A strong Metro system is important to all of us in the Washington region, and there is wide agreement that Metro needs additional resources to rebuild its health. But a regional sales tax—a widely discussed option—would be an unfair way to pay for it. A sales tax would ask struggling families in the Washington region to bear the largest responsibility for improving our transportation system, while leaving businesses and high-income households largely off the hook. It should be rejected as a Metro funding option.

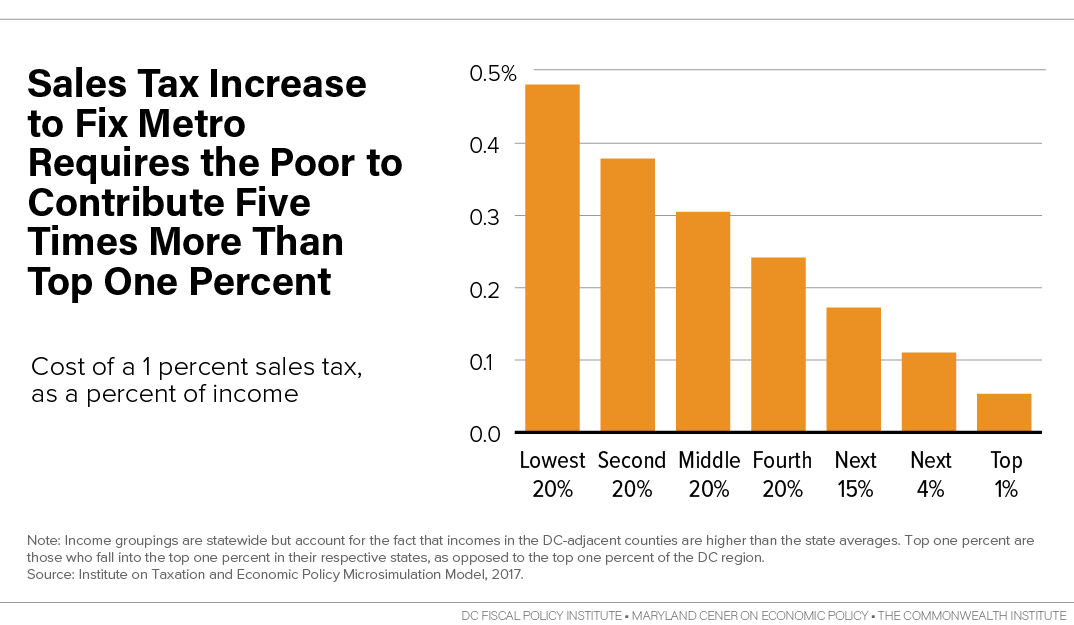

A 1 percent regional sales tax would hit the budgets of the area’s lowest-income families five times harder than those of the richest, according to an analysis released today by the DC Fiscal Policy Institute, the Maryland Center for Economic Policy, and The Commonwealth Institute for Fiscal Analysis. This tax would take up 0.5 percent of income from families with incomes below $25,000, such as a retail cashier or a retiree living on Social Security. The sales tax would take up less than 0.1% of income for the richest 1 percent, those with incomes above $600,000. Sales taxes fall more heavily on people living on low incomes, because buying taxable basics like shampoo, household cleaners, clothes and school supplies take up a sizable share of income, while barely registering on the budgets of the well-off.

A 1 percent regional sales tax would hit the budgets of the area’s lowest-income families five times harder than those of the richest, according to an analysis released today by the DC Fiscal Policy Institute, the Maryland Center for Economic Policy, and The Commonwealth Institute for Fiscal Analysis. This tax would take up 0.5 percent of income from families with incomes below $25,000, such as a retail cashier or a retiree living on Social Security. The sales tax would take up less than 0.1% of income for the richest 1 percent, those with incomes above $600,000. Sales taxes fall more heavily on people living on low incomes, because buying taxable basics like shampoo, household cleaners, clothes and school supplies take up a sizable share of income, while barely registering on the budgets of the well-off.

When added to recent fare increases and cutbacks in Metro hours and services, a sales tax would create a “triple whammy” for the residents who can least afford it.

Beyond basic issue of fairness, a sales tax would be harmful because many area families are struggling to cope with the high cost of living. Most low-income renters in the Washington metro area (incomes below $35,000) devote more than half of their income to housing, the analysis shows, which means even a modest sales tax could create added hardship—making it harder to pay rent, buy healthy food, or get school supplies.

Families living off the lowest wages also have gained the least from the area’s economic recovery. Workers in the bottom 40 percent of earnings in the area have seen wages fall or stagnate over the past decade, adjusting for inflation. Meanwhile, workers in the top third of the wage distribution have enjoyed wage gains.

Instead of a sales tax, the report recommends that businesses and high-income residents should play a large part in funding Metro’s repairs, since they benefit the most from a strong economy and have the greatest ability to pay. The report does not make specific revenue recommendations, and suggests that each area jurisdiction should be given flexibility to make revenues choices that makes sense and are fair.

The groups noted that an equitable approach to solving Metro’s crisis would be to rely largely on revenue increases, rather than on other changes that are likely to have a large impact on families with low-incomes and communities of color. That means minimizing fare increases, service reductions, or scaling back pay of middle-class workers at Metro.