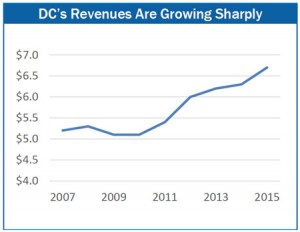

The District is a prospering city, and that has resulted in recent good news on the city’s finances. While many groups of residents are struggling with increasingly unaffordable housing costs and some remain unemployed, DC’s population is growing and real estate values are rising. These latter two factors contributed to a large budget surplus for 2013 and to projections of substantial increases in tax collections for the coming year.

The late February revenue forecast — which identified $139 million in increases in property, sales, and income taxes — comes just as Mayor Gray is putting the final  details on a budget proposal for 2015. Some of the increased revenues will be needed to address rising costs of existing services, such as a growing school population, but there undoubtedly will be room to fund some new efforts, too. Here are six ideas to put these additional resources to good use:

details on a budget proposal for 2015. Some of the increased revenues will be needed to address rising costs of existing services, such as a growing school population, but there undoubtedly will be room to fund some new efforts, too. Here are six ideas to put these additional resources to good use:

Direct more resources for high-poverty schools: A city-commissioned public education “adequacy study” recommended changing DC’s school funding formula to add a weight for at-risk students. This would allow DC public schools and DC public charter schools to improve instructional supports, afterschool programming, and social services for up to 30,000 low-income students.

Increase TANF benefits for families with children: The current level of DC’s benefits, just $428 a month for a family of three, leaves many families in a state of constant crisis. A proposal before the DC Council would raise benefits to $492 a month for a family of three and add a cost-of-living adjustment after that. Even with the proposed increase, DC’s benefits will remain significantly lower than those in Boston ($618), Los Angeles ($638), New York City ($789), or Baltimore ($574).

Create more Permanent Supportive Housing: This successful program provides housing and supportive services to the city’s chronically homeless, who typically suffer from life-threatening health conditions and/or severe mental illness. Permanent Support Housing reduces reliance on more expensive crisis-related services like emergency rooms, psychiatric hospitals, and jail. The DC Interagency Council on Homelessness began a seven-year plan to end chronic homelessness this year. The Mayor could fully fund the second phase of the plan to ensure DC stays on track to end chronic homelessness by 2020.

Provide homeless families access to services year-round: DC limits resources to families during hypothermic nights. This creates a crush of demand each year from November through March. Opening access to services year-round can improve the flow of families through the homeless services system into stable housing. It also could help families feel comfortable taking a short-term subsidy, knowing help is available if they don’t succeed.

Expand access to rental assistance from the Local Rent Supplement Program: This program helps make housing affordable to residents with very low-incomes. It offers vouchers to eligible households, which can be used almost immediately to help get residents into housing quickly. And it ties rental subsidies to projects developed by nonprofits, such as new housing built entirely for homeless residents.

Implement income tax recommendations of the DC Tax Revision Commission: DC’s tax system is off-balance, with middle-income residents paying the highest percent of their earnings in taxes. DC’s Tax Revision Commission recommended several steps to improve the income tax: increasing DC’s personal exemption and standard deduction, reducing tax rates on middle-income households, and increasing the Earned Income Tax Credit (EITC) for childless adults. It may be costly to implement all of the reforms at once, so these changes could be phased in over time.

In times of prosperity, it makes sense to invest. These six investments will make DC stronger down the road.

To print a copy of today’s blog, click here.