The District of Columbia’s economy is strong, increasingly diverse, and outperforming the rest of the region, DCFPI’s new report, Economic Powerhouse: DC Is Growing Faster than the Region, finds. This great news for the city means that businesses are succeeding in the District under current tax policies, and that further business tax cuts can’t be justified on the grounds that the city needs to be more competitive. Rather, business tax cuts would sap revenues that could help keep the District strong, such as investments in schools and housing.

The DC economy is strong on a number of important indicators:

The DC economy is strong on a number of important indicators:

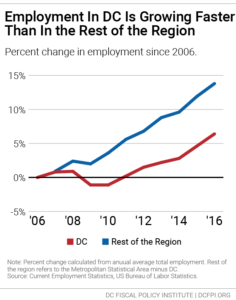

- Employment in the District grew 14 percent over the past decade, from 688,000 in 2006 to 782,000 in 2016. DC’s employment growth has far outpaced the rest of the region, where employment grew 6 percent.[1]

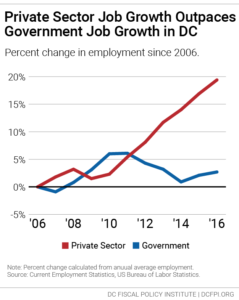

- DC’s job growth has been driven by the private sector. Private-sector jobs account for 93 percent of DC’s total increase in employment since 2006. The diversifying DC economy is a sign that the city has become much more than a “government town,” and that DC is a conducive environment for robust private sector growth.

- Wages earned in DC are growing robustly. The earnings of people working in the District increased 21 percent over the past decade, adjusting for inflation. That’s faster than employment growth, which means that average salaries are rising.

These findings of the District’s strong economic performance call into question the need for the $28 million business income tax cut set to go into effect in 2018. Stopping the tax cut would free up funds that could be better invested to build a strong future for DC.

The proposed FY 2018 budget fails to fully fund the plan to end chronic homelessness, provides no money to take families off the housing wait list, leaves school funding well below the level considered adequate, and fails to invest in better child care for low-income infants and toddlers.

The proposed FY 2018 budget fails to fully fund the plan to end chronic homelessness, provides no money to take families off the housing wait list, leaves school funding well below the level considered adequate, and fails to invest in better child care for low-income infants and toddlers.

It’s also worth noting that DC’s businesses income tax already is in line with Maryland and Virginia. A 2013 study conducted for DC’s Tax Revision Commission found that “the tax burden in the District for [corporations] is not significantly different from its Maryland and Virginia neighbors.” Since then, the business franchise tax in DC has been cut significantly—from 9.975 to 9.0 percent. Under the automatic tax cut trigger policy adopted by the DC Council, the business income tax will be further reduced to 8.25 percent—for a revenue loss of an additional $28 million per year.

A new DCFPI analysis shows that the District could preserve the tax cut for small businesses and still generate $21 million in new revenue by not cutting taxes for larger businesses.[2] With DC experiencing “soaring business profits”[3] and unfunded homeless services, now is not the time to give a tax cut to Wal-Mart and Home Depot. We urge the City Council to stop the business tax cut, especially for large businesses.

[1] Rest of the region refers to the Washington Metropolitan Statistical Area (MSA) minus DC. The Washington MSA includes the following jurisdictions: Virginia: Arlington, Fairfax, and Loudoun Counties; Alexandria, Fairfax, Falls Church, Manassas, and Manassas Park Cities. Maryland: Calvert, Prince William, Charles, Stafford, Frederick, Montgomery, and Prince George’s Counties. [2] https://www.dcfpi.org/dc-council-can-free-up-21-million-for-better-schools-and-affordable-housing-without-hurting-small-businesses [3] Economic and Revenue Trends Reports, DC Chief Financial Officer, https://cfo.dc.gov/node/232252

To print a copy of today’s blog, click here.