Chairman Brown and members of the Committee, thank you for the opportunity to speak today. My name isJenny Reed, and I am the Policy Director of the DC Fiscal Policy Institute. DCFPI engages in research and public education on the fiscal and economic health of the District of Columbia, with a particular emphasis on policies that affect low- and moderate-income residents.

I am here today to testify on the rapid loss of affordable housing in the District and talk about the District’s Local Rent Supplement Program ‘ one of DC’s key affordable housing tools to help very low-income residents.

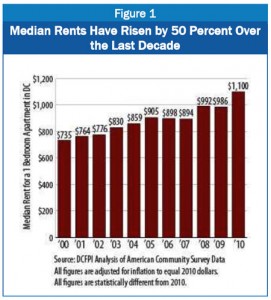

A recent report from DCFPI showed that over the last decade the District lost a significant amount of low-cost rental housing as rentalprices rose rapidly. In fact, as Figure 1 shows, median rents in DC have risen by 50 percent over the last decade. Rents even continued to rise in DC during the recession and grew more than 20 percent ‘ which means rents grew faster here in DC during the recession than in the seven years leading up to it.

Rising rents meant than many homes that were once affordable to low- and moderate-income DC residents no longer are. In fact, DC has lost more than 50 percent of its low-cost rental units (meaning rental units with rent and utility costs of less than $750 a month) over the last decade. Figure 2 shows that in 2000, DC had 70,600 units of low-cost rental housing. By 2010, that number had fallen to just 35,500. Low-cost rental units made up nearly 50 percent of DC’s rental stock in 2000, by 2010 that number had fallen to just 24 percent. It is likely that a large share of the low-cost units are ones with a federal or local subsidy.

To view the complete testimony, click here.