Chairperson McDuffie and members of the Committee, thank you for the opportunity to testify. My name is Erica Williams, and I am the Executive Director of the DC Fiscal Policy Institute (DCFPI) and a former appointee to the DC Tax Revision Commission (TRC). DCFPI shapes racially-just tax, budget, and policy decisions by centering Black and brown communities in our research and analysis, community partnerships, and advocacy efforts to advance an antiracist, equitable future.

DCFPI applauds the DC Council for advancing tax and racial justice over the last several years—efforts that have enabled the District to make great strides towards repairing the racially disparate harm of the pandemic, protecting vulnerable residents, and building a more equitable future. DC can, and must, do more to ensure its tax system is fair and innovates towards equity. We also applaud the Office of Chief Financial Officer for educating the public about and swiftly implementing the tax changes. My testimony highlights ways to make business taxes fairer and to use the tax code to reduce stubbornly high and harmful child poverty rates—two outcomes that would deeply benefit DC’s communities, economy, and revenue outlook. Specifically, my testimony includes recommendations for:

- Adopting a business activity tax (or BAT) for the District, and

- Strengthening the DC Child Tax Credit to maximize poverty reduction

A Business Activity Tax Would Make DC’s Tax System Fairer and More Equitable While Raising Revenue

DCFPI recently co-authored a proposal for a Business Activity Tax (or BAT) for the District with Nick Johnson, the former Executive Director of the TRC and now senior fellow at the Institute on Taxation and Economic Policy.

Despite benefiting from DC’s publicly funded services including mass transit, roads, and public education, some businesses operating in the District do not contribute to the District’s shared resources through its primary business taxes. By enacting a BAT—a new, simple, broad-based value-added tax—DC would make business taxation fairer and more racially equitable while raising significant revenue for the District.

Because of a federally imposed restriction, the District uniquely exempts from taxation certain businesses including major law firms, lobbyists, and consulting firms, most of which are white-owned. And these benefits go entirely business owners who live outside of DC. A BAT would correct this loophole, broadening the base of business taxation without increasing taxes on businesses that already meaningfully contribute to DC’s collective resources. This a reform that the TRC considered during its deliberations from 2022 to 2024.

A BAT, as DCFPI has envisioned, would:

- Modify the TRC proposal to complement existing franchise taxes, rather than adding to them or replacing them, so that it would affect only businesses that now pay little or no tax.

- Exempt the first $200,000 of economic activity from tax, benefiting the District’s small businesses and apply a low BAT rate.

- Broaden DC’s base of business taxation while leveling the playing field, compared with other options, and be consistent with the Home Rule Act.

- Not create incentives for businesses to move out of the District, both because of how the tax is structured, and because lawmakers could use revenue from the tax to make the District more economically competitive.

- Make DC business taxes more racially equitable because most of the unpaid business taxes foregone due to loopholes are from well-heeled, white-owned businesses. [1],[2]

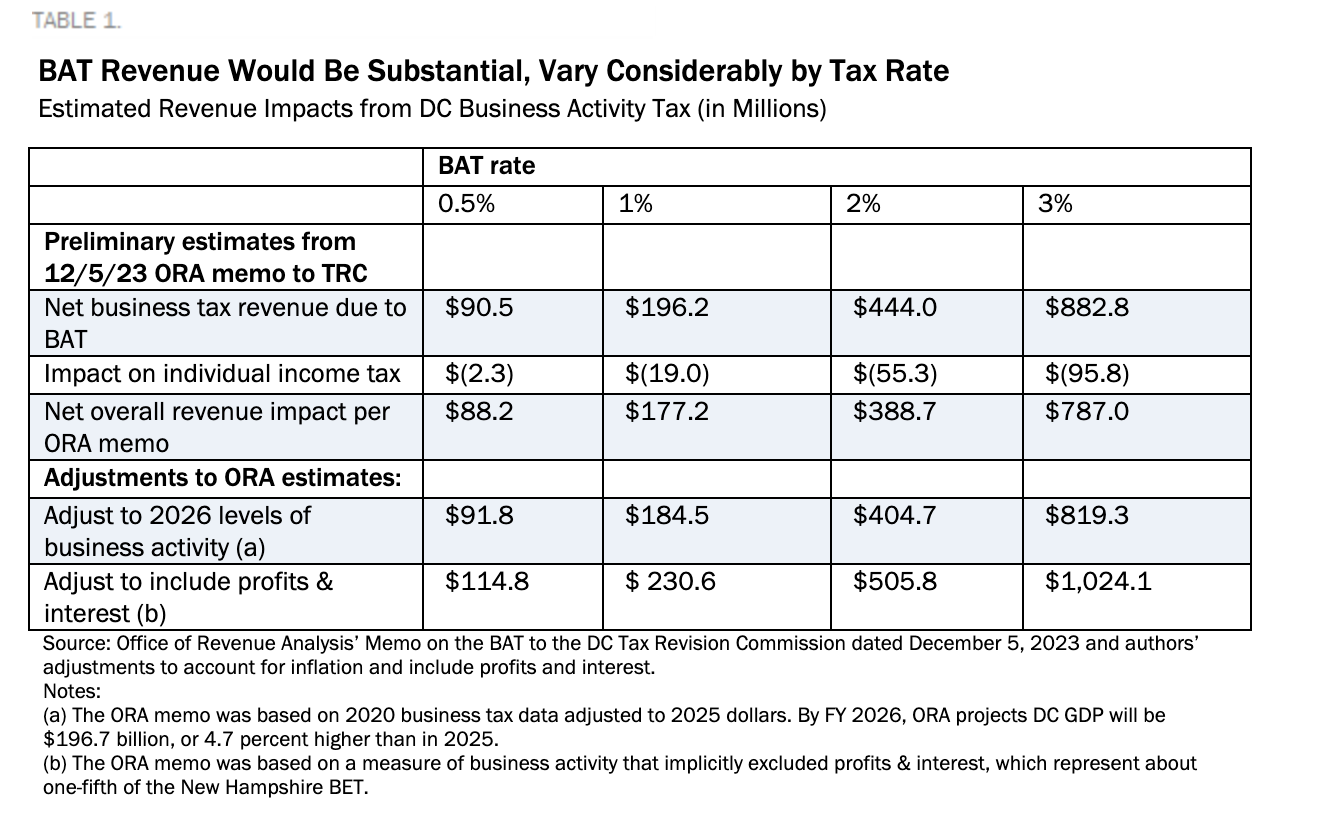

Revenues from the BAT would be substantial. A 2 percent BAT rate could raise $500 million in fiscal year (FY) 2026. Lawmakers could use these funds to fill in the gaps left by declining revenue sources like commercial property in order to maintain or expand investments in policies and programs that fuel an inclusive economy. Or lawmakers could also use BAT revenue to replace or reduce the sales tax increase and/or the payroll tax increase on businesses that lawmakers enacted in the FY 2025 budget.

DC’s Current Business Taxes Leave Loopholes that Allow Some to Avoid Contributing to Shared Resources

DC is denied the ability held by other states and major cities to tax profitable professional services firms. Under the Home Rule Act, DC is not allowed to tax the personal income of nonresidents. A 1980 court case found that the federal Home Rule Act didn’t just apply to wages. It also bars the District from taxing the “net incomes” of most unincorporated professional services firms that pass their profits on to owners in the form of income for tax purposes, if the owners are nonresidents. DC is forced to exclude these businesses—like law firms, lobbying agencies, accounting firms—from taxation under either the unincorporated business (UB) tax or the income tax.

In unpublished analysis for the TRC, the Office of Revenue Analysis (ORA) reported that of the 2,577 businesses subject to the Ballpark Fee, which only applies to those with gross receipts that exceed $5 million, nearly one-third neither filed the corporate nor UB franchise tax. (Note: there are other businesses with gross receipts below $5 million that also do not pay DC’s primary business taxes.)

DC’s franchise tax also enables corporations to minimize taxable income and shield profits from taxation. That’s because the corporate franchise tax is calculated based on the same limited definition of net income that the federal government uses for the federal corporate income tax, which allows for tax avoidance. There are many major Fortune 500 corporations operating in DC that do not pay federal taxes and likely do not pay DC taxes either because of write-offs that allow them to minimize their net income even when their profits soar.

That means that there are many businesses benefitting from DC’s economy without contributing to shared resources. Other DC businesses—such as legacy businesses—are forced to shoulder much more of that responsibility.

A Business Activity Tax Would Ensure Businesses Pay Their Fair Share of Taxes and Expand DC’s Tax Base

A BAT is a simple, low-rate “value-added tax” on the economic activity of businesses in the District. A value-added tax or VAT is a tax assessed on the value added in each production stage of a good or service. Such taxes are widely used around the world; many economists favor them because they tax a wide range of economic activity, unlike the narrower franchise tax focused on profits, while avoiding taxing the same transaction twice.

Under a BAT, total business activity would be defined as the difference between a business’s annual gross receipts (all money from all sources) and what it pays to other businesses. Only the amount of activity above a threshold amount would be subject to tax, which DCFPI proposes be set at $200,000 initially, as recommended by the TRC. That threshold should be adjusted annually for inflation each year thereafter, as done in New Hampshire—the state with such a tax. This would exempt the smallest businesses from the tax entirely, and it would reduce taxable activity for all other businesses. Multiplying the resulting amount by a tax rate would determine the amount of tax.

The formula would be:

Tax liability = (Gross receipts minus purchases, rent, royalties, and capital investments minus $200,000) times the tax rate.

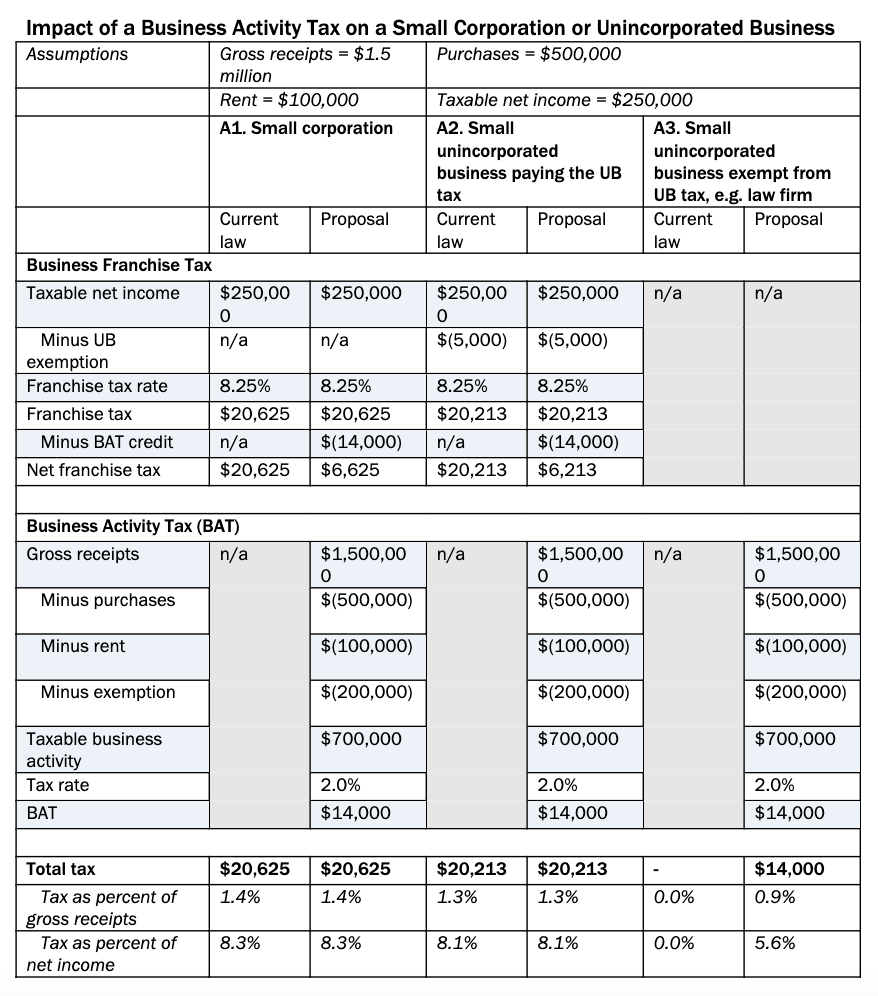

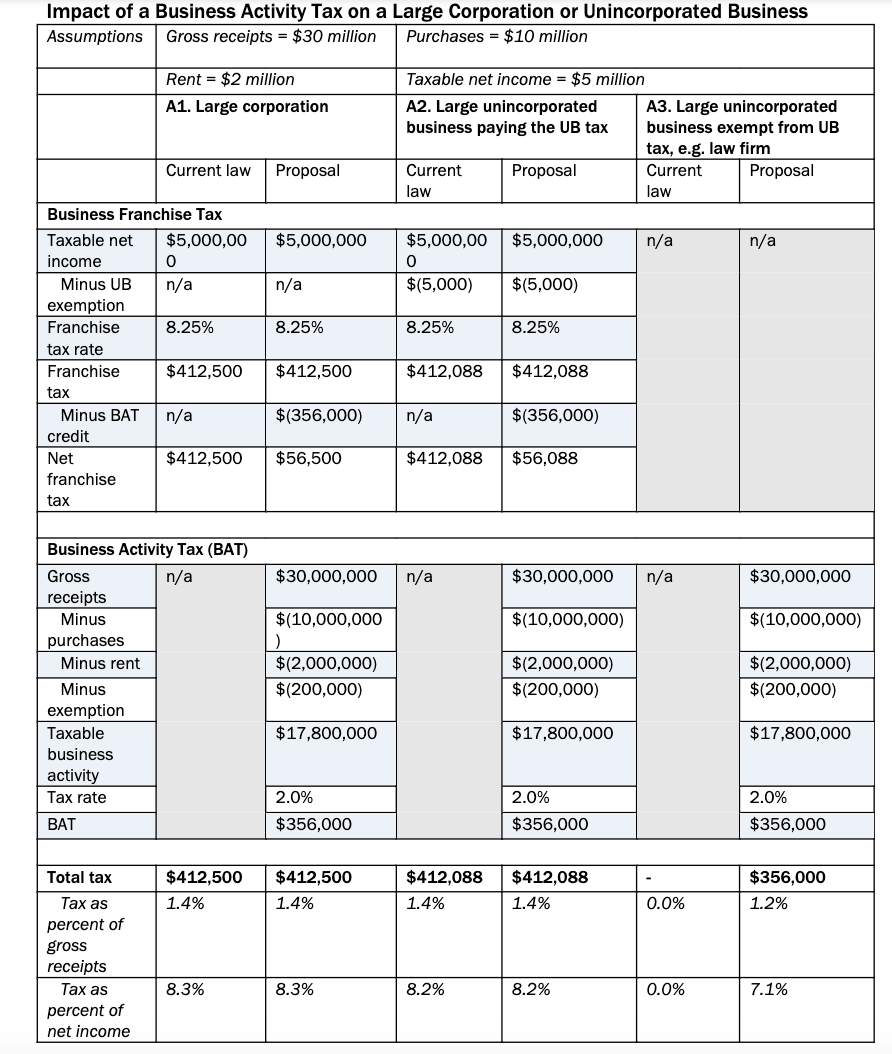

Since the goal of a BAT is to collect revenue from businesses that are currently paying little or no franchise tax, the BAT should be allowed as a dollar-for-dollar credit against the corporate franchise tax, the UB tax, or the individual income tax. That means that businesses that already pay significant DC franchise tax would not experience a tax increase. Businesses could also claim the BAT as a federal tax deduction because it is a business expense. (See the appendix for examples of the impact on small and large businesses.)

A BAT Would Level the Playing Field Between Businesses, Make DC Business Taxes Fairer and More Racially Equitable

In addition, a BAT as DCFPI has proposed would level the playing field between businesses as it expands the base. In the FY 2025 budget, the District increased the DC payroll tax to bolster general fund revenue.[3] The payroll tax has broad reach like the BAT in that nearly every DC private-sector employer, large or small, for-profit or nonprofit, pays the tax. But rather than ensure that all firms with business in the District pay their fair share of taxes, the payroll tax applies the same to those that currently do and don’t pay the business franchise tax (or whose owners pay income taxes) to the District. A BAT would expand the base without adding taxes for those who already pay substantial franchise (or income) tax.

A robust, fair system of business taxation is crucial for the overall resilience and equity of the tax system. In the case of the professional service firms operating in DC that do not pay DC’s primary business taxes, many of them are profitable because of what the District uniquely offers them—access to the federal government. A BAT would ensure that those firms also contribute to the success of DC’s economy by broadening DC’s tax base, which improves resilience to downturns and economic shifts and shocks and spreads the business responsibility for supporting DC’s public investments. Right now, DC residents who run businesses here bear the lion’s share of responsibility for DC’s business contributions to revenue, even as the services and amenities are enjoyed by a much broader set of business owners.

The BAT can also improve the racial equity of DC’s tax system. There are far fewer Black-owned businesses in DC, relative to the overall population of Black residents, than white-owned businesses. Black-owned businesses also tend to be smaller.[4] In particular, DC has very few Black-owned law firms; in the District, 3.9 percent of the partners at major law firms are Black and 2.6 percent are Latinx.[5] That means that currently, the majority of the unpaid business taxes foregone due to the federally imposed loophole are from white-owned businesses.

A BAT Would Have Minimal Impact on Business Location Decisions

A BAT would apply to a business’s economic activity associated with the District—not to its payroll or property in the District. The distinction is subtle but important. For a business operating across multiple states, as many do, the portion of their economic activity subject to the District’s tax would not be based on how many DC employees they have or how much DC property the business has. Rather, multistate entities would determine their DC tax liability using the same single sales factor formula that is now used to determine income and franchise tax liability.

Moreover, even a business that, for whatever reason, chooses to relocate its physical presence out of the District might not see an impact on their BAT liability. Depending on the choice of an apportionment rule, a professional services business that moves out of the District could still be subject to a BAT if it still has DC clients. BAT liability under a single sales factor rule would typically reflect where a firm’s clients are located and not where the provider of the services is physically located. Specifically, for sales of professional services or other services, a DC sale is generally one where the service is delivered to a DC address. So, moving out of the District would not be an effective strategy for minimizing taxation.

As we detail in our report, evidence from the New Hampshire experience shows significant and stable revenue without economic disruption.

A Business Activity Tax Would Improve the District’s Bottom Line and Help the Economy Thrive

A BAT is a promising revenue source at a time when the District’s economy appears to be changing. These revenues could help sustain public services at a time when landlords and tenants in downtown office buildings are paying less in tax, and/or they could be used to replace revenue from the new payroll tax, or the sales tax increase, which will hit low- and moderate-income residents hardest.

Even at low rates of taxation, a BAT would raise significant revenues. DCFPI’s update of ORA’s analysis to account for economic growth and to include profits and interest (which ORA did not include), finds that a 2 percent BAT could raise $500 million for FY 2026 (Table 1).

That level of revenue could be used to “buy down” the payroll and/or sales tax increases, fill in the gaps of declining revenue sources to maintain or grow public investments, or some combination of the two. For example, Council could reduce the payroll tax for businesses (leaving the increase in place for nonprofits) using just around half of what a 2 percent BAT would raise. For many businesses that currently pay substantial franchise tax to the District, this could mean a tax cut. Another portion of the revenue could reduce the sales tax back to 6 percent rather than allowing it to rise to 7 percent. Only five other states with sales taxes have a rate of 7 percent or more.[6] Even after reducing these taxes, remaining BAT revenue could be used to maintain current services that create an inclusive economy or to keep key promises the District has made to residents, like making child care affordable for all District families by expanding subsidies as indicated in the Birth-to-Three law—an investment that also greatly benefits businesses.

Strengthen the DC Child Tax Credit to Maximize Poverty Reduction

DCFPI applauds DC lawmakers’ recent efforts to improve fairness in the DC tax code, including the adoption of a Child Tax Credit (CTC) and making DC’s Earned Income Tax Credit (EITC) the strongest in the nation by tax year 2029. For over two decades, the DC EITC has played a critical role in reducing DC poverty, and the DC CTC will build on that success—taking aim at child poverty in particular—when it becomes available in tax year 2025.

A well-designed CTC is essential, as child poverty is higher in DC than nationally and disparities between the well-being of Black children compared with white children are extreme. Yet, DC’s CTC is only available to children under age 6, capped at three children per family, and sets the maximum credit at $420 per child, or about $1,100 below DCFPI’s proposed maximum.[7] DC lawmakers should strengthen the DC CTC to get more cash in the hands of families struggling and reduce child poverty across all ages.

DCFPI awaits estimates on DC CTC’s anti-poverty impact, with an expectation that the credit will ease hardship for eligible families. Data shows, however, that DCFPI’s proposed CTC for all children under age 18 and at the maximum credit of $1,500 would reduce DC’s child poverty rate by a whopping 18 percent, or lift 4,700 children out of poverty.[8] A stronger credit would allow DC to take aim at significant hardship that DC children are facing, including:

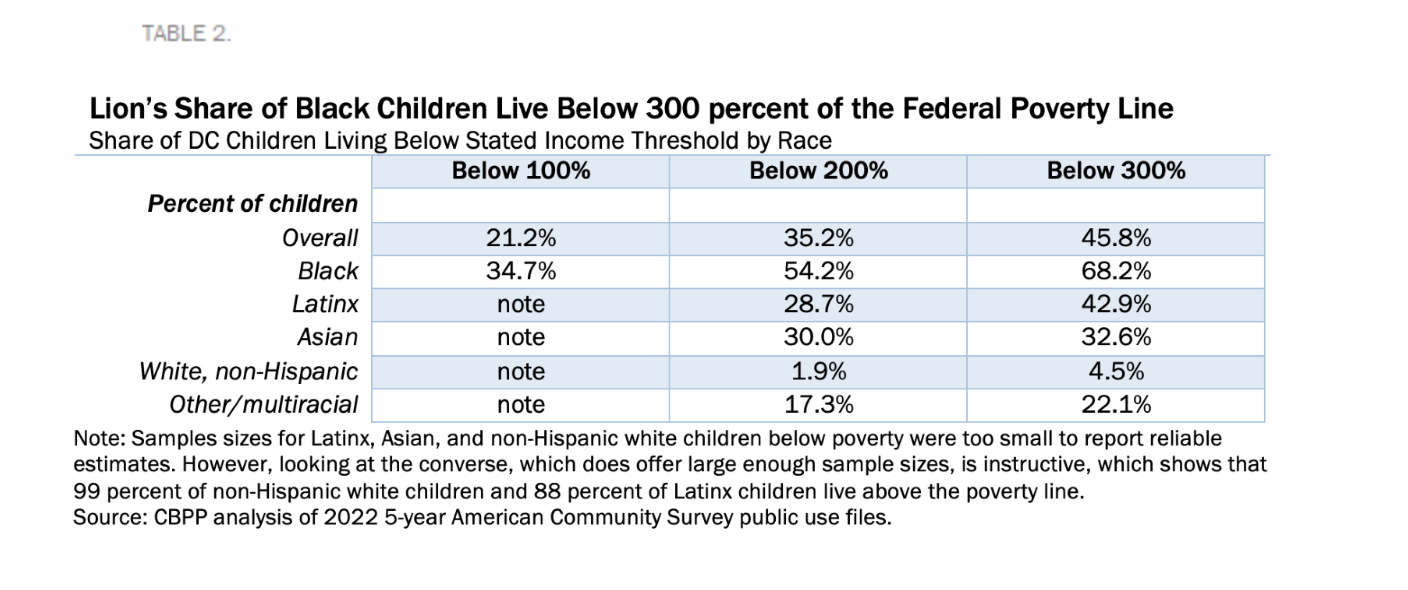

- The more than one-third (35 percent) of Black children living in families with incomes below the poverty line, around $30,000 for a two-parent family of four. Compare that to virtually all, or 99 percent, non-Hispanic, white children living above the poverty line (Table 2).

- And, the many children who are not technically poor but live in families that struggle economically. For example, overall, about 38 percent of children live in families with low incomes, defined as incomes below 200 percent of the poverty line, or $59,000 for a two-parent family of four. About 58 percent of Black children and 30 percent of Latinx and Asian children, compared with 2 percent of white children, live on low incomes.

Research on Child Poverty Shows the Undeniable Benefits of Boosting Income

Poverty and economic hardship have deep, long lasting effects on children and their lives, especially if it begins in their early years and persists over a long period of their childhood.[9] Parents with low incomes may struggle to provide nutritious meals or enriching learning environments in the home, or they may lack the means to access high quality child care. Getting cash, even small amounts, to families that have poverty-level and low incomes can make a long-lasting difference in children’s lives and how they fare as adults—from improving math and reading test scores to increasing access to college and boosting health outcomes.[10],[11],[12]

Increasing incomes to reduce poverty also would benefit the economy more broadly. One study looking at disparities in innovation—an important economic driver—by race, gender, and income, finds that if children in the bottom 80 percent of the income distribution in DC were to grow up to invent at the same rate as children from the top 20 percent, the District would have five times as many children growing up to be inventors.[13] In other words, if income inequality were eliminated, DC would have more people driving the future of our economy and, moreover, these people would come from more diverse backgrounds that bring new perspective to new innovations.

Modified Design Would Strengthen the Credit and Yield Greater Poverty Reduction

DCFPI commends Council for adopting a District CTC and recommends that the Committee and Council consider strengthening the credit in the following ways:

- Make the credit available to all children aged 17 and younger. At the federal level and in many states, CTCs offer a larger credit or boost for younger children because of the importance of children’s first years in life to their life outcomes and because there are relatively few investments in this country’s youngest children. However, research also speaks to the importance of addressing poverty for older children and for shortening the length of time that children experience poverty. DCFPI chose not to include a boost for younger children given that child poverty in DC is higher among older children than younger children, which is different than the national picture or what is typical among other states. About 24 percent of children over age six in DC are poor, compared to 20 percent of those age six or younger.[14] In addition, DC makes large investments in its youngest children relative to other jurisdictions. However, policymakers may want to consider a future expansion that offers a boost for younger children.

- Eliminate the cap on the number of eligible children per family. The District should move away from paternalistic and racist policies and practices that aim to judge and penalize larger family sizes among those with low incomes. These kinds of policies and practices are rooted in a racist and sexist history of control over Black women’s bodies, in particular, as evidenced through provisions enshrined in the TANF program.[15] The aim of a CTC is to reduce child poverty and boost the incomes of families to mitigate the high cost of raising children. DC should focus on those aims rather than unwarranted limits rooted in a racist past.

- Provide a larger credit for the lowest income families to ensure a greater reduction in poverty. A CTC that provides $1,500 per child to all families up to 200 percent of the official federal poverty line before phasing down the credit would reduce poverty by 18 percent under the supplemental poverty measure.[16] DCFPI’s proposal would ease hardship for tens of thousands more children. For moderate- and lower-middle-income families, the credit would also lower the taxes they pay as a share of their income, making the District’s tax code more progressive and helping these families invest in their children’s futures. More broadly, raising incomes through tax credits could support more children in the District growing up to innovate for the economy of the future.

Appendix: Examples of How A BAT Would Affect Small and Large Corporations or Unincorporated Businesses

- Nick Johnson, Tazra Mitchell, and Erica Williams, “A Business Activity Tax Would Make DC’s Tax System More Equitable While Raising Revenue,” DC Fiscal Policy Institute, January 30, 2025.

- Peter Enrich, “Memo to the DC Tax Revision Commission on the Proposal for a Value-added Based Business Activity Tax,” January 1, 2024, pages 2-3.

- Lawmakers originally adopted this tax to pay for paid leave for DC workers and, unlike federal payroll taxes, only employers pay the tax.

- Council Office of Racial Equity, “DC Racial Equity Profile for Economic Outcomes,” January 2021.

- National Association for Law Placement, Report on Diversity in U.S. Law Firms, January 2024, Table 12.

- “State Sales Tax Rates And Food & Drug Exemptions (As of January 1, 2023),” Federal Tax Administrators, accessed February 4, 2025.

- Erica Williams, “A Child Tax Credit Would Reduce Child Poverty, Strengthen Basic Income, and Advance Racial Justice in DC,” DC Fiscal Policy Institute, March 6, 2023.

- Ibid.

- For a thorough review of the literature, see: National Academies of Sciences, Engineering, and Medicine, “Chapter 3: Consequences of Child Poverty.” A Roadmap to Reducing Child Poverty. Washington, DC: The National Academies Press, 2019.

- Gordon Dahl and Lance Lochner, “Correction and Addendum to ‘The Impact of Family Income on Child Achievement: Evidence from the Earned Income Tax Credit,” March 1, 2016.

- Dayanand S. Manoli and Nicholas Turner, “Cash-on-hand and College Enrollment: Evidence From Population Tax Data and Policy Nonlinearities,” National Bureau of Economic Research Working Paper No. 19836, revised April 2016.

- For a thorough review of the literature on the health benefits of income support, see Arloc Sherman, Samantha Waxman, and Kris Cox, “Income Support Associated With Improved Health Outcomes for Children, Many Studies Show,” Center on Budget and Policy Priorities, 2021.

- Wesley Tharpe, Michael Leachman, and Matt Saenz., “Tapping More People’s Capacity to Innovate Can Help States Thrive,” Center on Budget and Policy Priorities, December 9, 2020.

- DCFPI’s analysis of the American Community Survey’s 2017-2021 5-Year Estimates.

- Ife Floyd et al., “TANF Policies Reflect Racist Legacy of Cash Assistance,” Center on Budget and Policy Priorities, August 4, 2021.

- Erica Williams, “A Child Tax Credit Would Reduce Child Poverty, Strengthen Basic Income, and Advance Racial Justice in DC,” DC Fiscal Policy Institute, March 6, 2023.