Each fiscal year, the mayor and DC Council decide how to raise and allocate the District’s resources through the budget, with input from residents about what is important to them. DC lawmakers failed to use the fiscal year (FY) 2026 budget to address major economic challenges on the horizon, including historic cuts to federal safety net programs and a projected local recession. Read What’s in the FY 2026 Budget? to see how the mayor’s proposed and Council-approved budgets meet community needs.

Mayor Bowser initially proposed a fiscal year (FY) 2026 budget and financial plan that abandoned residents with the fewest resources to fend for themselves. DC Council made improvements over the mayor’s proposal but failed to reverse the majority of her cuts to social safety net programs. For example, the FY 2026 budget doesn’t fund a single new Permanent Supportive Housing voucher for individuals who are experiencing chronic homeless and underfunds DC’s child care subsidy program, which will lead to DC’s first waiting list in decades. Ultimately, more DC residents will experience economic hardship, and the harm will disproportionately fall on Black and brown people because of systemic racism.

Priorities for the Revised FY 2025 Budget and FY 2026 Budget

The mayor and DC Council must be bold and visionary in ensuring that the 700,000 residents that call the District home are safe and economically secure. DCFPI urges consideration and prioritization of these funding recommendations for the revised fiscal year (FY) 2025 and 2026 budgets.

Budget Oversight Testimony

After the mayor’s budget is released, each Council committee holds budget oversight hearings on the portion of the budget the committee oversees where agency officials and the public are invited to testify. Below is testimony from DCFPI staff at these hearings.

- DC Residents Deserve Affordable and Thorough Health Care Coverage

- TANF Benefits Are a Lifeline for DC Families, and Limits and Cuts Will Do Major Harm

- DC Needs To Prioritize Displacement Prevention and Affordable Housing Preservation

- The DC Council Should Fund ‘Give SNAP a Raise’

- DC Leaders Should Act to Improve TOPA and Reduce Costs for Renters

- The Council Must Fund Childcare in DC

DC Can Raise Critically Needed Revenue By Taxing Wealth

DC is expected to lose $1 billion in revenue over the next three years, largely due to federal layoffs steep enough to throw DC into a mild recession, according to the Chief Financial Officer’s February revenue forecast. Raising revenue through targeted tax increases on high-wealth households and closing loopholes in DC’s business taxes would allow DC to stave off cuts and help District residents weather the storm.

Performance Oversight Testimony

DC Council holds oversight hearings on the performance of each agency to review the agency’s operations and effectiveness in implementing its budget over the last year. Below is testimony from DCFPI staff at these hearings.

- DC Council Needs to Address Displacement and Support Tenants

- Department of Corrections Must Improve Nutrition for Incarcerated Residents

- Baby Bonds and DC’s Racial Wealth Gap

- DC Can Do More to Ensure Tax System is Fair

- Insufficient Funding Jeopardizes Health Care Access for Early Educators

- Funding Early Childhood Education is Vital to DC’s Future

- The District’s Pay Equity Fund is a Success- and it Deserves Full Funding

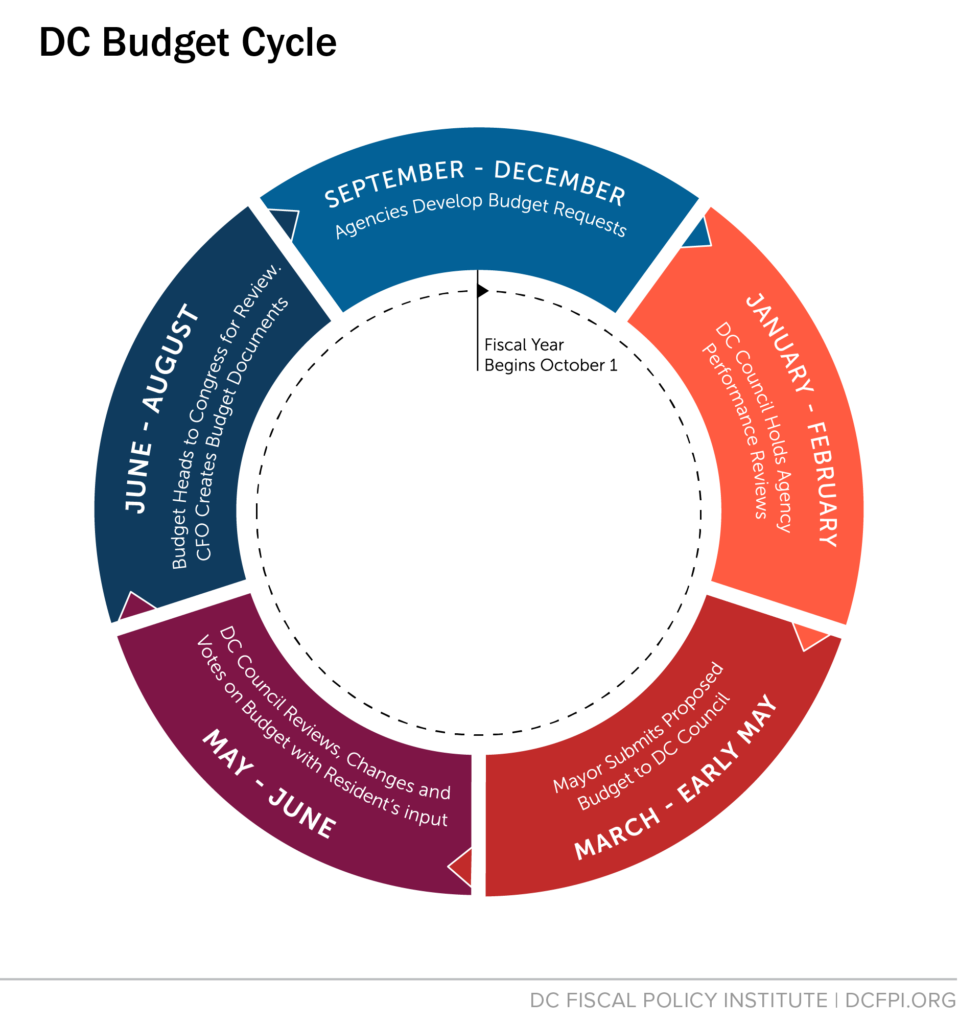

Budget Timeline

DC’s fiscal year begins October 1 and ends September 30. In the spring, the mayor presents a budget to DC Council, which then reviews, changes, and approves it before it is sent back to the mayor to sign into law and submitted to the US Congress, which can choose to modify or reject it.

Resident’s Guide to the Budget

This guide breaks down the process of how DC creates its budget, including how to read budget documents and where in the process residents can influence the decisions of elected officials. Read it here.

Further Resources

Four Ways Residents Can Influence the DC Budget

How to Testify Effectively before the DC Council

DC’s Tools to Create and Preserve Affordable Housing

How DC Funds Its Public Schools

The fight for racially-just budget, tax, and policy decisions can’t happen without you. Sign up to DCFPI’s email list or follow us on Bluesky, Facebook, and Instagram so we can send you regular updates on our efforts and ways you can get involved.