Chairwoman Alexander and other members of the committee, thank you for the opportunity to testify today. My name is Ed Lazere, and I am the Executive Director of the DC Fiscal Policy Institute. DCFPI engages in research and public education on the fiscal and economic health of the District of Columbia, with a particular emphasis on policies that affect low- and moderate-income residents. Our organization also chairs the Medical Care Advisory Committee (MCAC).

I am here today to applaud and thank the Department of Health Care Finance (DHCF) for their part in providing access to health care for the District’s lowest-income residents. DC has led the nation in implementing the Affordable Care Act, and DHCF continues to improve the scope and reach of DC’s Medicaid program. I am also here to share a few areas of the District’s budget where I believe the Department can improve use of dedicated funds and savings from enhanced federal Medicaid reimbursement to improve access to services and ensure better health outcomes among patients.

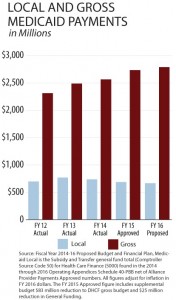

Medicaid Savings: The District’s broad expansion of Medicaid to residents and its desire to expand the scope of the benefit has meant the DC receives growing federal reimbursement for services. First, the federal government fully covers the  cost of newly eligible residents in 2015 and 2016. Starting this year, the federal government will pay for the full cost of the Children’s Health Insurance Program or CHIP. This means that despite enrollment growth, the FY 2016 budget proposes reductions in local contribution but growing gross Medicaid expenditures. A graphic in my written testimony illustrates this trend.

cost of newly eligible residents in 2015 and 2016. Starting this year, the federal government will pay for the full cost of the Children’s Health Insurance Program or CHIP. This means that despite enrollment growth, the FY 2016 budget proposes reductions in local contribution but growing gross Medicaid expenditures. A graphic in my written testimony illustrates this trend.

Second, policy changes will drive more local savings in the District’s Medicaid program. For example, the creation of the Health Homes program and the coverage of adult substance abuse treatment under Medicaid will pull down enhanced federal Medicaid match — creating about $5 million in local savings for the Department of Behavioral Health. Health Homes, which coordinates care and connects behavioral health patients to primary care services, could have long-term cost-savings for the District as well.

Unfortunately, the FY 2016 budget uses these savings to cover gaps in the General Fund rather than to enhance other health programs. In addition, the Budget Support Act calls for taking $23 million from Healthy DC’s fund balance to meet needs in the city’s overall financial plan. DCFPI believes that the Department and DC Council should be using savings and Healthy DC to improve health services delivered and to expand access to services for groups who are not eligible for Medicaid, including Alliance beneficiaries. The Department could also use savings for more evaluation and monitoring of personal care services, ensuring that those services are high quality and that the new rates for Personal Care Aide services are translating to living wages for home health aides as intended. Enhanced Federal reimbursement will phase out over time, so the Department should be keeping those savings within the health cluster and looking for cost-effective investments in the near term.

Alliance: The DC Healthcare Alliance six-month in-person eligibility requirement continues to be an undue burden on residents and on Department of Human Services’ service center capacity. In FY 2014, the Department found that up to 67 percent of monthly Alliance re-certifications were terminated due to not being able to complete the re-certification interview, and the added volume continues to lead to long wait-times, delayed processing of applications, and wrongful denials for residents seeking a range of public benefits. Often, beneficiaries must go several times to complete one re-certification. DCFPI and the Legal Aid Society of the District of Columbia conducted a study that found that Alliance beneficiaries make up 25 percent of service center traffic even though they represent a small number of beneficiaries who get services there.

Health Care Finance should pursue changes to the program expeditiously — including adjusting the recertification period to a year and allowing health centers to help with applications and renewals. The Department reports that the initial cost of taking on new enrollees could be great. However, if the Department continues to wait, utilization costs of the older and sicker population currently using Alliance benefits will grow, making the investment that much more costly. Reducing the frequency of the requirement will help beneficiaries maintain their health and curb per-member costs for DC.

Managed Care Organizations (MCOs): One issue that could continue to put upward on costs are problems with case management and care coordination in the Managed Care Program. Over 73 percent of Medicaid beneficiaries are enrolled through one of the MCOs, yet it is unclear whether the population is getting the services and supports that they need. For example, the Department of Health Care Finance estimates that the MCOs paid more than $35 million in expenses related to avoidable ER visits, hospital admissions and readmissions.[1] Moreover, the department’s quarterly performance reports show that in the first year of the MCOs’ contracts, the companies failed to establish strong case management and care coordination programs among their enrollees.[2] This means that many residents with complex health needs may not get timely access to the services that they need. Poorly managed care also effects the fiscal health of the District. Again, we ask the Department to act expeditiously in developing a pay-for-performance rate plan that holds MCOs accountable for these costs.

Thank you for the opportunity to testify, and I am happy to answer any questions.