In the two weeks since Mayor Gray released his proposal for next year’s budget, we here at DCFPI have been examining the documents, asking additional questions and analyzing the numbers. In our new analysis released today, we break down the FY 2012 budget request from Mayor Gray to see what cuts were made, what revenues were raised, and how has DC’s budget changed since the Great Recession took hold of the economy.

As Mayor Gray worked to develop the FY 2012 budget proposal, the city faced a substantial gap ‘ $322 million ‘ between expected resources and the cost of maintaining city services. Mayor Gray’s FY 2012 proposed budget includes notable revenue increases, yet it also contains sizable budget cuts and leaves the District government far smaller than just a few years ago. While FY 2012 represents the first time in four years in which the District experienced an increase in revenue ‘a welcome sign that some parts of DC are starting to recover ‘ total tax collections are still well below pre-recession levels.

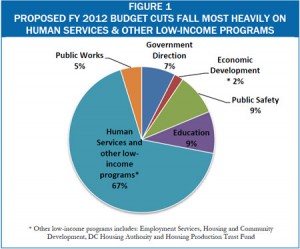

Mayor Gray’s proposal largely keeps in place cuts that have been made since 2008’in areas ranging from libraries to child care’in addition to making significant additional reductions in human support services. The disproportionately large cuts proposed to human service programs’two out of every three dollars cut in Mayor Gray’s proposal come from these programs which include homeless services and aid to people with disabilities’were largely made to protect areas like education and public safety (see figure 1). However, these cuts cannot be viewed in isolation. City leaders’ hopes of improved educational outcomes and public safety could be undermined if residents lack shelter, economic opportunity, and basic support for children and other vulnerable family members.

to human service programs’two out of every three dollars cut in Mayor Gray’s proposal come from these programs which include homeless services and aid to people with disabilities’were largely made to protect areas like education and public safety (see figure 1). However, these cuts cannot be viewed in isolation. City leaders’ hopes of improved educational outcomes and public safety could be undermined if residents lack shelter, economic opportunity, and basic support for children and other vulnerable family members.

Highlights of DCFPI’s analysis of the FY 2012 proposed budget are below.

- The proposed FY 2012 general fund budget of $6.3 billion is about $105 million higher than the approved FY 2011 budget, after adjusting for inflation’an increase of 1.7 percent over last year. Yet this modest boost in local spending is largely needed to; replace federal stimulus dollars that were available for 2011 but will not be for 2012, rising enrollment in public schools and Medicaid, and staff and maintenance expenses that Mayor Gray has proposed moving out of the capital budget to the yearly operating budget. When these are taken into account, funding for most services in the FY 2012 budget is less than the amount available for FY 2011.

- Mayor Gray’s proposed budget includes sizable budget cuts and continues the trend since the recession began of making investments in education, but makes cuts to all other areas of the budget, particularly human services. In fact, two out of every three dollars cut from the budget come from human support services and other low-income programs. (See Figure 1)

- The FY 2012 proposed budget includes $158 million in new revenues. Just under half would come from increases in taxes and fees and the remaining half from other policy changes ‘ primarily from a proposal to increase income tax withholding from DC residents. Notable tax increases include a proposal to increase the income tax, from 8.5 percent to 8.9 percent, for income over $200,000 a year and to limit the amount of itemized deductions that can be claimed by families with incomes above $200,000. In addition, the FY 2012 budget implements a provision adopted in 2009 ‘ known as combined reporting ‘ to close corporate tax shelters used by multi-state corporations.