The fiscal year (FY) 2021 DC budget should raise sufficient revenue to address DC’s challenges and invest in things that build equitable, inclusive state economies—such as high-quality early learning and schools in all wards, affordable housing, human services, and workers’ well-being.

Tax Changes Should Boost Equity and Adequacy

The District budget presents an opportunity to make critical investments towards a DC where all residents can thrive, particularly native DC residents. The taxes that people and businesses pay support high-quality services and programs that meet people’s basic needs, build opportunity for many, and advance racial equity. Yet, we need more revenue to pay for the growing demand and cost of these vital public structures.

Tax policy is our key tool to ensure there is adequate revenue to meet growing needs so all DC residents can benefit from our city’s growing prosperity. And by asking DC’s richest households and profitable businesses to pay their fair share, we can reduce taxes for others and still have more revenue to invest in things that strengthen our communities, like schools. The FY 2021 budget should only include tax changes that advance fairness or lead to savings or new revenue. Tax changes that meet these criteria include:

Closing tax loopholes for corporations: Each year, the District wastes millions of dollars on ineffective economic development tax incentives. Scaling back or eliminating these tax breaks, beginning in FY 2021, would mean that corporations pay their fair share and our city would have more resources to invest in the things that actually strengthen the economy, like a skilled workforce.

The FY 2021 budget should repeal the ineffective and poorly targeted Qualified High Technology Company tax incentive program—which would ultimately save at least $24 million annually. The FY 2020 budget scaled back this incentive following a review from city officials that found many of the companies claiming it are primarily located outside of the District and not contributing to economic growth. The budget should also establish strong penalties, or “clawbacks,” for all economic development tax breaks to hold companies accountable to their commitments.

Expand the DC Earned Income Tax Credit (EITC): This refundable income tax credit helps people who work but earn low earnings by putting money back in their pockets. The FY 2021 budget should expand EITC eligibility to all adult workers without children in the home. Currently, childless workers must be age 25 to 64 to be eligible for the credit (families with a child in their home are eligible at age 18).[1] This would reward the hard work of an additional 14,200 people struggling to make ends meet. The average tax benefit would be $420 among the newly eligible workers, and it would cost $6 million per year.

Repealing the poorly targeted tax credit for child care expenses: The FY 2020 budget made permanent a $1,000 refundable tax credit for child care expenses—the Keep Child Care Affordable Tax Credit—for children under age four attending a licensed facility, at an estimated cost of $1.4 million per year. Families with incomes up to $150,000 are eligible for the credit, excluding those receiving a child care subsidy. That maximum income is nearly six times higher than the federal poverty level for a family of four.

Many families struggle to afford high-quality early education: the average annual cost of infant care in DC is nearly $24,000 a year. While this tax credit offsets a small portion of that cost, it isn’t targeted at families who need it the most and is unlikely to enable them to obtain better quality care. Unlike tax credits, child care subsidies are highly targeted. Investments to make quality early education affordable should go first to improving the quality of care for the children receiving subsidies who need it most.

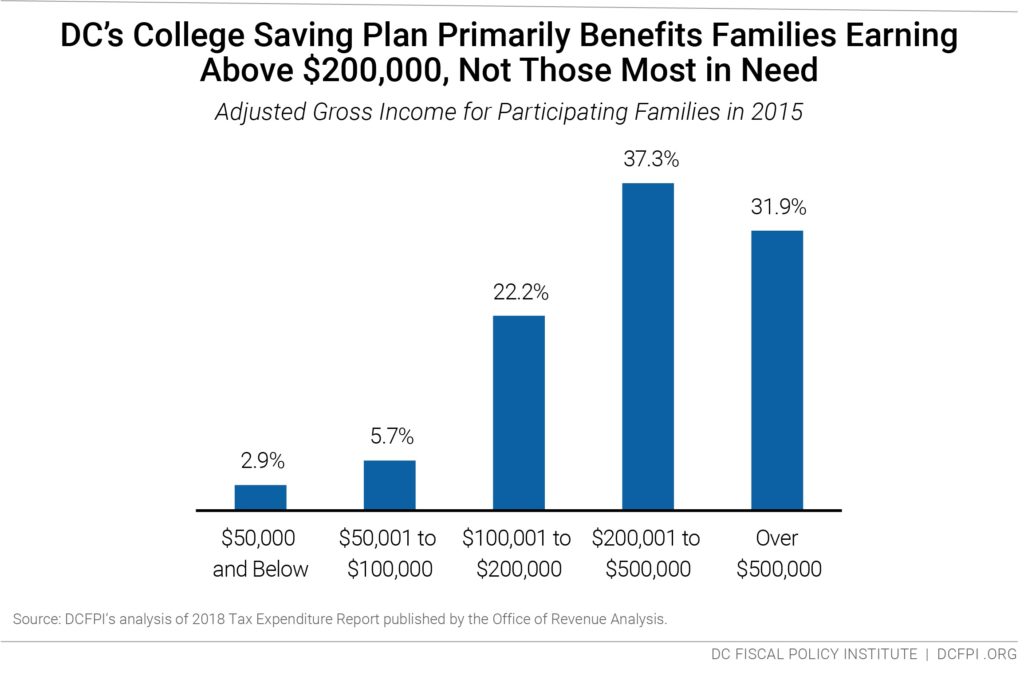

Repealing and replacing the DC College Savings Plan tax deduction: DC taxpayers can receive up to an $8,000 deduction for contributions to a college savings plan to pay for higher education expenses, such as tuition, fees, and books. This tax break, which costs $2.4 million annually, primarily benefits upper middle class and wealthy residents, while providing almost no benefit to lower-income families. More than 90 percent of the benefits flow to families making over $100,000, and 70 percent flow to those earning above $200,000 (Figure 1)—that is, families with disposable income whom would likely save for their children’s future without a tax incentive. Lawmakers should eliminate this deduction and replace it with a program that targets college savings to students in low-income families who’d otherwise not have resources to save.

These recommendations will better ensure that the District has an equitable and stable revenue system that adequately funds public investments and ends special treatment for the wealthy and profitable corporations. Doing so helps set the foundation for an economy whose benefits are more widely shared.

[1] There is one small exception. Non-custodial parents who are up to date on their child support are eligible if they are under age 25.