Each year, the Mayor and the DC Council have to make tough choices creating the city’s budget. Just like you and me, they have to make sure expenses do not exceed revenue, which means working hard to ensure that the city has enough resources to cover the services residents need.

That’s why a tax cut for wealthy tech investors that the DC Council will vote on in less than two weeks would take our city in the wrong direction. At a time when the city has been forced to put critical services for children and families on a contingency wish list, it does not make sense to adopt a tax cut that would limit resources substantially for years to come.

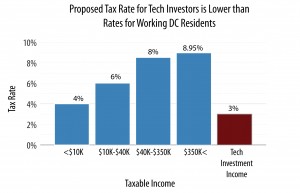

The Council should vote no on Bill 19-764, the Technology Sector Enhancement Act of 2012. Here’s why: The legislation would allow investors in DC’s tech industry to pay just three percent income tax on the earnings from these investments, which would become the lowest income tax rate for the District as the chart below shows.

According to DC Chief Financial Officer Natwar Gandhi, this tax cut could add up to “substantial” losses in revenue for the District. And as we noted yesterday, there is no evidence that cutting taxes for investors would help DC’s economy.

Any discussion of tax cuts is especially disconcerting right now because revenue limitations have forced the city to put important services that help our children and families on a contingency list that is unlikely to get funded. That list includes $7 million for homeless individuals and families. So, when winter ends, the shelter capacity for individuals could be cut in half, along with other service reductions. In addition, the budget for next year does not have funding to protect particularly vulnerable families on TANF who need time to deal with serious issues that interfere with their ability to work, such as domestic violence, illness, or the demands of caring for a family member with a disability.

These are vital services for DC residents, and yet the District cannot afford to fund them. DC simply does not have enough revenue to provide for its residents. Is this really the time to offer tax cuts to wealthy investors?

As President Clinton said in his address last night, the United States is a great nation because we believe that “we are in this together” and not that “you are on your own.” The DC Council should heed President Clinton’s words and reject legislation that promotes a “you are on your own” approach.

If you believe the DC Council should vote no on tax cuts that don’t benefit all DC residents, sign on here.