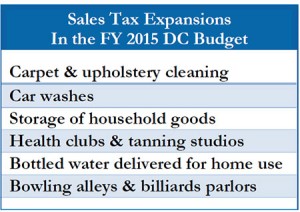

In recent weeks, the District’s Dime has discussed why we support the DC Council’s vote to expand the sales tax to a number of services, including health clubs, following a recommendation of the DC Tax Revision Commission. A number of pundits have joined the conversation, as have some policy think tanks, some of which are generally aligned with lower taxes. They are all in agreement: broadening the base of the sales tax makes sense, especially as part of a tax package that lowers taxes for almost all residents and businesses.

Here are some of the highlights:

Washington Post: “D.C.’s tax reform is overdue ‘ and a good compromise“ by the Editorial Board. They write: “Of more immediate concern is whether the council will resist the lobbying underway to roll back the reasonable expansion of the sales tax to businesses that have been exempted until now, such as health clubs, yoga studios and car washes. A sales tax adds a small cost, and carving out exemptions for favored businesses is unsound and unfair. Council members need to stand firm against the pressure.”

Vox: “DC Wants to tax yoga lessons — and it’s a great idea“ by Matt Iglesias. He writes: “Right now if you buy some handweights at the store, you pay sales tax. But if you buy a gym membership you don’t”¦If you exempt a large and growing share of economic activity from taxation, then you need to tax the rest at a very high rate to make up the lost revenue. Gym owners and yoga instructors are getting a sweetheart deal from the current tax code, but the inverse of their good deal is that other business owners are being penalized.”

New York Times: “Washington’s Gyms Want a Tax Break. That’s a Problem,” by Josh Barro. He writes: “Every industry has a story about why it should be exempt from sales tax; Washington’s gyms, asking why you would tax a service that makes people healthier, are no exception. But when states and cities can’t tax services, they simply resort to ever-higher taxes on goods. So if D.C. heeds the #donttaxfitness call, you can expect the Council to tax something else, instead.”

The Atlantic: “Why Every City Needs a Yoga Tax,” by Kriston Capps. He writes: “A sales tax on gym memberships is no more a tax on fitness than a sales tax on books is a tax on knowledge”¦ raising monthly fees is unlikely to lead droves of members to cancel their memberships”¦”

The Tax Foundation, which has a mission to promote “smarter tax policy” at the federal, state, and local level, also supports the sales tax base expansion in this blog post. So does the Cato Institute, a think tank committee to “limited government” among other things. The Cato blogger writes: “I’m not in favor of new taxes, but it is also not fair that gyms are exempt from sales taxes that hit most other retailers and their customers.”

These comments support the notion that expanding the sales tax to more of what we buy is the right approach, especially as part of a tax reform package that lowers many tax rates.

To print a copy of today’s blog, click here.