Chairman Gray and members of the Council, thank you for the opportunity to speak today. My name is Ed Lazere, and I am the executive director of the DC Fiscal Policy Institute. DCFPI engages in research and public education on the fiscal and economic health of the District of Columbia, with a particular emphasis on policies that affect low- and moderate-income residents.

The mission of the DC Fiscal Policy Institute is based on the premise that public services are important to the health of the District of Columbia and all of its residents, especially its low-income residents. We also believe strongly in the need for budget decisions that promote long-term budget stability. Any organization that supports a healthy public sector should support such goals. We therefore come to this hearing with the hope that the gap-closing plan that the Council will approve will limit the need for service reductions as much as possible, but we also are aware of the gloomy fiscal outlook beyond Fiscal Year 2010 and the need to be mindful of that.

I want to start by thanking the Chairman and the Council for their sincere interest in working through this budget crisis in a responsible way. Mr. Chairman, you have said that “everything is on the table,” including budget reductions from all sectors of the District government and revenue increases. We appreciate the openness to a broad and balanced approach.

With that in mind, I would like to raise five points.

DC’s Rainy Day Fund: I understand that the bond rating agencies recommended against attempts to change the rules of our rainy day fund now, as we contemplate using it. I disagree with the suggestion that it is wrong to alter rules that make it impractical to draw on $330 million in local tax dollars that were set aside in good times for use in times such as these. Their position is particularly surprising, considering that the District simply wants to change the rainy day fund rules to be consistent with the rules that all other states impose on their rainy day funds.

Given the advice from the rating agencies, I respect the position that using the rainy day fund now may not make sense, assuming we can find some other reasonable way to balance the FY 2009 budget. Because we would have to pay back half in 2010, it would not reduce that budget gap by much. Moreover, using the rainy day fund now would add to the already-large gap in FY 2011, when the second half would have to be repaid.

Nevertheless, I still recommend that the Mayor and Council start a vigorous dialogue with the Congress about altering – at some point in the future – the federal restrictions that make our rainy fund harder to use than in any state. It often takes years to work out such agreements with the Congress, and the District often has little control, so starting early makes sense.

Use of One-Time Resources in the FY 2010 Budget: Some Council members have expressed concern that the Mayor’s proposal for FY 2010 relies in part on using one-time resources, including excess funds in special-purpose accounts. The concern stems from the fact that using one-time resources in 2010 leaves a large budget gap in 2011.

It is my understanding that one proposal from the Council would be to take all one-time resources available in FY 2010 and spread them over several years of the financial plan, so that they can be used to help address the budget gaps beyond 2010.

While I understand this reasoning, I disagree with this approach. The DC budget regularly uses one-time resources, and there has been no requirement in the past to spread those resources over the four-year financial plan. This proposal would set a new and conservative fiscal policy in the middle of the worst fiscal crisis since the mid-1990s. Moreover, there are likely to be one-time resources that become available for FY 2011 and out-years, as happens every year; simply don’t know what they are now. For this reason, we should not assume that using all currently available one-time resources in FY 2010 will leave us with none in FY 2011.

Spreading out the one-time funds over several years – rather than spending them in FY 2010 – effectively means that we will have to adopt more budget cuts or revenue increases in FY 2010 while leaving money in the city’s coffers.

Addressing the FY 2011 Budget Gap: The Council has noted that the FY 2011 budget has an unresolved budget gap of at least $335 million – $200 million from unspecified budget cuts and $135 million in FY 2010 programs labeled as one-time that really should be considered recurring. The budget gap is serious.

At the same time, I do not believe the Council needs to take steps now to fully resolve that gap. Balancing FY 2009 and FY 2010 are hard enough. I expect that the Council’s budget actions for FY 2010 – recurring budget cuts, revenue increases, and spreading out one-time resources if that occurs — will reduce the FY 2011 gap but will not be enough to close it, since that gap is larger than the FY 2010 gap. Given that, I don’t think it makes sense to adopt additional recurring cuts or revenue increases in FY 2010 to address a problem in FY 2011. And it doesn’t make sense for the Council to adopt specific budget cuts just for FY 2011, both because budget assumptions will change a lot between now and 2011 and because the Mayor will soon start a process with agencies to develop an FY 2011 budget to be submitted in March 2010. The gap for FY 2011 can be addressed through the annual budget process.

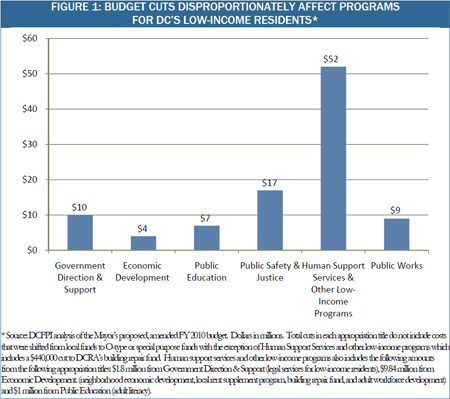

Making Budget Cuts More Balanced: The Mayor’s budget proposal includes roughly $100 million in budget reductions according to DCFPI calculations. (This does not include cuts in earmarks or savings from shifting locally funded services to special purpose funds or federal funds.) More than half of those cuts are in the human support services appropriations title or other programs serving low-income families. Yet these programs make up just 30 percent of DC’s budget. The cuts in these programs are three times larger than the cuts in any other part of the DC budget.

The cuts include a substantial cut in cash assistance to needy families with children that my colleague will discuss, as well as job training, literacy, legal services for the poor, disability services, and housing, among others. These cuts are not only imbalanced but also target services that address long-overlooked and underfunded parts of the budget. The District spends very little on adult literacy, for example, even though one-third of adults are functionally illiterate, and spending on adult job training is low even though there are as many as 60,000 adults who could benefit from it.

The cuts could push more families into poverty in the midst of a deep recession, and thus could lead to unanticipated increases in demand for social services. For example, the Mayor proposes to cut the rapid housing program in half. One of the goals of this program is to help families where there is a risk of a child entering the foster care system. Every dollar spent on this program saves an estimated $4 in reduced placements. Moreover, many of the proposed cuts would limit the ability of the city to invest in low-income residents in ways that might help them take advantage of the eventual rebound in DC’s economy. Some Council members have noted that the District should not cut back on services like street maintenance and trash pickup because it would have long-term effects on the city’s vitality. The same applies to investments in DC residents.

As the Council considers expenditure savings needed to balance the budget, I hope it will pursue a more balanced approach, including restoring some of the more harmful cuts in services to low-income families.

Raising Revenue: The Council is likely going to need more gap-closing measures than those proposed in the Mayor’s plan, particularly if the Council chooses not to tap the Rainy Day Fund. Chairman Gray has noted that the Council will consider revenue-raising options, which we believe is warranted to address the larger budget gap. As my colleague will explore in more detail, the District has raised revenues only modestly during this downturn, and actual tax increases have been minimal, even though the city cut taxes substantially during the economic downturn. Revenue increases can help preserve the services that the Council and Mayor agreed to when they adopted the FY 2010 budget, and revenue increases are just as effective as budget cuts in bridging the gap between existing resources and budgeted expenditures. Indeed, some economists note that tax increases are less harmful to the local economy than spending cuts that reduce services and take money out of the local economy.

Thank you for the opportunity to testify.