Despite having higher home values, DC homeowners pay the lowest property tax bills in the capital region, a new DCFPI report finds.

Middle- and high-income DC residents’ property tax bills are far lower, often by $1,000 a year or more, than similar households in the four adjacent counties: Fairfax, Arlington, Montgomery, and Prince George’s Counties. The combination of a low tax rate and policies that restrain property taxes even as home values rise would appear to refute any suggestion that property taxes make it hard for DC to compete for residents in the regional housing market.

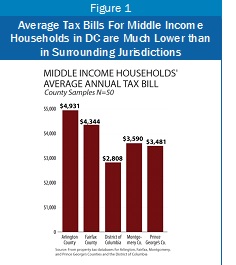

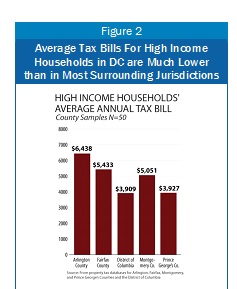

Our report identifies the average value of homes owned by residents at a middle-income level and a higher-income level in DC and in four suburban jurisdictions, and then compares property taxes for homes sold at those values. Here is what we found:

- DC homeowners own higher-valued homes: Middle-income DC residents — those making $68,500 to $129,000 a year — tend to have higher-valued homes than homeowners in other jurisdictions. Residents in this income range own homes worth $500,000 on average — about the same as those owned by homeowners in Arlington, andhigher than homes in Fairfax, Montgomery, and Prince George’s Counties. Higher-income DC households — those with incomes of $129,000 to $214,000 — own homes worth about $640,000, again higher than in most suburban counties.

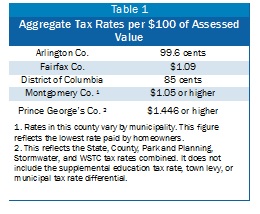

- DC’s residential property tax rate is the lowest in the region: When state and municipal property tax rates are considered for the surrounding counties, DC tax rates are by far the lowest, at 85 cents per every $100 of assessed value. See Table 1. DC also has provisions that limit property tax bills. For example, the homestead deduction reduces the amount of a home’s assessment that is subject to tax by $71,400. In addition, under the District’s assessment cap no matter how much a home’s value grows in a given year, the taxable portion can grow no more than 10 percent.

- Middle-income DC homeowners pay far less in property taxes than suburban counterparts: As a result, DC homeowners pay the lowest property tax bills in the area. The average property tax for DC’s middle income homeowners — $2,800 — is $1,500 lower than the property tax bills for middle-income homeowners in Fairfax and Arlington counties and $700 lower than for middle-income homeowners in Montgomery and Prince George’s Counties.

- Higher-income DC households also have smaller property tax bills than neighbors inthe suburbs: The average property tax for higher-income DC homeowners — $3,900 — is $1,500 lower than the property tax bills for higher-income homeowners in Fairfax and Arlington Counties and $1,000 lower than for higher-income homeowners in Montgomery County.