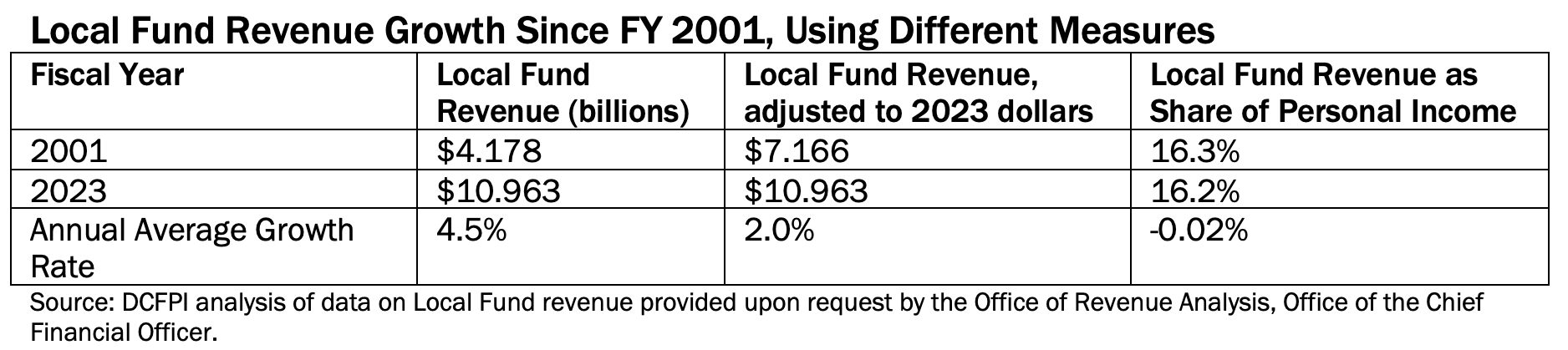

Adjusting for inflation with the consumer price index (CPI) shows the annual growth rate of Local Fund revenue over the past 22 years declines from 4.5 percent to 2 percent (Table 1).

But even accounting for inflation doesn’t offer a fully adequate adjustment of budget trends because the CPI is based on what consumers buy, not what governments buy (labor, equipment, office buildings, etc.). The CPI is also unable to account for growth in particular sectors of the population whose needs may be costlier than the average residents’, like seniors, or particular areas of spending that may require more intensive resourcing, like health care.

Moreover, spending needs to keep up with real growth in the economy beyond inflation and population in order for the District to be able to recruit and maintain public employees and contractors. The District will struggle to find teachers, first responders, and other employees willing to take on core service-providing jobs if spending on those services increases so slowly that it holds down wages.

DC Will Need $1.6 Billion More in Revenue By Fiscal Year 2028 to Keep Pace with the Economy

At a minimum, DC lawmakers should set a course to raise enough revenue to maintain the average level of revenue as a share of the economy seen over the last two decades, or 15 percent. That would increase revenue by $1.6 billion in the last year of the financial plan, FY 2028, in real terms. Some revenue may materialize if economic factors improve or if the District’s revenue projections prove overly pessimistic. Otherwise, DC lawmakers will need to raise revenue or risk jeopardizing their ability to adequately fund public services.

If DC were to commit to raising enough resources to maintain the peak level of revenue in FY 2022 as a share of the economy (about 16.6 percent), it would have $2.9 billion more than it is projected to have by FY 2028 (or $1.3 billion more than the 20-year average level of revenue as a share of the economy) to fund public services broadly and address inequity. Letting revenue fall relative to economic growth will only cause DC to backtrack on its promises and lose ground on its achievements thus far to creating a thriving, racially and economically equitable District.

[1] It’s important to note that Local Fund revenue and spending as a share of the economy in FY 2021 – FY 2023 does include federal funding delivered to states and DC via the American Rescue Plan Act as Local Revenue Replacement to shore up normal, recurring spending and stave off budget cuts. These funds were used differently than other forms of federal aid during the same timeframe.