The District’s lowest-income residents are severely squeezed by high housing costs, causing damaging ripple effects throughout these families’ lives. Solving this crisis will require more money, but also creative ways to build new affordable housing and preserve what we already have. A DCFPI event last week brought together private-sector housing development and finance leaders to explore their ideas about how to expand DC’s affordable housing efforts to match the enormous scale of the need.

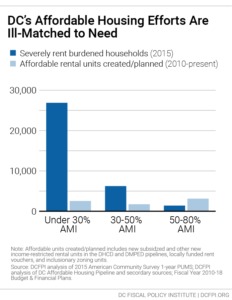

Big Solutions to DC’s Big Affordable Housing Challenge started with a DCFPI presentation on the scale of the affordable housing challenges faced by DC’s extremely low-income residents—those with incomes below 30 percent of the area median, or about $33,000 for a family of four. While DC’s recent affordable housing efforts have been substantial, they have not been well-targeted to these residents, who face significant challenges throughout all aspects of life because they lack an affordable home. How can the District create more housing affordable to these residents, and on a scale that matches the substantial needs?

Big Solutions to DC’s Big Affordable Housing Challenge started with a DCFPI presentation on the scale of the affordable housing challenges faced by DC’s extremely low-income residents—those with incomes below 30 percent of the area median, or about $33,000 for a family of four. While DC’s recent affordable housing efforts have been substantial, they have not been well-targeted to these residents, who face significant challenges throughout all aspects of life because they lack an affordable home. How can the District create more housing affordable to these residents, and on a scale that matches the substantial needs?

Here are the takeaways from a panel discussion of leaders in the housing field, including David Bowers, Vice President at Enterprise Community Partners; Tom Borger, Chairman of Borger Management, Inc.; Robert Burns, Executive Director of City First Enterprises; Diana Meyer, Sr. Vice President at Citi Community Development; and W. Chris Smith, Chairman and CEO of WC Smith.

- Preserve existing housing affordable to extremely low-income residents. To do this, the District will need to be creative and nimble to compete in the fast-moving real estate market, something that has challenged local governments, including DC, in the past. Working with landlords of small, low-cost buildings as well as owners of larger, federally-subsided buildings to preserve affordability will be a critical part of a preservation strategy.

- Rental assistance is the best tool to meet the housing needs of the lowest-income residents. Not only does rental assistance help families afford their housing, it also provides certainty and security to private-market landlords, who know that the tenant’s rent will be paid even if the tenant’s family loses income due to a job loss or other reasons. And, buildings dedicated as affordable need ongoing rental assistance to cover their operating costs and stay in good condition.

- Public funding is the glue in any partnership between DC government and the private housing sector. Well-designed subsidies and incentives can enlist private sector housing providers and financial institutions in meeting the District’s affordable housing challenges. Many in the private sector are looking for opportunities—but DC has to make the numbers work for them.

- Meeting the housing needs of DC’s extremely low-income residents won’t happen overnight. Substantially increasing public funding for affordable housing, as well as building the capacity of DC housing agencies and housing developers to ramp up their efforts, will take some time. Yet as one panelist said, it’s not necessarily taking one big step that will solve DC’s affordable housing challenges, but many small steps. Steady incremental progress across, for instance 10 years, will get the District far toward its goal of meeting the housing needs of extremely low-income residents.