Ever wondered how DC collects the funds it needs to provide critical services such as schools, libraries, and road construction? DCFPI is here to help with a new report, Revenue: Where DC Gets Its Money. This report aims to answer your questions about how much DC collects and from whom, how revenue sources have changed over time, and how DC stacks up against surrounding jurisdictions.

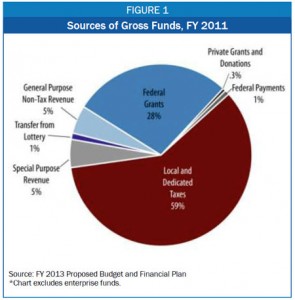

In fiscal year 2011, the District collected about $8.8 billion in revenue. As seen in Figure 1, the majority came from local taxes. Federal grants made up the next largest share at 28 percent. This includes the grants that most other states receive, such as Title I funds for schools serving low-income children. Other sources including federal payments and private donations; each makes up 5 percent or less of the District’s total revenue sources.

This is just the beginning of the story when it comes to DC’s revenue. Read the report to find out more, including the difference between alcohol excise taxes and alcohol sales taxes. And how DC’s residential property tax rate compares to the rate in surrounding counties (spoiler alert: DC’s rate is lower). And why exercise equipment is taxed but gym memberships are not. We could go on and on, but we’ll leave some surprises for the report itself.

To print a copy of today’s blog, click here.