As the center of a fluid, multi-jurisdictional region, the District of Columbia is in constant comparison with its neighbors. Topics of comparison range from housing prices to crime, from amenities to business climate, from services to taxes. This analysis explores this last angle of comparison: taxes paid by individuals in the metropolitan area based on where they live.

angle of comparison: taxes paid by individuals in the metropolitan area based on where they live.

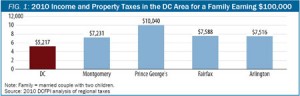

Over the last decade, DC has quietly become the lowest-tax jurisdiction in the region. Because of tax decreases in the District and increases in surrounding areas, District residents generally pay taxes that are lower than — or in some cases the same as — their neighbors in adjacent counties.

This analysis calculates the taxes paid by hypothetical families of different sizes and compositions at three income levels — $50,000, $100,000, and $200,000 — in the District and in Montgomery, Prince George’s, Fairfax, and Arlington Counties. It includes the major taxes that households pay based on where they live — income and property taxes, including the annual tax on cars in Virginia.

Findings include:

- Taxes paid by DC residents are lower than taxes for Montgomery County and Prince George’s County residents for all incomes and family types included in this analysis. For example, taxes in DC for a single resident earning $200,000 are 7 percent lower than in Montgomery County, while DC taxes are 48 percent lower than in Prince George’s County for a married couple with two children earning $100,000

- In most cases, taxes for District residents are lower than taxes for residents of Fairfax and Arlington Counties. For example, taxes for a married couple with two children are about one-third lower in the District than in Virginia. The exceptions are married couples earning $50,000, and single taxpayers earning $200,000, for whom taxes are slightly higher in the District. For those family types, District taxes are between 1 percent and 6 percent higher.

- DC’s lower overall taxes are primarily due to low property taxes in the District. Not only is the District’s property tax rate the lowest in the region, but DC also offers sizable benefits that limit a homeowner’s taxable assessment, including a large Homestead Deduction. For homeowners included in this study, property taxes are between 26 percent and 67 percent lower in the District than in surrounding counties. Moreover, Virginia also levies a property tax on cars, while DC and Maryland do not.

- Income taxes for District residents are higher than in Virginia but lower than in Maryland. This is largely due to the differences in marginal tax rates for middle-income earners. Virginia’s top marginal rate is the lowest of the three states at 5.75 percent, compared to 8.5 percent for the District and 7.95 percent for Montgomery and Prince George’s County residents earning less than $200,000.

These findings show that for many taxpayers, taxes in the District are the lowest in the region.

While it’s good to know how our taxes compare regionally it doesn’t mean that DC should aim to be the low-tax leader. This analysis suggests that residents of many jurisdictions, including Montgomery and Fairfax Counties in our region, pay higher taxes because residents value the services that come with greater tax levies. A focus on low taxes, by contrast, could lead to reductions in services that affect the quality of life and economic competitiveness of these counties, such as education and transportation.

To read the full report, click here.