Today, District officials announced that DC ended fiscal year 2012 with a stunning surplus of $417 million. That comes on top of the $240 million surplus announced just last year. This is a clear sign that DC is turning the financial corner from the recession. Officials today also noted that DC’s tax collections this year are running well above their levels last year and expect to announce an increase in revenues in February.

But while DC has been building up significant resources, many DC residents continue to struggle in the wake of the recession. Unemployment remains high for residents without a college degree, and cuts in services during the recession, from disability services to libraries to public works have affected all DC residents.

The Mayor and Council should take this opportunity to use some of DC’s substantial resources to make investments in areas that have been neglected since the recession ‘ such as affordable housing and job training for families with children, just to name a few.

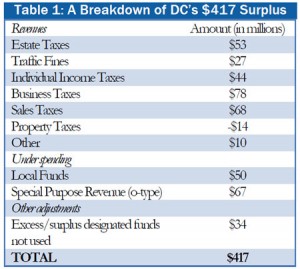

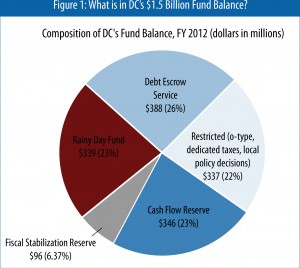

How did DC get a $417 million surplus and what’s next? The $417 million surplus is largely the result of higher  than expected tax collections and under-spending in some areas of the budget (see Table 1). In recent years, 100 percent of the surplus has been added into DC’s fund balance ‘ which is part savings account, part bond escrow and part holding tank for various reserve funds. Figure 1 breaks out the various parts of DC’s fund balance which now stand at $1.5 billion.

than expected tax collections and under-spending in some areas of the budget (see Table 1). In recent years, 100 percent of the surplus has been added into DC’s fund balance ‘ which is part savings account, part bond escrow and part holding tank for various reserve funds. Figure 1 breaks out the various parts of DC’s fund balance which now stand at $1.5 billion.

Legislation passed in 2010 required that all surplus funds be saved. That law mandated that any of DC’s undesignated end-of-year surplus (meaning not reserved for debt service, the rainy day fund or other policy reasons) would be put into two new reserve accounts. The first, a working capital reserve, helps the CFO cover the District’s bills throughout the year (revenues don’t always come in just as bills are due) and reduces the need for DC to do short-term borrowing. The second, the fiscal stabilization reserve, is modeled after DC’s rainy day fund and is to help DC cushion the blow from any sort of unforeseen disaster’which can include financial crises. With $248 million added to the two reserves in fiscal year 2012, the total for the two reserves now stands at $442 million (see Figure 1).

Should we use this money to roll back some of the tax increases made in prior years? The surplus is one- time money, meaning can’t be spent on programs or services that re-occur every year, like a tax break. But beyond that, DCFPI’s analysis shows that DC already has the lowest taxes on families in the region, and a 2011 poll found that DC residents overwhelmingly feel it is more important to maintain services than to hold taxes down. In addition, DC has a Tax Revision Commission (DCFPI’s Ed Lazere is a member) that is currently analyzing what DC’s tax rates should look like. Both Mayor Gray and DC Council Chairman Mendelson said today that they too felt that DC’s current unmet needs should be a priority over broad tax cuts at this point in time, and they felt that when the Commission produces its recommendations is the right opportunity to look at changing major DC taxes.

time money, meaning can’t be spent on programs or services that re-occur every year, like a tax break. But beyond that, DCFPI’s analysis shows that DC already has the lowest taxes on families in the region, and a 2011 poll found that DC residents overwhelmingly feel it is more important to maintain services than to hold taxes down. In addition, DC has a Tax Revision Commission (DCFPI’s Ed Lazere is a member) that is currently analyzing what DC’s tax rates should look like. Both Mayor Gray and DC Council Chairman Mendelson said today that they too felt that DC’s current unmet needs should be a priority over broad tax cuts at this point in time, and they felt that when the Commission produces its recommendations is the right opportunity to look at changing major DC taxes.

Should we spend some of DC’s additional resources? We at DCFPI don’t think DC needs to save every penny it collects each year, especially since the city’s fund balance is one of the largest in the nation. When the proposal to save all surplus funds was raised in 2010, DCFPI argued for a more balanced approach to save some and spend some, a position we continue to support. However, this year it looks like the city will be able to accomplish both goals by saving DC’s 2012 surplus to build up reserve accounts and then investing the growing revenues this year in DC neighborhoods and residents.

How can we invest in DC residents? The additional revenue the city expects to collect this year could help make investments in a number of areas that have been neglected since the start of the recession. Affordable housing, which is disappearing at a rapid pace, has seen resources cut back; there are currently waiting lists for vendors that provide job training to adults with children; school library collections are in need of books, magazines and other materials; and DC’s shelters have been overwhelmed with an increase in homeless families who have nowhere else to turn.

In the coming week, the District’s Dime will look more closely at the unmeet needs in DC and how expected additional revenues could help meet those needs. Stay tuned!