There are many ways to help DC residents struggling with high and rising housing costs, including Mayor Gray’s recent commitment for 10,000 units of affordable housing. Yet even that tremendous effort will leave many families in need, with more than 50,000 households now paying over half of their income on housing.

Another important way to ease the impact of severe housing cost burdens is by improving DC’s tax credit for residents with high property tax bills or high rents ‘ known as schedule H. Improvements adopted last year by the DC Council ‘ but not yet funded ‘ could help tens of thousands of DC families and individuals throughout the city.

The Schedule H Property Tax Relief Act passed by the DC Council would increase the maximum credit to $1,000 and would increase the income eligibility from $20,000 to $50,000 by 2016. Unfortunately, these changes cannot be implemented until funds are found to pay for them.

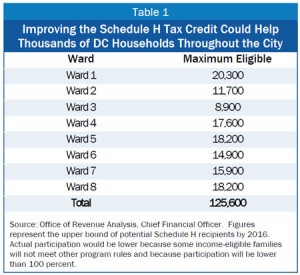

If implemented, Schedule H could help tens of thousands of DC families and individuals, based on their income, by 2016. These families live throughout the city, including as many as 8,900 in Ward 3, 20,300 in Ward 1, and 18,200 in Ward 8 (see Table 1). Even if participation in Schedule H is less than 100 percent, as is expected with tax credits, there is no doubt that thousands of families across the District would benefit. The Schedule H changes will make many residents newly eligible for the credit, but even currently eligible residents will benefit from the increased maximum credit and other changes that make applying for Schedule H easier.

If implemented, Schedule H could help tens of thousands of DC families and individuals, based on their income, by 2016. These families live throughout the city, including as many as 8,900 in Ward 3, 20,300 in Ward 1, and 18,200 in Ward 8 (see Table 1). Even if participation in Schedule H is less than 100 percent, as is expected with tax credits, there is no doubt that thousands of families across the District would benefit. The Schedule H changes will make many residents newly eligible for the credit, but even currently eligible residents will benefit from the increased maximum credit and other changes that make applying for Schedule H easier.

With the likelihood of increased revenues for DC on the horizon, and with housing costs that continue to rise faster than incomes, we urge Mayor Gray to make funding improvements to Schedule H part of his commitment to making housing affordable in his fiscal year 2014 budget.

To print a copy of today’s blog, click here.