Today, DCFPI releases its budget toolkit, your in-depth guide to the proposed FY 2015 budget. Our toolkit breaks down how Mayor Gray proposes to allocate local funds and analyzes how the proposed budget will impact education, health care, affordable housing, taxes and more.

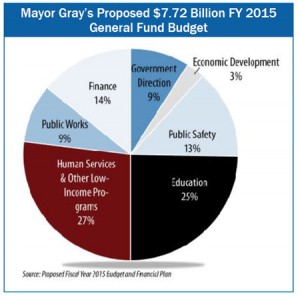

On April 3rd, Mayor Gray submitted his budget proposal for fiscal year 2015, which starts October 1, 2014. The proposed general fund budget ‘ the portion of the DC budget that comes from local taxes and fees, including dedicated tax revenue and special purpose funds ‘ is $7.72 billion ‘ a $302 million, or 4 percent increase over FY 2014, after adjusting for inflation.

The budget would make investments across DC government in a number of critical areas, particularly education, health care, cash assistance for families with children and affordable housing. The largest increases from FY 2014 to FY 2015 include funds to cover: repayments of debt issued for construction and other capital projects; increases in enrollment in publicly funded schools and new supplemental funding for at-risk students; increases in mental health services; increases for maintain, operating and leasing DC government buildings, and other mayoral policy priorities that will be discussed in greater detail.

The proposed budget also includes a variety of changes to taxes and fees that would result in a $27 million reduction in revenues, equal to about one-third of one percent of the city’s locally funded budget. The proposed revenue changes would start to implement a number of recommendations issued by the DC Tax Revision Commission in February 2014 as well as a number of changes that were not recommended by the commission.

Despite the many investments in the budget, some areas remain left behind. The proposed budget appears to cut funding for homeless families services despite the tremendous increase in families seeking shelter this past winter.

To read more about the overall budget, or in-depth analyses of funding for education, health care, energy assistance, affordable housing, workforce development, or taxes, check out our toolkit website. We also have a spreadsheet that tracks funding across agencies from FY 2000 ‘ FY 2015; use it to do your own budget analysis! And check back next week for more detailed information on the budgets for homeless services, Temporary Assistance for Needy Families (TANF) and Interim Disability Assistance.

To print a copy of today’s blog, click here.