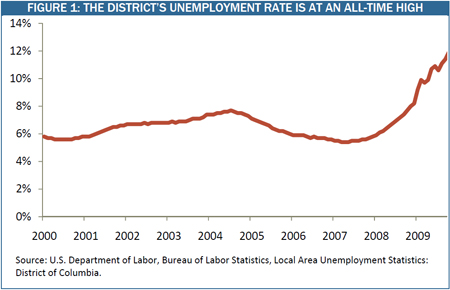

There are thousands more people looking for work in DC than there are jobs for them to take. That’s what happens in a recession. It means that many workers cannot find a job no matter how hard they try. In DC, nearly 40,000 residents are unemployed, up from 18,000 in 2008. Our unemployment rate ‘ now at nearly 12 percent, is the highest on record.

In the midst of this bad news is some good news: the District is taking steps to make sure that workers who lose their jobs can get the help they need. The DC Fiscal Policy Institute recently testified on two pieces of legislation to strengthen the city’s unemployment insurance program, which will come with $18 million in federal stimulus funds to help cover the costs.

What will the bills do?

- Provide additional unemployment benefits for unemployed workers with children or other dependents. The first bill provides $15 per week for each dependent, or $50 for those with more than three dependents.

- Benefits for workers in training programs. The first bill will also help workers acquire skills that will help them compete for jobs when the economy improves.

- Increase DC’s maximum unemployment benefits. A second bill would increase the maximum weekly benefit from $359 to $379. DCFPI testified that this proposal will help workers with prior jobs that paid about $35,000 or more, but won’t help workers who were in lower-paying jobs. We recommend altering the formula so that all unemployed workers get more.

Unemployment insurance not only helps workers pay the rent and keep food on the table for their families; it also keeps dollars in circulation in the local economy. Money spent on rent, groceries, clothing, and other necessities keeps the economy from declining further. In fact, Mark Zandi of moodyseconomy.com estimates that every $1 spent on unemployment benefits creates $1.63 in economic activity as those benefits get spent.[1]

There may not be much the city can do to end the recession, but taking advantage of federal stimulus funds to soften the blow for laid-off workers is an important response.

[1] Sharon Parrott, Center on Budget and Policy Priorities, “Temporarily Increasing Unemployment Benefits is Better Targeted and More Stimulative Than Suspending Taxation of Unemployment Benefits”